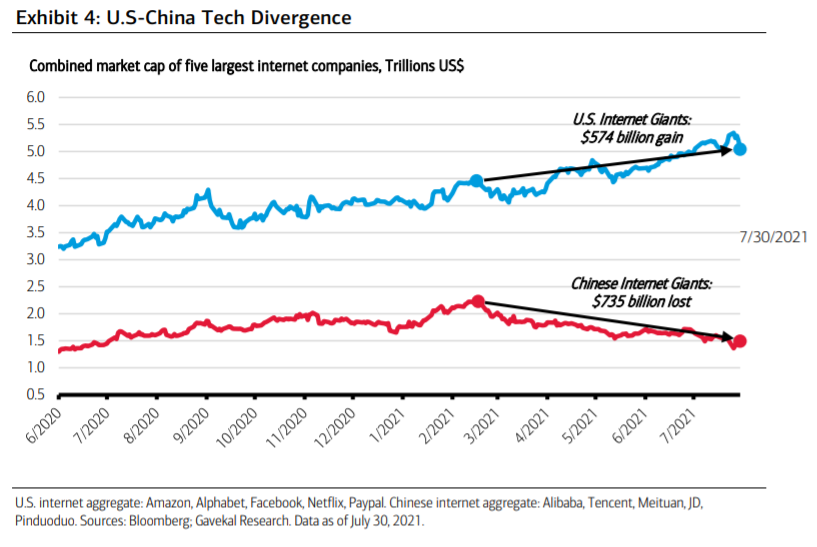

Den seneste måned har vist en dramatisk forskel på tech-giganternes markedsværdi. De kinesiske myndigheders indgriben over for Kinas egne tech-selskaber med skrappere reguleringer har høvlet 735 milliarder dollar af markedsværdien for de 98 største kinesiske selskaber på Nasdaq-børsen. I samme periode er de amerikanske tech-giganters markedsværdi steget med 574 milliarder dollar. Det får Merrill til at anbefale investorerne at være forsigtige med at investere direkte i de kinesiske tech-selskaber, da den politiske risiko er blevet stor. Vil investorerne investere i den kinesiske vækst, kan det være bedre at investere i europæiske og amerikanske selskaber, der sælger til den kinesiske middelklasse. Og så kommer Merrill med dét, banken kalder en fair warning: Væksthistorien i Emerging Markets sker på de kinesiske myndigheders betingelser.

The Cost of China’s Crackdown

The sweeping regulatory crackdown on China’s private sector has roiled global markets

and sent the Nasdaq Golden Dragon China Index, an index tracking 98 of China’s biggest

firms listed in the U.S., declining by more than 20% in July. The carnage from the

crackdown: nearly $735 billion lost in value of China’s largest internet stocks since their

highest value five-and-a-half months ago, just as the largest U.S. internet companies

added $574 billion in value over the same period (Exhibit 4). A clear divergence between

U.S. and China technology giants—as many U.S. Mega-cap tech names hovered near highs

during corporate earnings season and China’s crackdown escalates for internet platform

companies with data security as a key risk.

U.S. internet aggregate: Amazon, Alphabet, Facebook, Netflix, Paypal. Chinese internet aggregate: Alibaba, Tencent, Meituan, JD, Pinduoduo. Sources: Bloomberg; Gavekal Research. Data as of July 30, 2021.

The upshot: Relative to the U.S., MSCI China valuations may be at their lowest levels seen

in the last five years. However, investors should assess the risks before bargain hunting.

The selloff among the targeted (tech, education, property, etc.) Chinese stocks recently

under pressure has moderated some after policymakers stepped in to reassure markets.

The market action, however, serves as a not-so-friendly reminder of the risks associated

with investing in China’s private sector—one in which the Chinese Communist Party looms

large.

Although they are not impervious to regulation, we maintain an overweight to U.S. Large caps, with Technology as one of our favored sectors, and are neutral on EM as an asset

class. In the near term, the biggest risk may be to the 250 Chinese companies listed on

U.S. exchanges with data security as an ongoing political priority for Chinese regulators.

Investors looking to gain exposure to the rise of the EM middle class could consider

allocating via U.S. and European multinationals with significant exposure to the Chinese

consumer—think luxury brands, food and beverage companies, and automobile

manufacturers. Fair warning, most exposure to the EM growth story comes at the terms of

Chinese regulators.