Den globale økonomi kollapser på grund af coronakrisen, konkluderer det tyske Ifo-institut, der forudser, at der bliver en nedgang i tysk økonomi i år på 1,5 pct. Først om et år vil økonomien rette sig.

Uddrag fra Ifo:

ifo Economic Forecast Spring 2020: Economy Collapsing

The global economy is collapsing as a result of the coronavirus pandemic. As things stand, the German economy could shrink by 1.5 percent this year. This is also likely to have a substantial impact on the labor market. The downside risk in the present forecast is considerable.

The global economy is collapsing as a result of the coronavirus pandemic. In order to stem the spread of new infections and to counteract an overburdening of the health care system, many countries are now restricting freedom of movement and bringing public life largely to a standstill. At the same time, most countries are attempting to mitigate the expected economic consequences with wide-ranging economic policy measures. It is almost impossible to make a precise prediction of the economic costs of the coronavirus crisis at present, as there is a high degree of uncertainty about the further spread of the virus and in particular about the measures governments have taken to contain the pandemic. Nor is there any historical experience of comparable events from which to derive probable crisis patterns. Finally, there are currently very few economic indicators available which which to estimate the macroeconomic extent of the consequences of the coronavirus crisis.

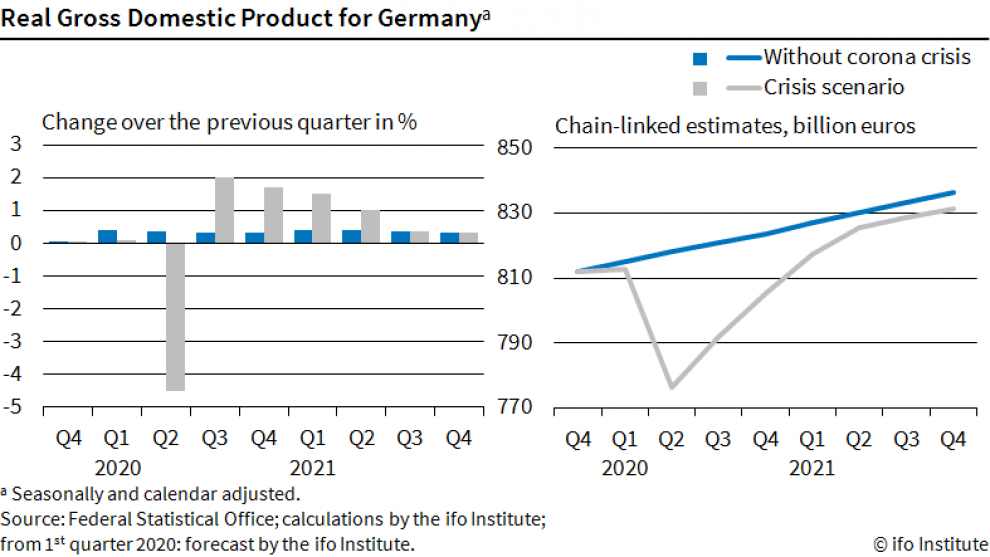

As things stand, the German economy could shrink by 1.5 percent this year. This would reduce the growth rate by almost 3 percentage points compared with a situation without the outbreak of the coronavirus crisis. While there is likely to be a slight increase in gross domestic product in the first quarter as a result of the strong start to the year, the crisis will take full effect in the second quarter, leading to a 4.5 percent collapse in GDP. By the first half of 2021, the production of goods and services should then gradually return to a normal level (see Figure). Starting from the low level of production in the second quarter, the growth rates in this catch-up process will be strong, initially at 2.0 percent compared with the previous quarter. It is assumed here that the corona crisis will also have longer-term effects, due to company bankruptcies, for example, which will push output at the end of the forecast period 0.6 percent below its pre-crisis level. The overall economic costs of the corona crisis in connection with this scenario amount to a total of around 115 billion euros in both years.

Given the assumed magnitude, the coronavirus crisis will also have substantial effects on the labor market. By extending the regulations on the short-time allowance and reducing flextime credits, most of the adjustments will probably be made via the average working time per employee, which in the assumed scenario is likely to fall by just under 1 percent in 2020. However, the adjustment of working time is unlikely to be sufficient to fully compensate for the decline in economic output, especially in those sectors of the economy particularly affected by the coronavirus crisis. This is reflected in an increase in the unemployment rate from 5.0 percent in 2019 to 5.3 percent in 2020. Accordingly, the number of people in employment is likely to fall by more than 100,000 compared with the previous year. This would be the first decline in 15 years.

The global economy is also likely to suffer considerably as a result of the coronavirus crisis. Global GDP will increase by only 0.1 percent this year, compared with 2.6 percent last year. World trade is also likely to be severely affected, with a decline of 1.7 percent. At the beginning of the year, overall economic production will already have contracted slightly due to the decline in real activity in China and South Korea. But Japan is also likely to slow down. As the pandemic worsens, global economic output is likely to slump by 2.6 percent, especially in the second quarter. Europe and the US are contributing to this in particular. Here, the course of the crisis is likely to be very similar to that in Germany. By contrast, activity in China and South Korea is likely to increase slightly again as a result of the lower infection figures. From the summer onwards, there will probably be a gradual catch-up process worldwide with growth of just under 2 percent in the third quarter and 1.7 percent in the fourth quarter. Similar to Germany, output at the end of the forecast period is likely to be 0.5 percent below the pre-crisis level.