Tiden efter coronakrisen vil være helt anderledes end tiden efter finanskrisen, vurderer Nordea, der venter en stærk fremgang i andet kvartal. Coronakrisen kan være udjævnet i løbet af halvandet eller to år, mens det tog 10 år for finanskrisen. Men der er også betydelig usikkerhed. Det kinesiske finanstilsyn advarer om globale bobler, og der bliver måske ikke vaccineret så mange som hidtil antaget. Omvendt er der ophobet en gigantisk opsparing, der sammen med finanspakker kan sætte skub i økonomien. Bliver det undervurderet af centralbankerne? Men én ting er sikkert: Inflationen stiger.

When it rains, it pours (bond bearish news)

The cross-currents between COVID-19, macro and market “dynamics” have in recent weeks started to rattle some markets. Sudden spikes in interest rates have returned with effects also on equities & FX markets

You know you’re in for an interesting week when it kicks off with the Chinese head honcho of banking regulation stating that he is “very worried” about bubble tendencies in the global financial markets and the Chinese real estate market.

Maybe “Jay-Jay” Powell ought to lend him an ear – Powell who famously warned about stretched equity valuations in 2018 when the P/E for NASDAQ was 21, while now seems totally fine with a P/E of 33. Hmmm…

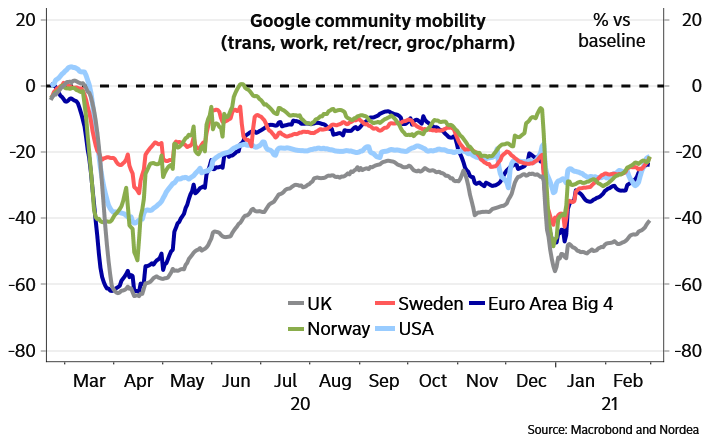

Chart 1. Google mobility data continue to climb

In other news, business cycle data were mixed during the week, with a continued high US manufacturing ISM and upward revisions to Euro-area PMIs while Chinese PMIs/ISM services surprised to the downside and Euro-area retail sales for January slumped. Mobility data, however, continues to climb from the January lows registered when the second COVID-19 wave ran rampant.

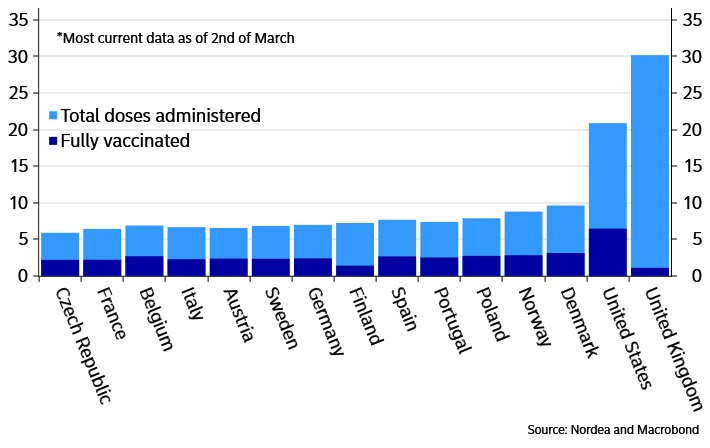

That said, new cases in the West excluding the UK are currently increasing again, likely driven by the B117 variant. However, in a newly published research note based on the positive Israeli experience we conclude that vaccinations in a not too distant future will turn the trend.

In short, we see crucial vaccination thresholds being reached very soon in the UK, early April in the US and continental Europe by May. Virologists are probably too pessimistic and re-openings of economies should be swifter than expected.

Chart 2. Current pace of vaccinations

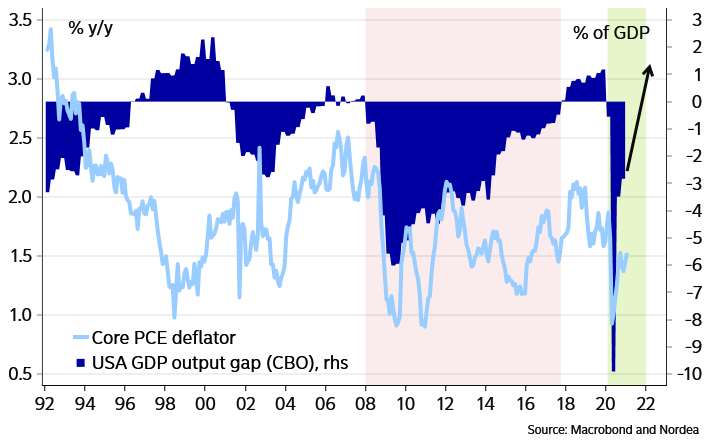

This is nothing like the financial crisis aftermath

Given our take on COVID-19, and other reasons, economic growth should be expected to pick up pace markedly in Q2. Yet again we feel the urge to stress how different we believe the comeback from this recession will be compared with previous experiences in general, and the financial crisis in particular.

