Nordea har lavet en analyse af tendenserne i Kina, hvor væksten bliver lidt lavere end forventet, ikke kun på grund af Deltaen, men også på grund af forsyningsproblemer og politiske indgreb. Præsident Xi griber ind over for high-tech sektoren samt uligheden for at få en mere ligelige velfærdsudvikling. Nordea tror ikke, at der sker permanent skade for vækstmaskinen, og Nordea er fortsat relativ optimistisk omkring de langsigtede perspektiver.

China outlook: How worried we should be?

China’s growth momentum has been hit by the delta virus, the slowdown in construction and weak consumer confidence. At the same time, the recent policy moves increase the political risk in many sectors and raise worries about the long-term outlook.

In this note, we will first go through China’s short-term growth prospects and then analyse how do the recent policy changes affect the long-term growth outlook. Our main conclusions are:

- China’s growth momentum has recently weakened and not all of the weakness is due to the virus. Weak consumer confidence and slower construction activity are likely to dent growth going forward which implies that we see mainly downside risks to the close to 6% GDP forecasts widely made for China in 2022.

- It will take at least a few more months of vaccinations to achieve herd immunity and in the meantime, China will continue to tackle the virus by introducing lockdowns wherever needed.

- Weaker growth momentum is likely to encourage the authorities to introduce some policy easing in the coming months. However, the size of the policy boost will be limited as the focus is still on deleveraging.

- Beijing’s actions and Xi’s recent speeches have raised lot of questions about China’s future and for a good reason. However, the actions so far can be linked to the country’s 5-year plan and while business models in a number of sectors are certainly challenged, we continue to believe that the goal of increasing economic well-being in the country will dominate the policy actions going forward.

Strict lockdowns until herd immunity is reached

China has now vaccinated more than 60% of its population and aims to take that number close to 80% by the end of October. However, given the uncertainty of the real efficiency of the Chinese vaccines towards the new virus mutation and the low number of Covid-19 cases so far, experts have estimated that more than 80% of population has to be vaccinated before herd immunity is reached. Thus, we expect that China will continue to introduce aggressive lockdowns if needed in the coming months and for example travelling across borders will continue to be very limited well into 2022.

The virus keeps consumers on their toes

China’s growth momentum was hit in the summer and we expect the third quarter q/q growth rate (published on 18 October) to decline from 1.3% in April-June. In annual terms, China’s GDP growth in 2021 is likely to be in line with the 8% forecasts due to the strong base effects, but the starting point for growth in 2022 is not the best possible one and we mainly see downside risks to the next year’s forecasts that often hover at levels close to 6%.

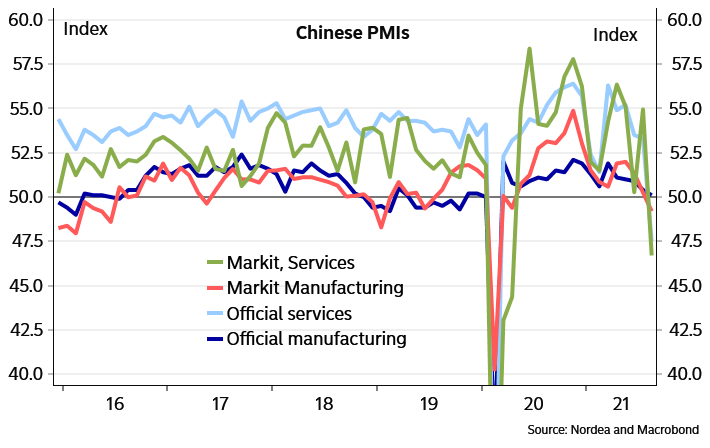

The main factor behind weaker momentum is of course the delta virus mutation, which resulted in tighter Covid-19 restrictions in China and also hit consumer confidence. On top of the weaker PMI numbers especially in the service sector, the high-frequency data on for example traffic jams, people’s mobility and cinema box office also showed slower activity in July-August and will likely also be reflected in retail numbers next week.

