De seneste meldinger fra ECB viser, at centralbanken er parat til en ekstra indsats for at sikre prisstabiliteten. Der er udsigt til flere lempelser på ECB-mødet i juni, mener Nordea. ECB har droppet enhver formodning om, at der kan komme et V-opsving.

Uddrag fra Nordea:

ECB Watch: Hawks still see upside inflation risks

The latest monetary policy account signals the ECB stands ready to do more but amidst all the uncertainty, it is difficult to see ahead. More easing measures will likely be introduced in June.

The ECB sees it has already done a lot to preserve price stability in the Euro area, but stands ready to do more. Today’s monetary policy account pointed to more information being available at the June monetary policy meeting, including new staff forecasts, and at that point, the Governing Council would have to stand ready to adjust the PEPP and potentially other instruments if it saw that the scale of the stimulus was falling short of what was needed. Further, the ECB emphasized that pre-emptive action was preferable.

The ECB has already abandoned the most optimistic economic recovery scenarios, e.g. ruling out a swift V-shaped recovery. The uncertainty about the future remains exceptionally large though, and also the ECB clearly needs more information to guide its future monetary policy decisions.

While it was clear that the short-term inflation outlook had deteriorated, the medium to longer-term outlook was more ambiguous and some Governing Council members even pointed to upside risks. It was also noted that inflation had in the past shown a high degree of persistence and there could be upward pressure on prices from the costs of containment measures and supply disruptions, as well as from a number of structural effects following the pandemic. These were seen to include the exit of firms from the market and associated changes in the degree of competition, lasting changes in supply chains and the location of production, and increasing emphasis on resilience, leading to higher buffers and inventories. There could also be tighter limits to production as the spatial distribution of global production changed. Not every Governing Council member is convinced the upside inflation risks are gone.

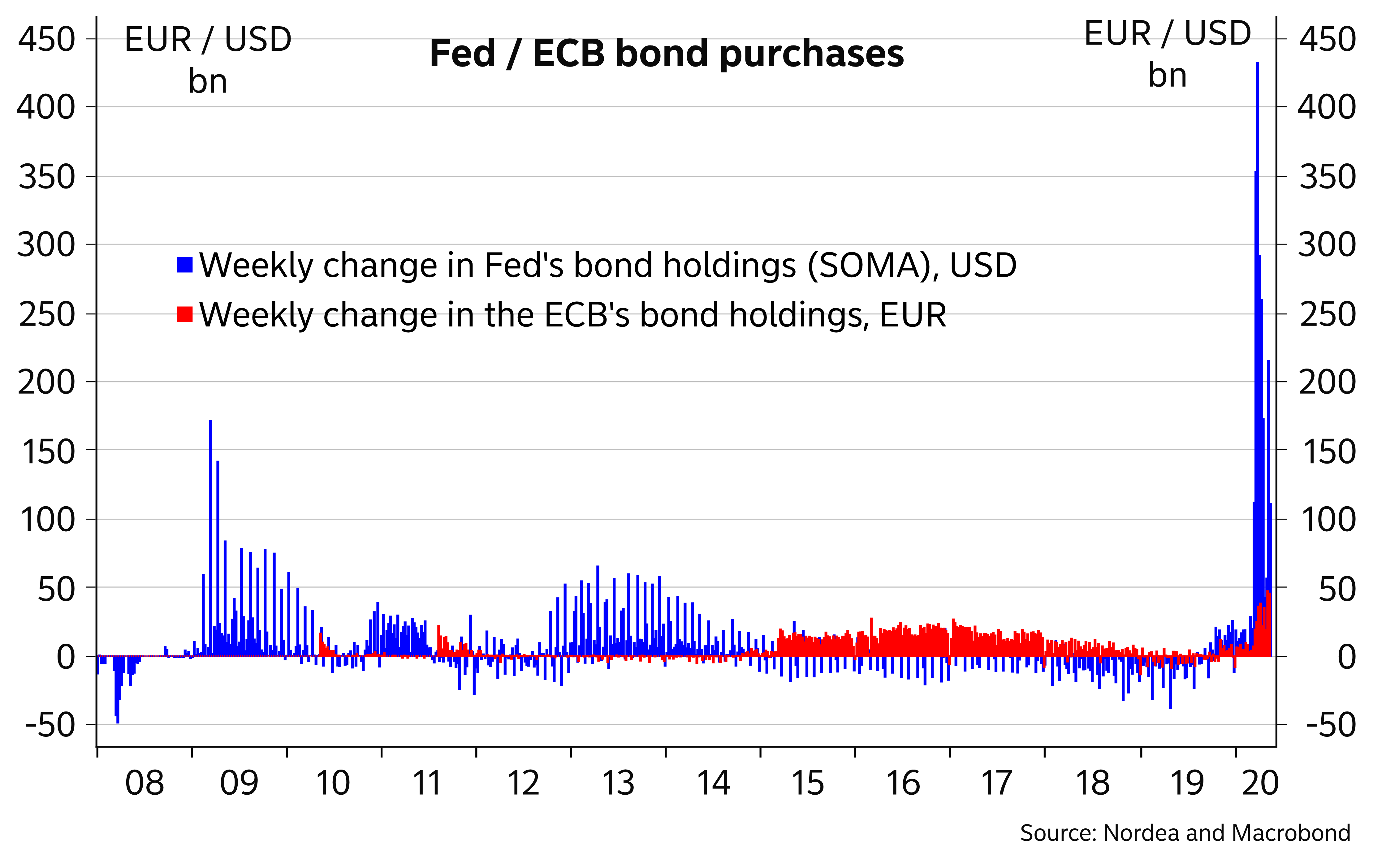

On the monetary policy measures announced, the flexibility of the pandemic emergency purchase programme (PEPP) was emphasized. It will be very interesting to see, how far the ECB has deviated from the capital key in its sovereign bond PEPP purchases, when the data is released in June. Bid deviations will inevitably open the ECB from more criticism, especially in countries like Germany.

Not everybody was enthusiastic about the flexibility, and concern was voiced that large-scale interventions in sovereign bond markets could give rise to the risk of “fiscal dominance” and that the programme had to be executed carefully in order not to encourage irresponsible behaviour on the part of governments. Such voices most likely remain in minority for now.

The new pandemic emergency longer-term refinancing operations (PELTROs) were seen as significant, since the provision of term funding without the operational complexity associated with TLTRO III was seen as important in providing funding for banks at attractive conditions and in helping to preserve the smooth functioning of money markets. On that note, the demand of only EUR 0.85bn in the first PELTRO this week must have been a disappointment.

It was also noted that the number of “fallen angel” bonds was increasing, while downgrades of high-yield issuers were already much more prominent. The ECB may well consider including bonds that have recently lost their investment grade status in its purchase programmes.

Going forward, we continue to expect that the PEPP will be expanded and extended. Further modifications to the TLTRO terms could also be in store. We do not expect the ECB to lower its benchmark rates any more. It is clearly focusing on other means to ease policy.