fra zerohedge

It’s official: The Republican tax reform bill is dead on arrival in the Senate now that John McCain has become the third Republican senator to confirm that he plans to vote against it.

What’s worse for the Trump administration, McCain reportedly wants the bill to receive input from both parties – a criticism that he cited as his reason for voting against the Trump administration’s plan to repeal and replace Obamacare. This is particularly problematic because there’s approximately zero chance that any Democratic lawmakers will break ranks to vote with Republicans, despite President Donald Trump repeatedly saying that he expects to win a modicum of bipartisan support.

McCain reportedly confirmed his opposition – and also that the bill in its current form is DOA – during an interview with Fox Business’s Charlie Gasparino.

#BreakingNews — senator GOP making it known not happy w house tax plan @SenJohnMcCain telling people its DOA we discuss now @FoxBus

Sources: GOP Senators have been privately criticizing the House tax reform bill, including @SenJohnMcCain. I discuss NOW on @FoxBusiness!

In recent weeks, John McCain has reiterated his demand that Republicans pass their tax plan through a bipartisan process. McCain voted down his party’s Obamacare repeal bill precisely because it failed to meet this standard. And it will be impossible to pass the House plan – or anything close to it – through anything but a secretive, partisan process.

On Monday, Susan Collins declared her opposition to repealing the tax on multimillion-dollar estates. The current bill includes such a repeal, and many House conservatives seem deeply attached to repealing what Republicans have successfully tagged as “the death tax.” And for months now, Bob Corker has also insisted that he wouldn’t vote for any tax plan that adds even a penny to the debt, even during the first ten years, where Congress would legally be allowed to do so. As it stands, the House plan would increase the deficit by a total of $1.5 trillion over ten years.

And at this rate, it’s unclear if the plan in its current form will even pass the House. Republican lawmakers from blue states hammered Ways and Means Chairman Kevin Brady about measures in the bill to repeal deductions for state and local taxes, while lowering the cap on the mortgage interest-rate deduction to $500,000. It would also eliminate deductions for student-loan interest. Controversially, it will also add an excise tax for corporations involved in cross-border payments that has drawn the ire of the US business community and its army of lobbyists.

So far, many powerful lobbying groups, including the National Association of Realtors, the National Federation of Independent Business, the National Association of Home Builders, the Independent Sector (a lobby for charities) and the National Farmers Union; and the American Institute of Architects

The ink wasn’t even dry yet on the just published Republican Tax Cut And Jobs Act last week when, within an hour of its unveiling, UBS’s analysts were already predicting that it has virtually no chance of passing: As UBS chief economist Seth Carpenter wrote shortly after the publication, “to our read, the release confirms our view that tax reform is far from being a done deal.

The bill contains several specifics that we believe will prove sticking points, which increase the difficulty of finding the votes to support the plan in both the House and the Senate.” Fast forwarding to Carpenter’s conclusion: “We maintain our view that tax reform is unlikely this year or next.”

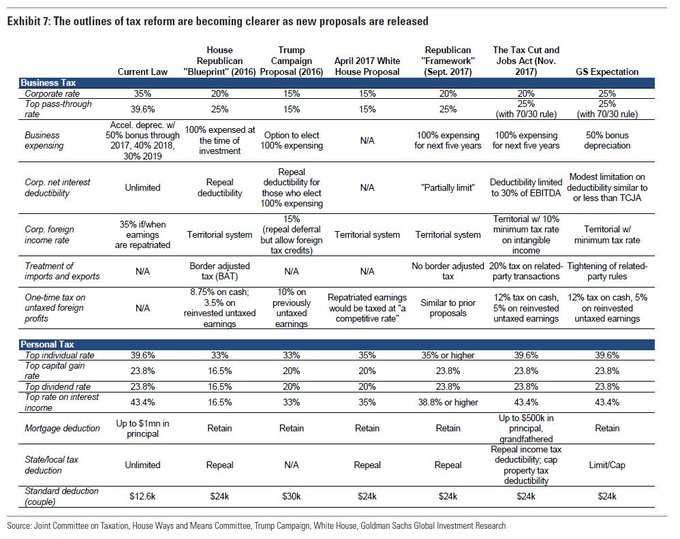

And as we pointed out yesterday, the TCJA resembles the plan outlined by Goldman weeks ago…

So it shouldn’t come as a surprise that Goldman believes the bill has a 65% chance of passing by Q1. Of course, that prediction was made before McCain came out against the bill. Last month, he had reluctantly voted to pass the $4 trillion Senate budget plan. And adding another twist to the already complicated outlook for the bill, Goldman CEO Lloyd Blankfein said last week that “now’s not the best time for tax cuts”, a view diametrically opposite that of his former “right hand man”, Gary Cohn, currently Trump’s chief economic advisor, who has been charged with overseeing the reform effort, alongside Treasury Secretary Steven Mnuchin.

* * *

Notably, reports that McCain will oppose the TCJA followed news that the senator had been hospitalized with an injury to his Achilles tendon…

Because of the Republicans’ razor-thin majority in the senate, they can only afford to lose two Republican votes on any piece of legislation, assuming united Democratic opposition.