by Eric King via Contra Corner blog,

Today David Stockman, the man President Ronald Reagan called upon along with Dr. Paul Craig Roberts to help save the United States from disaster in 1981, warned King World News that we are now entering the “terminal phase” of the global financial system that will end in total collapse.

Eric King: “David, I wanted to get your thoughts on gold in the midst of this big deflation you think is in front of us. When you look at the collapse of 2008 – 2009, gold was one of the best performing asset classes. Gold went down but it went down much less relative to virtually everything else. Contrast that to 1973 – 1974, where we had a 47 percent stock market collapse. But during that time we had skyrocketing gold and silver. What’s in front of us because it looks like gold and silver may be ending a 4 year bear market and ready for a 1973 – 1974-style up-move?”

David Stockman:

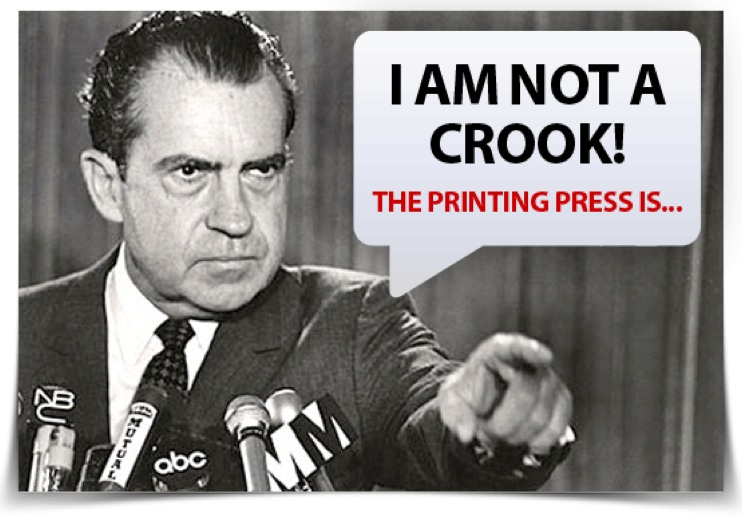

“Yes. I think the two periods are quite different. Although at the bottom it’s central bank errors that underlie each. But remember that in the 1970s we had just finally exited a semi-stable Bretton Woods Gold Exchange Standard system. There still was, at the end of the day, an anchor on the central banks that was thrown overboard by Nixon in 1971….

“So the first go-round was a rip-roaring price inflation because there had not yet been enough time under the fiat money and balance sheet expansion by the central banks to create excess capacity in the world industrial system. So as the boom in demand took off, commodity prices soared. That fed into domestic costs and labor wages in particular.

There weren’t a million cheap workers coming out of the rice paddies in China yet because it was still in the Dark Ages of Mao and not part of the world economy. And so you had a classic inflation blowoff and flight to gold in the 1970s as a result of that initial money printing cycle.

Now, I think 40 years later central banks are erring to much greater extent but the cycle is different. We have now created massive excess industrial shipping, mining and manufacturing capacity in the world. Therefore we don’t have a short-run consumer price blowoff. We still have massive cheap labor in the world and so therefore we don’t have a wage price spiral.

We Will See Total Collapse

The result is that all of the massive stimulus from the central banks has gone into the financial inflation, not goods and services. The financial inflation is obviously the great bubble that afflicts the entire financial system of the world. It’s becoming increasingly unstable and it will eventually collapse. And when it does I think it will mark the complete failure of a monetary system that has basically been metastasizing since 1971.

World Will Panic Into Gold And The Price Will Go Parabolic

Well, when a monetary system finally fails, there will be a flight to the only money that’s left in the system and that will be gold. That will be the hour in which the next great surge in the gold price occurs. You can’t predict the exact moment, but you can certainly have a pretty confident view of the direction (parabolic).

The central banks are clearly destroying the monetary system that emerged after Nixon went to Camp David in August, 1971. So here we are 45 years later and we are nearing the end of an unstable fiat central bank driven system and the alternative is fairly obvious — at some point going back to real money. I don’t think governments will do that voluntarily, but certainly people trying to protect their wealth will. When that happens it will trigger a huge political crisis and hopefully an opportunity to change the regime and get back to some kind of viable and sound financial and monetary system.”

Eric King: “David, it was fascinating listening to you talk about the difference between the 1970s vs today. During the horrific 1973 – 1974 bear market (in stocks) we saw gold skyrocketing. And we have seen gold trade very strongly through a number of crises from 2000 – 2011, at one point rising a stunning 700 percent.”

We Are Entering The “Terminal Phase” Of The Global Financial System

David Stockman: “Yes. Well, I think those cycles that you mentioned are relevant benchmarks, but they were warmups. What happened in each of those episodes was a short-run break in the system, collapse of confidence and flight to gold. What I think we are facing now is a terminal phase of a monetary system that isn’t viable, stable or sustainable. Therefore gold has but one characteristic — massive upside in the years ahead.”