Fra Zerohedge/ BofA

By now every investors, especially Wall Street professionals, realize that stocks are where they are only thanks to central banks, so left to their own devices a crash is inevitable. It’s also why before the QE nuke launched by the Fed in late March, the S&P was set to plunge below 2,000.

The flipside is that the higher the market goes, the more prone it is to flash crashes and “breaking” as investor confidence that central banks will prop up stocks at or near all time highs, especially with lack of fundamental support, fades away.

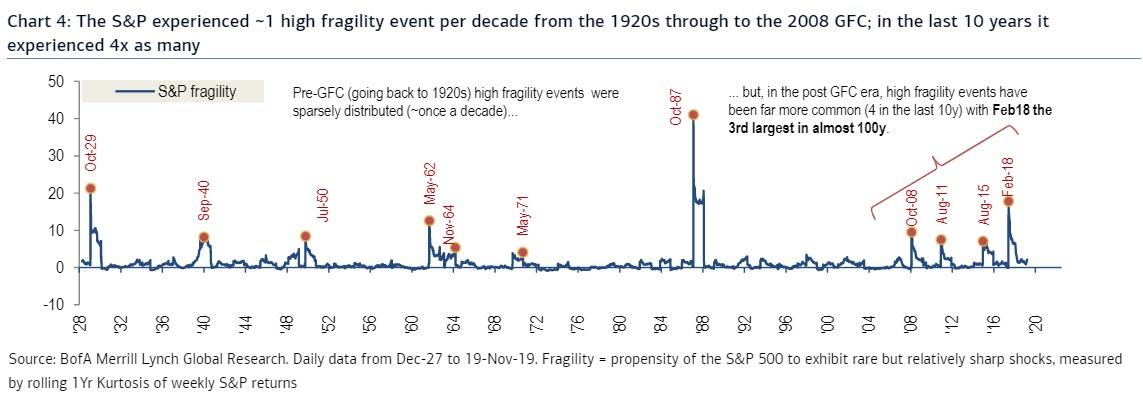

That’s why, picking up on one of his favorite topics, Bowler and team writes that “in recent years markets have become increasingly fragile, recording a 4-fold increase in the frequency of tantrums and flash-crashes post-GFC vs the 80 years prior.”

According to Bowler there have been two key drivers of higher fragility in our view:

- failing trading liquidity due to high frequency traders shutting down machines as stress rises, something this website has correctly covered since the start in 2009, warning that HFTs would eventually resulted in an extremely illiquid, unstable and, yes, fragile market as far back as April 2009, and

- asset bubbles created by an investor base starved of alpha and forced to chase trends against their better judgement in a world addicted to the central bank put.

Caught in a vice of HFTs momentum chasing algos on one hand, and central banks dictating overall market direction simply by injecting trillions in liquidity, the BofA strategist notes that “closing your eyes and chasing the trend was impossible to avoid for most, but this also turned into a massive log-jam for liquidity when the tide turned, as investors with little fundamental conviction simultaneously rushed for a fast-narrowing exit door.”

