Forbrugets betydning bliver ofte overset, når investorerne vælger deres portefølje, skriver Merrill i en analyse. Forbruget er den vigtigste drivkraft. Det udgør 60 pct. af verdens BNP, og USA og Europa har stadig langt større betydning end de nye økonomier, selv om væksten sker dér. Merrill kunne udtryke sig som Bill Clinton: It’s the economy, stupid.

Uddrag fra Merrill:

The Power of the Global Consumer

Over the course of any business cycle there are a host of factors that can impact the

value of a portfolio, ranging from corporate earnings reports to interest rates, global trade,

geopolitical risks and more. But over the long term, we believe that every portfolio should

have exposure to one of the most powerful economic forces of the 21st century: the

steady rise of global consumer spending, both in the developed and developing economies.

While it may get lost in the headlines on trade wars, impeachment and the Middle East,

consumer spending is the key driver of economic growth in the U.S. and abroad, accounting for nearly 60% of the world’s GDP, according to the United Nations (UN).

According to the latest data, global consumer spending reached a record $48.4T in 2018,

thanks to steady job gains and rising wages in many parts of the world, to go along with

structural tailwinds such as higher education rates and greater labor force participation

among women.

At the top of the list is the United States, amassing $14T in consumer spending for

the year, more than the next five countries combined. The strong consumer was one of

the key reasons that economic growth in the U.S. accelerated in 2018 even as global

economic growth slowed, and a key reason that even in the face of a U.S. manufacturing

slowdown last year, the U.S. economy chugged on. At nearly 70% of GDP, the U.S.

economy follows the consumer, which was supported by a robust jobs market, healthy

household balance sheets and strong consumer confidence, which we expect to continue

in 2020 and keep the record economic expansion going.

Looking abroad, the next largest consuming cohort is the European Union (EU), which by

itself makes up 21% of global spending. Remarkably, while the EU has less than half the

population of China, the EU consumer still spends nearly twice as much, totaling $10.4T

in 2018 compared to $5.3T for China. This disparity is explained partly by the large

wealth gap that exists between the two, as per capita income in the European Union

currently stands at $36,570, about four times that of China, according to the World

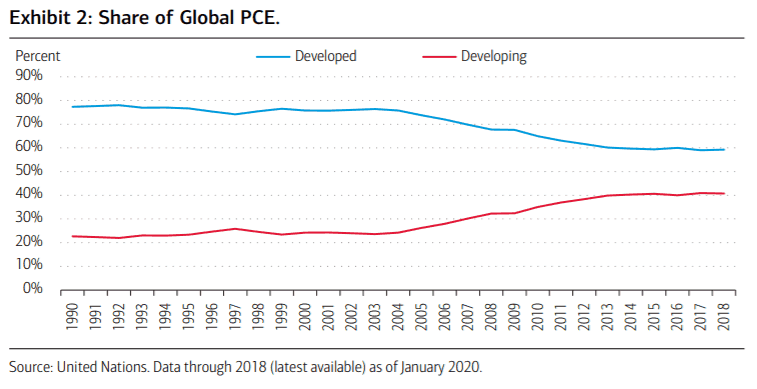

Bank. In fact, despite the rise of emerging markets like China and India, it may come as a

surprise to many investors that the U.S. and EU still command the largest share of global

consumption, 50% together in 2018 versus only 14% from China and India combined.

The latter have gained significant share over the past few decades, but the gap remains

wide and has actually been very steady over the past few years. Throw in other nations

such as Japan, Germany and the UK, and the share of global consumption by developed

nations totals $28.7T, nearly 60% of global spending (Exhibit 2).