Kerneinflationen i eurozonen faldt kraftigt i august til 0,4 pct., og den ventes at falde igen i september. Men Nordea vurderer, at det er et midlertidigt fald, som skyldes et forsinket udsalg af beklædning i et par store lande. Servicepriserne stabiliserer sig i Europa, og derfor er der ingen risiko for en deflation. Der er ingen udsigt til en ECB-lempelse i september.

Euro area: Sharply lower core inflation

Core inflation dropped sharply in August and more will follow in September. However, the drop was mostly due to temporary factors and is unlikely to move staff projections ahead of the next ECB meeting enough to prompt fresh easing.

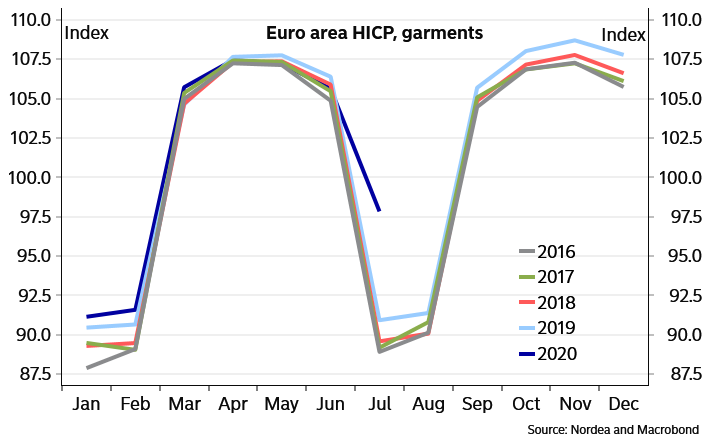

Euro area core inflation dropped sharply to 0.4% y/y in August following a sharp rise in July. The main reason is delayed summer sale in France and Italy, which will likely pull core inflation lower again in September.

ECB’s challenges are obvious. The Fed’s adoption of Average Inflation Targeting (AIT) adds expectations for the ECB to follow along those lines or at least do much more to re-anchor medium- to longer-term inflation expectations at target. At the same time the disinflationary impulse from the coronavirus recession pushes core inflation lower for the next year or two.

Executive Board member Isabel Schnabel’s interview with Reuters suggests no new easing measures are likely at the September ECB meeting unless staff inflation projections turn more negative, which does not seem likely even with today’s numbers. We expect to see another expansion of the Pandemic Emergency Purchase Programme (PEPP), but only later.

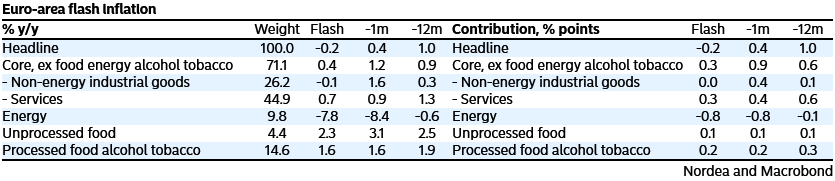

August inflation drops slightly more than expected

Headline inflation dropped to -0.2% y/y, dragged down by a 0.8%-point negative contribution from energy prices. Core inflation is heavily influence by prices of clothes, which are not following the usual seasonal pattern due to late summer sales in France and Italy. Clothes (garments) is part of Non-energy industrial goods (NEIG), which was responsible for most of the increase in core inflation in July and most of the subsequent drop in August.

But more importantly, service price inflation dropped to 0.7% y/y. Not surprisingly, monthly changes have widely been either very small or slightly negative in service sectors in many Euro-area economies.

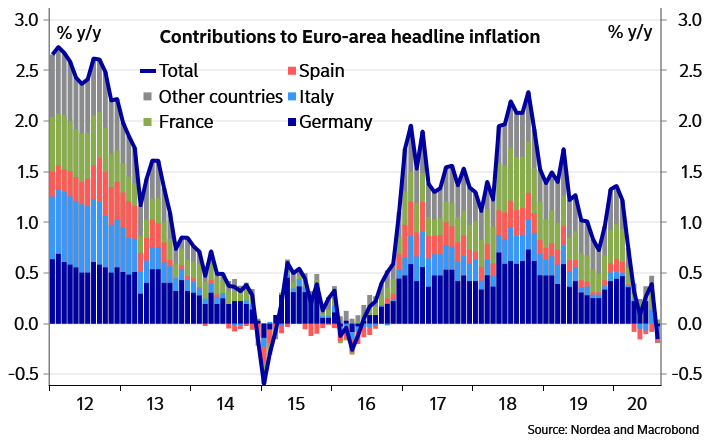

In July, there was a decline in service prices in Spain which compared with the normally positive move in July was dramatic and took the Euro-area service inflation down already then. In August, not much relief was experienced on that front.

In a bigger picture, service prices in France, Germany and Italy have been much more stable leading to a conclusion that wide-spread deflationary risks are still limited.

Chart 1. the numbers

Chart 2. Delayed summer sale

Chart 3. No country stands out