Bank ING hører til dem, der ser mest dystert på næste år. Banken tror på en lavere væskt i USA end de fleste analytikere og ser ingen forbedring i Europa. Aktierne kan få en nedtur.

Uddrag fra ING:

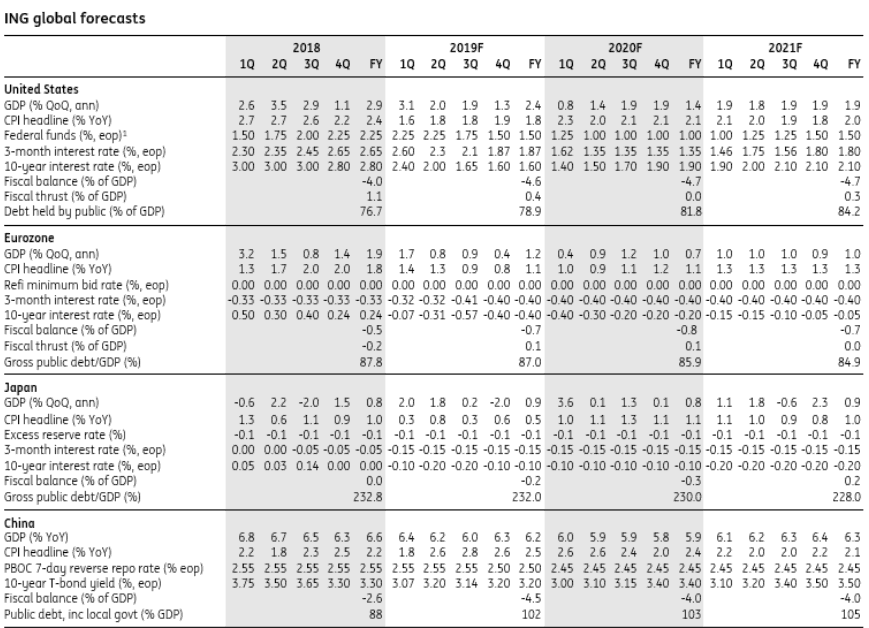

After a turbulent year, financial markets are ending 2019 in a positive mood. But with trade tensions building once again and the major economics struggling to shrug off manufacturing weakness, we’re expecting growth in the US and eurozone to come in sub-consensus in 2020

For months now, market sentiment around a phase one US-China trade deal has flitted between optimism and pessimism. Last month, the optimistic mood prevailed but, as we warned back then, things appear to have changed direction.

Financial markets remain in a positive mood, but with the headlines on trade looking less encouraging and the global backdrop and strong dollar acting as headwinds for growth, we are less sanguine on the economic outlook. We continue to forecast sub-consensus growth of 1.4% and expect the Federal Reserve to cut rates twice more in the first half of 2020

There are gradually more signs that the Eurozone economy is bottoming out after a deceleration that started in January 2018. However, for the time being, a strong upturn doesn’t seem to be in the offing implying that 2020 is unlikely to see stronger growth than in 2019.

Markets are primed for a Conservative majority when UK voters head to the ballot box. But a week is a long time in politics, and a hung parliament definitely can’t be ruled out. Whatever happens, 2020 looks set to be another uncertain year for Brexit and the UK economy.

We have seen default cases rising in China’s bond market. But is it really a bad thing?

So far, Japan’s consumption tax hike seems to have gone down far more smoothly than its previous equivalents in terms of both GDP growth and inflation. Though the coming months could still see some fallout even if the front-loading was smothered by inventory fluctuations.

The end of US exceptionalism is sparking calls for a weaker dollar in 2020. We think the dollar decline will be far more differentiated than broad-based. We do not think the dollar is particularly overvalued against the euro and Japanese yen. If the dollar does turn lower in 2020, we think it will be probably be against the battered commodity currencies.

It does not take much to coax market rates lower. Re-heat a US-China trade war, add a pinch of US impeachment concern, toss in another UK vote on Brexit and then simmer in a mix of corporate angst and 2020 uncertainties. Market rates are then ready to test lower as soon as risk assets judge that the brewing cocktail is toxic enough to call it a day for 2019.