Goodbye Carney, hello rate cut? skriver Nordea i en analyse om den britiske centralbank, hvis chef, Mark Carney træder tilbage. Analytikere er delt i spørgsmålet om en sænkning af renten. Nordea tror på en uændret rente. Briterne har stadig plus-renter.

Uddrag fra Nordea:

Market expectations for a January cut have rapidly increased, but it is not yet a done deal. Carney’s last BoE meeting will instead be like Christmas for central bank watchers. We give you the arguments for and against a cut. We expect BoE on hold.

Key takeaways

- Three factors make us go with unchanged rates in January of which a predicted PMI rebound on Friday is the main reason.

- Moreover,the timing of a potential rate cut would be at odds with Brexit happening the day after and the BoE’s reaction function post the Brexit referendum.

- Only a small PMI rebound would make us go with a rate cut instead. If market pricing is >70% for a rate cut, the BoE should deliver.

- If the BoE cuts in January, this should not be perceived as the beginning of a big easing cycle.

- Risk-reward favors a slightly stronger GBP and higher Gilt yields in the coming week. On a 3-6-month horizon, however, we do expect the GBP to weaken.

Until 9 January 2020, Brexit had for the past 3.5 half years more or less been the only driver of sterling and Gilt yields. Well, along came Carney, “deciding” it was time to bring the Bank of England back in focus! In his speech, he said the MPC had discussed how risk management could favour a near-term rate cut. His last Bank of England meeting on 30 January will thus not be just another dull “let’s-wait-and-see-on-Brexit” affair.

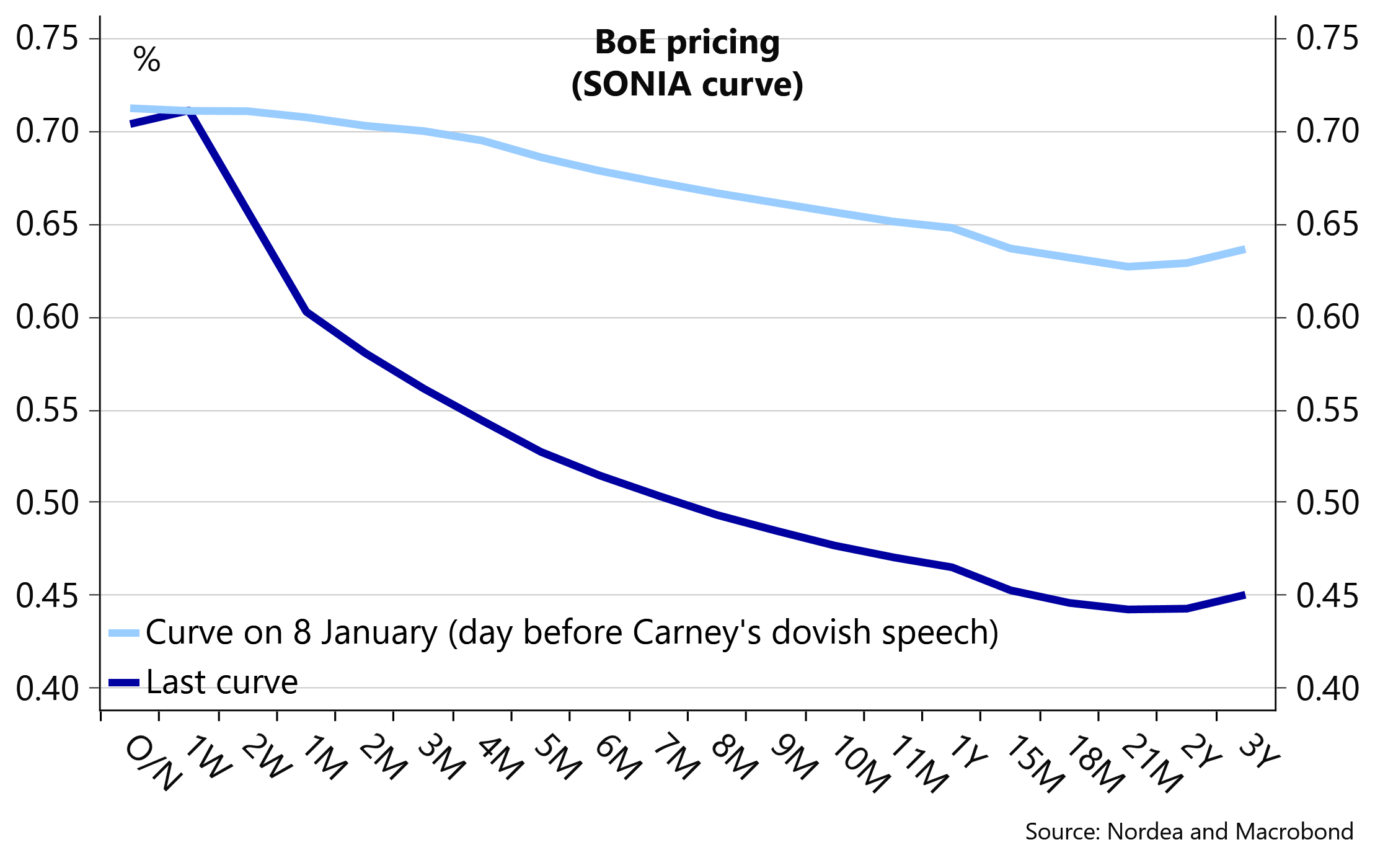

While there is nothing unusual about central bankers thinking about their legacy at their last meeting, nor the MPC having a discussion about easing policy when two MPC members have recently voted for a rate cut, Carney undoubtedly knew what the market reaction would be. And what a reaction. In just 10 days, Carney’s words combined with a cocktail of dovish MPC speak and a number of weaker key figures, rate cut expectations for the January meeting increased from around 5% to 65%. Nobody puts Carney in the corner.

Now the rest of us can look forward to Carney’s last meeting which will be like Christmas for central bank watchers.