Nordea har analyseret den danske regerings finansieringsbehov i år og næste år, og mener, at finansieringsbehovet er sat alt for højt. I år er det reelle behov 100 milliarder kr. mindre end regeringens antagelse, og næste år er det 75-80 milliarder kr. mindre. Derfor er der reelt ikke brug for en finansiering næste år. Dansk økonomi har klaret sig bedre end ventet i august. Overfinansieringen fører til et for stort spread til en række euro-obligationer, især de tyske, og Nordea anbefaler at købe DGB29-obligationer.

Trade idea DKK: Buy DGB29 vs. Germany.. No issuance need makes the 29 the buyback paper

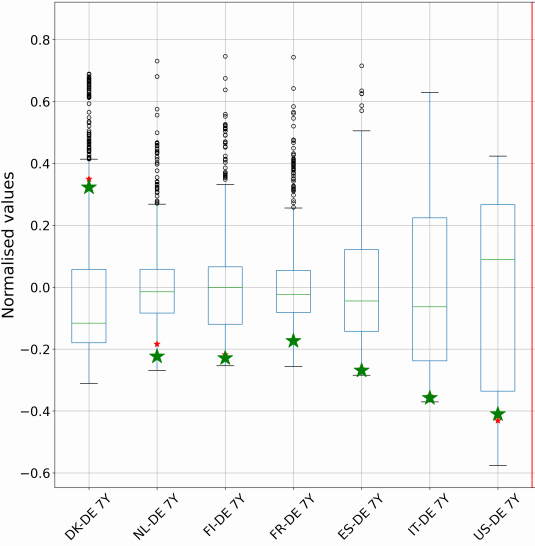

With a clearly negative net financing requirement next year, it looks odd that DGBs trade with such an elevated spread to semi-core and core. Buy DGB29 as it will turn into a buyback paper next year.

The Danish administration has overfunded itself massively through 2020 in anticipation of a wider usage of aid packages and voluntarily postponements of tax payments and VAT. The ultimate 2020 net financing requirement will prove to be much smaller than anticipated back in August – by the magnitude of at least 100bn.

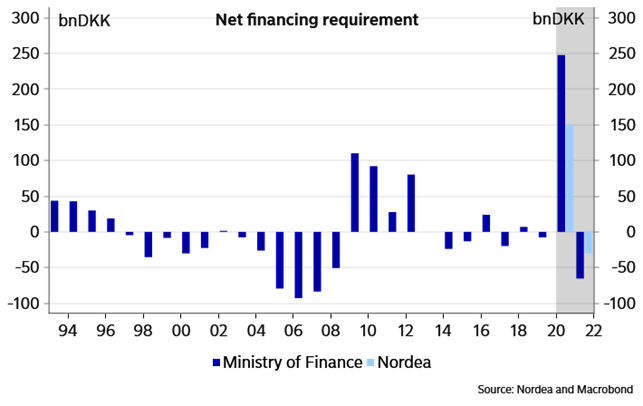

There is essentially no need for financing next year as the net finance requirement will be substantially negative as was the case ahead of the great financial crisis in 2008 (Denmark: Much lower than expected demand for government money)

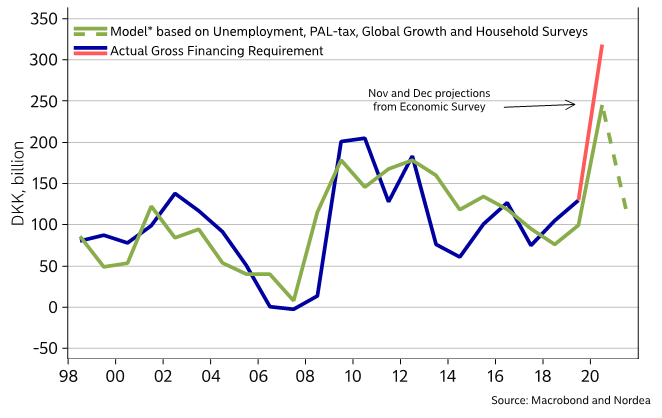

Chart 1. A substantial negative net financing requirement in Denmark next year

The official funding strategy for 2021 is due within days after the agreement on the budget for 2021 last Sunday. Due to accrual technicalities we expect a slight upwards revision of the 2021 funding requirement (less tax payments have been postponed until 2021 compared to the official expectation in August).

Even with a slight upwards revision, we still expect a substantial negative net financing requirement for 2021. Our estimates suggest an official gross financing requirement of 218bn DKK of which around 75-80 bn DKK are just “unused” funds from the USD commercial paper program. Effectively there is very little need for DKK issuance next year.

