Merrill har analyseret det mest dramatiske år siden 30’erne og hæfter sig ved de to vidt forskellige kursudviklingen fra coronakrisens start og fra efteråret med de begyndende vaccinationer. High-tech og onlinevirksomheder havde et forrygende år, men fra efteråret kom de cykliske aktier op, altså de normale aktier, der havde været undertrykt. Men det betyder ikke, at vinderne får nedtur, for digitaliseringen fortsætter. Derfor venter Merrill, at vinderne også vil få fremgang i år, ligesom de cykliske aktier, og Asien vil stadig være et vigtigt investormarked, for dér er væksten uafbrudt.

One Year Later: How Markets Have Moved Since the Start of the

Coronavirus Outbreak

Interest rate-related volatility has been the primary driver of equity markets over recent

weeks. But as we cross the 12-month mark since widespread shutdowns first brought large

segments of the global economy to a virtual standstill in mid-March of last year, it is worth

looking back at how equities have moved over the course of the pandemic so far.

The past year has been a historic period for investors, who have faced not only a once-in-acentury public health crisis, but also the deepest (-10.0%) peak-to-trough contraction in

world GDP and the fastest (21 trading days to reach a 20% decline) global equity bear

market in post-war history.

But one year later, following aggressive monetary intervention by

central banks, trillions of dollars in global fiscal support, and a major reconfiguration in the

behavioral patterns of households and businesses, markets have made significant aggregate

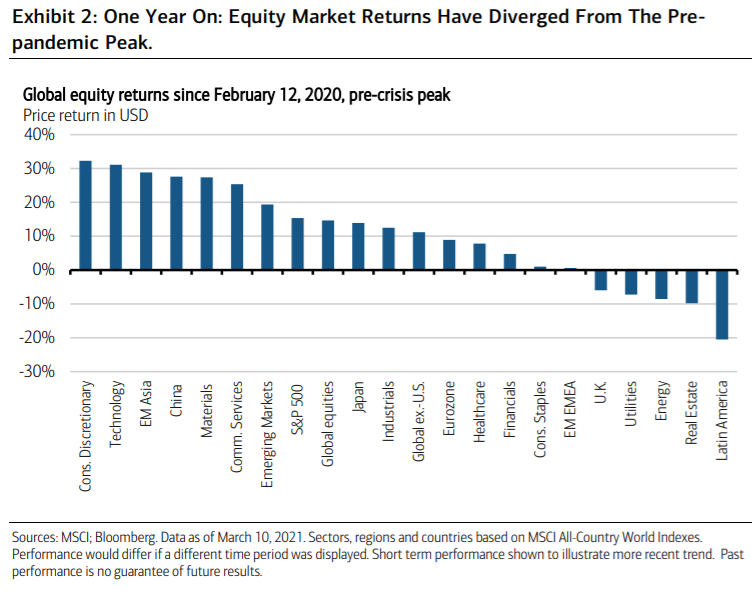

gains. As of March 10, 2021, the MSCI All-Country World Index stood 14.7% above its prepandemic peak, though returns have been widely dispersed across individual sectors, regions

and countries.

Consumer Discretionary and Information Technology have been the leading sectors of the

past year as dependence on internet services has increased with the need for physical

distancing. Emerging Asia—led by China and other north Asian markets that limited the

spread of their local outbreaks by responding quickly in the initial stages of the

pandemic—has been the top-performing region. And the digital economy-oriented U.S.

market has outperformed International Developed, particularly developed Europe, which

has much lower exposure to related sectors such as Information Technology and

Communication Services. At the tail end of the return distribution meanwhile have been

the Energy sector, Real Estate and Latin America as markets geared to travel, hospitality

and natural resources.

