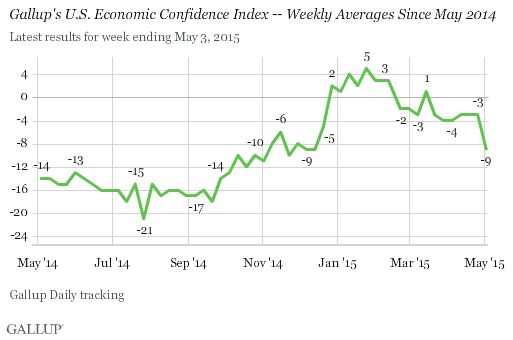

WASHINGTON, D.C. — Gallup’s U.S. Economic Confidence Index was -9 for the week ending May 3 — its lowest weekly score since December. This reflects a six-point decline from the previous week, and is the largest week-to-week drop since last July.

After falling from the high points in January and February this year, the index had barely moved in the previous six weeks. It had wavered between -3 and -4 since late March, before dropping last week. This included an average of -3 for all of April. And nearly all weekly readings in 2015 prior to now had been close to zero, with little week-to-week change.

Even after last week’s sharp decline, the index’s latest figure is well above most readings Gallup recorded from 2008 to 2014.

The recent dip in Americans’ economic confidence — which is being dragged down largely by the lower economic outlook component — is likely the culmination of a variety of economic factors.

Though stocks rebounded by last Friday, the previous week had been fraught with market losses in the Dow Jones industrial average and Standard & Poor’s 500 market indexes. Meanwhile, the prices Americans were paying for gas increased in the latter half of April, with the U.S. Energy Information Administration reporting an increase of 17 cents per gallon over two weeks. Gallup has found that Americans’ confidence in the economy is related to how much they pay at the pump. Additionally, the recent report that the nation’s GDP grew a lackluster 0.2% in the first quarter — a disappointing figure compared with previous quarterly growth — may have dampened consumers’ economic hopes.

Americans’ Ratings of Current Conditions, Economic Outlook Both Down

Gallup’s Economic Confidence Index is the average of two components: Americans’ ratings of current economic conditions and their views of whether the economy is improving or getting worse. The theoretical maximum of the index is +100, if all Americans say the economy is “excellent” or “good” and “getting better.” The theoretical minimum is -100, if all Americans say the economy is “poor” and “getting worse.”

For the week ending May 3, 24% of Americans said the economy is excellent or good while 29% said it is poor, resulting in a current conditions score of -5 — down four points from the previous week and the lowest current conditions score since December. The economic outlook score saw a sharper drop of eight points, to -12 — its lowest reading since November. The latest outlook score is the result of 42% of Americans saying the economy is getting better, and 54% saying it is getting worse.

Apart from the latest weekly figure, April’s -3 monthly average was slightly below the -2 recorded in March. This is the third straight month the index has declined after reaching its high point since 2008 of +3 in January. That reading was the first time in years the monthly index was positive, and it remained positive in February, albeit just barely at +1.

Bottom Line

Several pieces of unwelcome economic news last week may have contributed to Americans’ confidence dropping to its lowest point since last year. The latest fall, however, could be merely a snapshot of low confidence for a single week and not something that will necessarily be sustained. On that point, confidence began to improve slightly in the latter part of the week, although it was still below the levels seen through March and April.

Americans’ confidence in the economy does appear responsive to the latest reports on U.S. economic activity, and this Friday’s report on job creation and unemployment could help determine where confidence heads in the coming weeks. Unless the economic news continues to be bad, Americans may soon forget about the weak first quarter GDP and rising gas prices, which, the EIA projects, will stabilize during the summer. And even in the midst of last week’s negative economic news, there were bright spots, including the federal government’s reporting increases in consumer spending and a 15-year low in jobless claims. But last week, the bad news appeared to carry more weight in Americans’ evaluations than the good news.

The data in this article are available in Gallup Analytics.