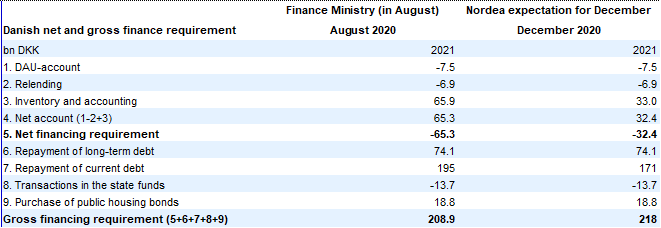

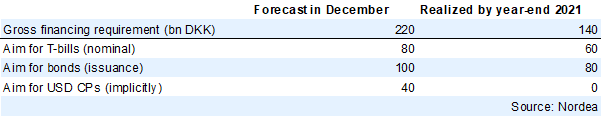

Table 1. Finance ministry in August 2020 compared to our expectation for the update December 2020

We expect the debt office to stick to a fairly high issuance target for bonds around 100bn DKK, but we highly doubt that it will be realized by year-end. The aim for T-bills will likely be set at 80bn DKK but we also bet that it will be revised lower during 2021. There is also a clear possibility of 5-10bn DKK worth of green bonds, which should attract new money to the Danish market and hence tighten “black” DGB spreads to Germany.

Table 2. Our estimate for the official issuance strategy vs our estimate for the realized 2021 issuance

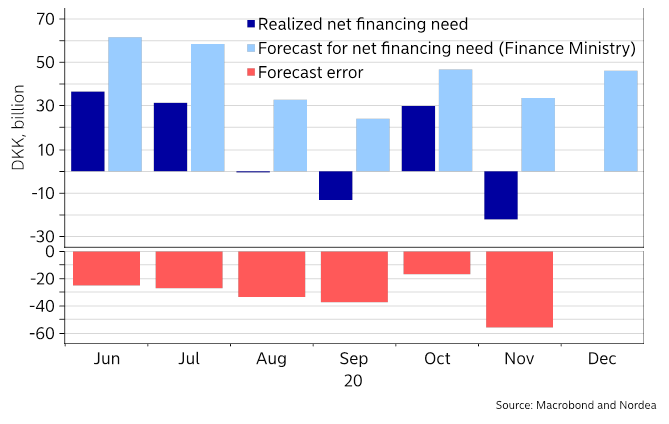

The government forecasting error has been one way traffic over the last six months due to political reasons. When all companies are allowed to postpone tax payments until 2021, it makes sense to politically communicate that funding will be made ready if almost all companies decide to postpone the payments.

That was of course never likely, not least as the Danish economy has performed better than feared with a fairly decent comeback to activity over summer. We expect forecasts to remain too elevated for 2021.

Chart 2. Official estimates for the net financing need compared to the realized need

Our fundamental model for the underlying gross financing need in Denmark indicates a clear risk/reward towards a lower realized gross financing need for next year. If unemployment drops by 0.1%-point per quarter, PAL-tax accounts for 40bn DKK, growth returns to trend and consumer confidence return to normal levels, our model suggests a gross funding need just below 140bn DKK. Much below what will likely be communicated as the official target in the 2021 strategy from the debt office.

The first move will be to handle the situation via (large) buybacks of outstanding govies and subsequently to lower the issuance target during the spring or the early summer. The DGB29 will likely prove to be the relative winner of such a buyback scheme as it becomes a natural buyback paper when the new 10yr bond is opened.

Chart 3. Our model for gross financing needs in 2021 indicates a clear risk picture towards less funding needed

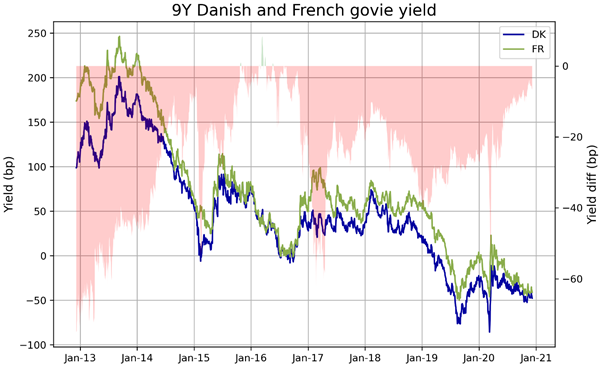

The current yield spread to France is at levels last seen in the aftermath of the issuance suspension following the DKK-crisis in 2015. At that time the many months without government bond auctions killed liquidity and increased the illiquidity premium in Danish Government bonds.

Chart 4. Yield on Danish and French generic 9 year government bonds. Coloured area is excess pickup in Denmark relative to France

In our view, the main reason for the wide spread to Germany is that the issuance since March has been large without a Danish QE program to match the ECB. When danish net-issuance declines markedly during next year, we strongly believe that spreads will tighten to EUR government bonds.

We hence suggest to buy DGB29’s versus Germany. The trade could also work against other EUR core or semi-core countries but the trade would be more sensitive to ECB PEPP increases in case.

Target 9 bps, Stop/Loss 19 bps (reference spread 15.4 bps)