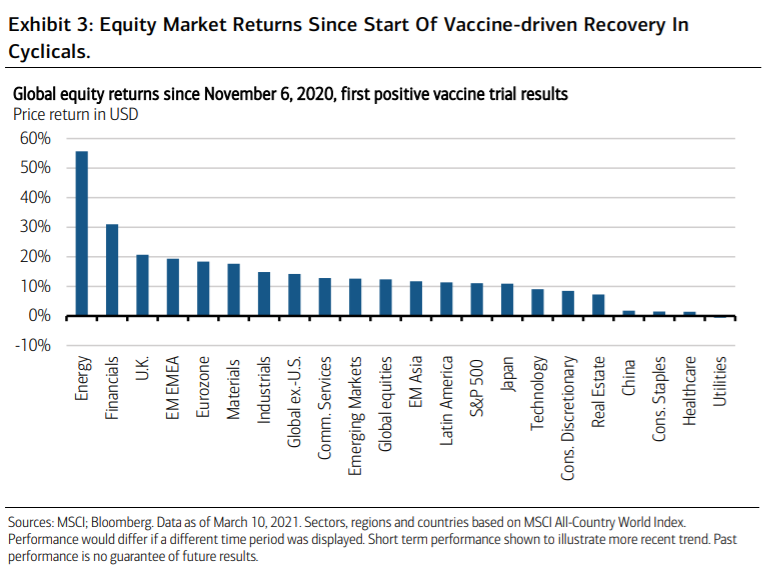

This 12-month snapshot of course masks the more recent rotation that began in early

November of last year. The November 9 release of the first successful trial results on the

coronavirus vaccine efficacy began a shift into many of the pandemic laggards, which was

reinforced by similar announcements from other leading pharmaceutical companies over

the following weeks.

Since this period, cyclical sectors such as Energy and Financials have

continued to benefit from regulatory approvals and now the first disbursements of the

new vaccines as investors look ahead to economic reopening in more economies around

the world later in 2021. And most recently, rising inflation expectations and the current

runup in global bond yields have only provided an additional relative tailwind for the

markets most beaten down by the pandemic.

Over the past four months, Energy and Financials have led all other global sectors, Latin America has outperformed China, and non-U.S. markets have outperformed the S&P 500, particularly Western Europe and emerging EMEA (Europe, Middle East and Africa), which have some of the highest regional concentrations within the cyclical sectors.

We expect this relative shift in sector returns to likely persist as global growth recovers

and global interest rates move higher. But technology-related segments and emerging

Asia have nonetheless been able to keep pace with the broader market advance of recent

months, even as investors anticipate normalization in the most depressed segments of the

global economy from the second half of 2021. And as we look further ahead into the

current decade, these growth leaders of the past 12 months across sectors, regions and

countries could also be able to perform well alongside better returns across more cyclical

segments.

A post-coronavirus world should bring forward the expansion of the digital economy as a

greater portion of healthcare, education, retail, entertainment and other services are

delivered remotely. This in turn will likely boost demand for cloud-based software services,

and increase the need for upgrades to supporting infrastructure and hardware such as

high-speed telecommunications networks and advanced semiconductors for data

processing and storage. As online activity commands a larger share of global output over

the years ahead, these improvements in network reliability, speed and capacity will be

critical in supporting a larger number of wireless connections consuming ever larger

amounts of data.

Manufacturers are likely to favor more localized, automated and capital-intensive supply

chains, both to reduce costs and to lower dependence on overseas suppliers of

components and finished goods (including medical supplies and pharmaceuticals) in case

of future disruptions. This too should increase demand for electronic equipment,

components and enterprise software, as well as for new production techniques such as

additive manufacturing.

Headwinds may persist for key segments of the real estate market such as retail, office

and hotel as more activity is conducted online and virtually. And though base metals and

other commodities used in the production of low-carbon energy and battery storage may

see increased demand, fossil fuels are also likely to remain under pressure as remote

activity caps mass transportation demand, and as economies around the world look to

reduce their greenhouse gas emissions and ultimately transition to net-zero.

Lower income, natural resource-dependent economies in Latin America, the Middle East and

Africa are therefore likely to account for a relatively small share of global growth, with the

largest increase in the global consumer class expected to come from the Asia-Pacific

region. Per capita incomes across these regions are likely to grow most quickly in markets

that can increase their share of value-added in the expanding digital economy, though

supply chain localization among leading global manufacturers could limit the potential

gains.

Many of these trends predate the outbreak. But moving beyond the past 12 months

and looking through the recent volatility, one of the main legacies of the pandemic is likely

to be an acceleration of these changes as we move deeper into the 2020s.