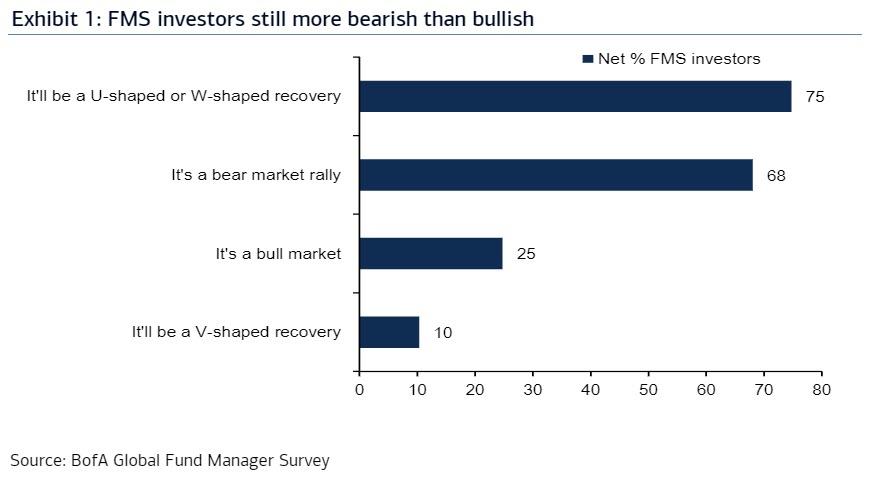

Which brings us to today: with most institutional investors believing this is a bear-rally, something the latest BofA Fund Manager Survey confirmed earlier today…

… but at-risk of being forced to chase the trend if it continues (having been conditioned as such in the last 10 years), the risk is of bigger bubbles leading to larger shocks, leading to even bigger bubbles, leading to even larger shocks, and so on. In a dismal assessment of how far the rally has already gone without any fundamental justification, Bowler writes that “there will be plenty of opportunity (and time) for negative surprises to arise, given the sheer size of this economic crisis, even with a vaccine on fast-track.”

We most certainly agree, as does more than two-thirds of Wall Street, which is why it is hardly a secret that the higher the S&P rises, the more prone it will be to sudden, “unexplained” crashes.

And while it would be difficult to see a strong convexity event at these levels of vol, it would likely result in a larger upside surprise to volatility than in past bear-rallies, as for example both the VIX and V2X have fallen at near their fastest pace recorded.

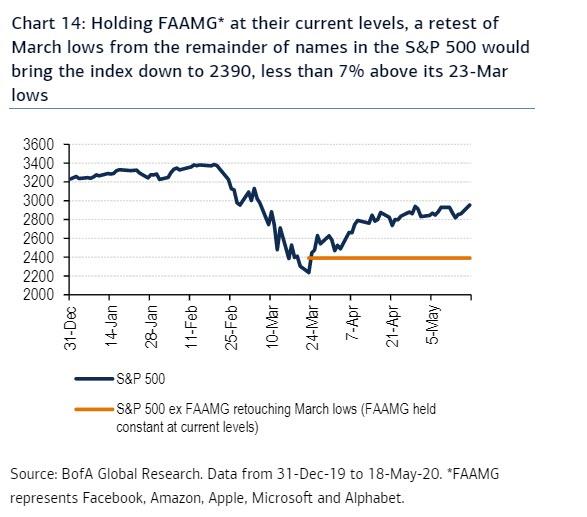

“But the FAAMGs will keep the market elevated”, all the bulls will scream in unison, to which Bowler has a simple answer:

With many believing that the seemingly ‘defensive’ Tech can continue to hold up the S&P 500, here we highlight where the index could fall if the second leg of the covid-19 selloff unfolds even with the FAAMG not receding from here (as a reminder, they make up 21% of the S&P 500).

Chart 14 shows that holding FAAMG at their current levels, a retest of March lows from the remainder of names in the S&P would bring the S&P down to 2390, only less than 7% above its 23-Mar lows (in comparison, the S&P closed 32% above its March lows as of 15-May). If any of the FAAMG names capitulates in an extreme scenario where most of the stocks snap back to their lows, the S&P could trade even lower.

Indeed, while these big tech names and some bio/pharma names (Healthcare accounts for 15% of the S&P 500) may do particularly well in the Covid-19 economy, some investors may be overestimating the extent to which big-cap tech can prevent the entire market from falling simply due to its large weight. Furthermore, we still believe that markets may be underestimating the cyclicality of large tech as a whole when faced with the reality of the ensuing recession.

In conclusion, Bowler – who now appears to have a vendetta with the central banks, the HFTs and Robin Hood retail traders who just keep buying this market even as he doubles, triples and quadruples down on his bearish stance – warns that “history suggests markets won’t escape economic reality, and that this bear market will be similar in length to that of the ensuing recession, but there is a risk is of wider overshoots, which reconcile more violently in a world still prone to fragility.