The 2020 recession was an output shock and once the root cause is vaccinated away, economies should return to the starting point fairly quickly. It was definitely not the effect of any major economic imbalances being cracked by higher interest rates, such as the financial crisis, and expected to hold back growth for ages.

It took 10 years for the US economy to close the output gap created by the financial crisis. This time it could take as little as 1.5-2 years. The conclusion is similar for the Euro area.

Chart 3. Will we see a markedly positive output gap already 2022?

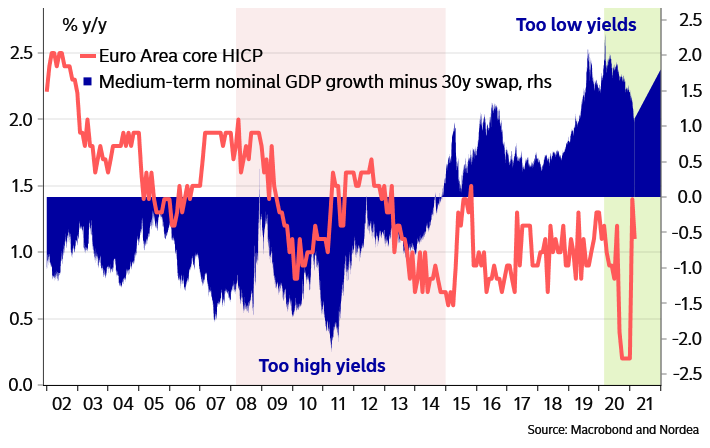

On top of being an output shock-related recession, stimulus measures have been M A S S I V E in comparison with the financial crisis. On the monetary side we are all aware of huge QE purchases and exploding money supply. Another way to look at it is that the Fed and the ECB policies this time have pushed down long-term yields massively below medium-term neutral levels. After the financial crisis, long-term yields remained at restrictive levels compared with the economy for many years, particularly true for the Euro area.

Chart 4. ECB – from too restrictive to too complacent?

Arguably, the ECB indirectly pursued a too tight policy all the time between 2002-2014, with interest rates being much higher than the “potential” nominal growth rate of the economy. This was likely an important part of the disinflationary “spiral” in place since the creation of the monetary union. Now, instead, they could make the mistake of sticking to a vastly too stimulative policy with interest rates all the way out to 30 years and beyond markedly below potential nominal growth.

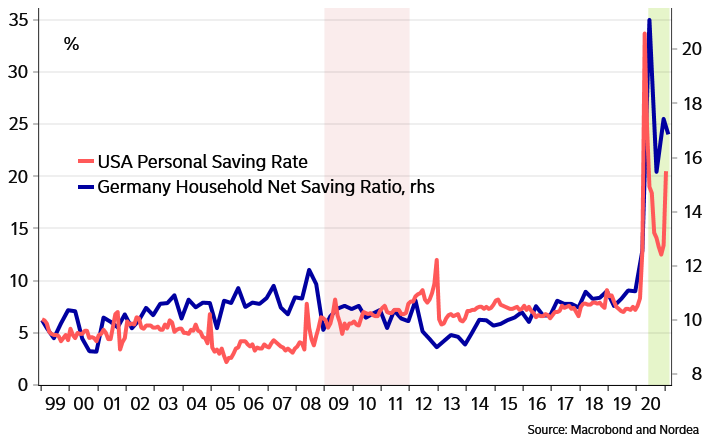

And then we of course have fiscal policy. No matter how you slice and dice it, the end result of the measures taken has been an extreme increase in “excess” savings amongst households around the world. At no time in modern history has there been such a surge in personal savings ratios as now, and that is true before the new Biden stimulus checks for 2021 likely get approved. In other words, there is a HUGE pile of cash on the side line to put to work when the economies open up.

Chart 5. Plenty of cash ready to spend

Either central banks are blind to all these fundamental differences to the aftermath of the financial crisis and simply don’t get it, or else they won’t admit to it until the COVID-19 episode is laid to rest. Let’s hope it’s the latter and to be fair, so far central bankers in general have given the rising interest rate trend a silent nod of approval, citing that the main reason behind it is an improved growth and inflation outlook.

Inflation risks are plenty

We have all these fundamental differences in the economic situation and in our view they add up to a higher inflation risk than in the past. Central banks and markets, however, still seem to bet on a brief base effect driven inflation spike over the coming months and then a drop back to normal, and in the central banks’ view, too low inflation rates. This assumption, we guess, is mostly driven by an expected low wage cost pressure.

We would thus guess on a scenario where core US inflation spikes in the coming months, falls back somewhat over the summer but then reaches a new high later in 2021. The large increase in the ISM services price this week could clearly be seen as an indication that it’s more than a simple base effect spike going on. Tapering anyone?