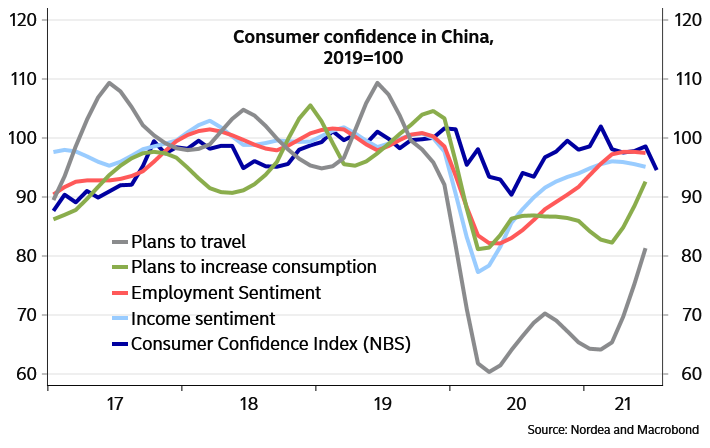

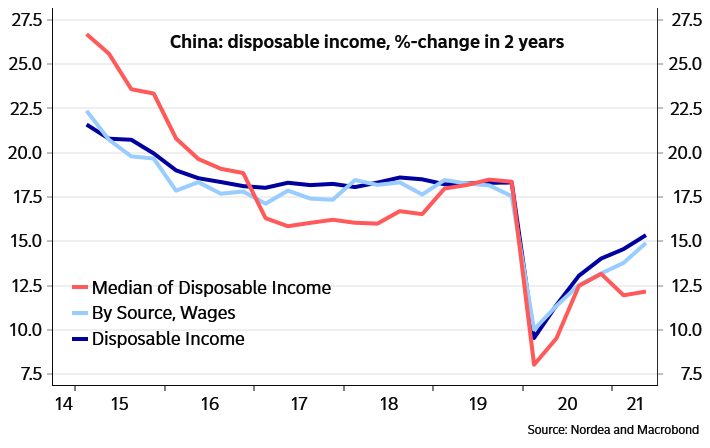

From the growth perspective, it is worth noting that Chinese consumers have not yet fully recovered from the Covid-19 crisis. In 2020, income development was badly hit by the crisis and unlike the GDP, households’ income development has not recovered to the pre-crisis trend. This has been reflected in many expenditure indicators, which have not returned to pre-crisis growth trend, and in the People’s Bank of China quarterly survey, which shows that consumers’ propensity to save has remained high. Thus, we probably need to see robust income growth and a safe and robust environment at least for some time more before consumption will really take China’s growth to the next level.

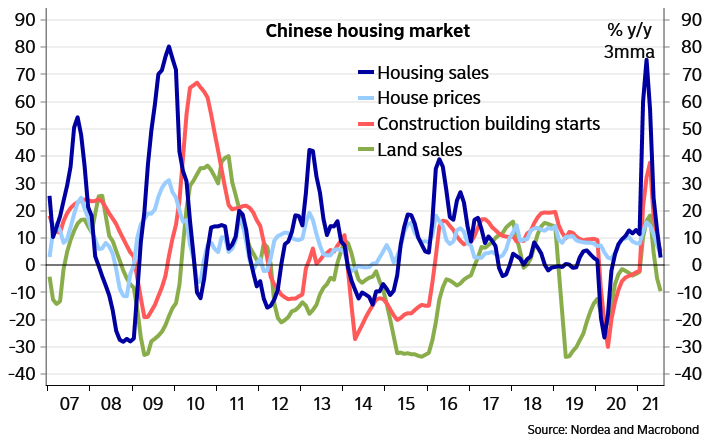

Another weak point of the Chinese economy is the real estate sector. The political environment for the sector is not the most encouraging one under the current leadership, which is reflected in tighter regulation and higher financing costs. This together with lower consumer confidence has partly resulted into slower growth of construction starts and prices. That trend may not reverse anytime soon and the sector is likely to drag down growth instead of being one of the main engines of growth like in the past.

The slower momentum in construction has also dented manufacturing production, which on the other hand has so far been supported by a strong export performance despite the fact that Western consumers are expected to shift back to consuming more services. The lower PMI numbers on new orders both externally and domestically may indicate that growth will slow down also in manufacturing.

Delta virus hurt growth in the summer

Consumer confidence has not fully recovered

Household income has not returned to pre-crisis trend

Real estate and construction are now breaks to the economy

Somewhat looser policy stance on the cards

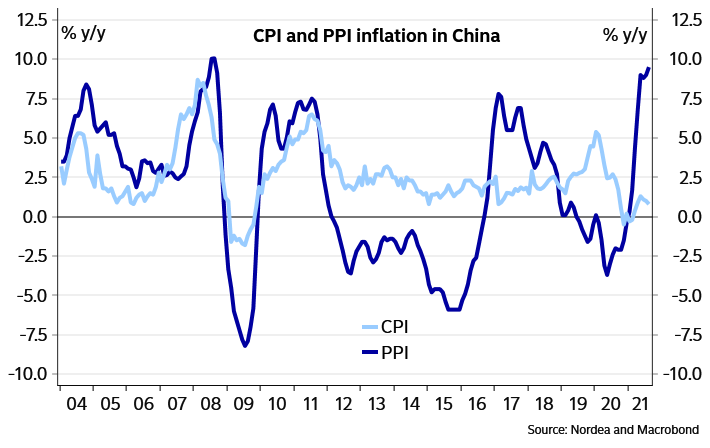

Given the weakening of growth momentum it is likely that the authorities will take some steps towards an easier policy stance. Inflation does not limit monetary authorities’ room for manoeuvre as the rapid rise in producer prices has only had a limited spill-over effect on consumer price inflation, which continues to be low (0.8% in August). We expect some small steps towards easier financing conditions, including bringing forward a part of the 2022 bond quotas and/or lowering reserve requirement ratio and interest rates.

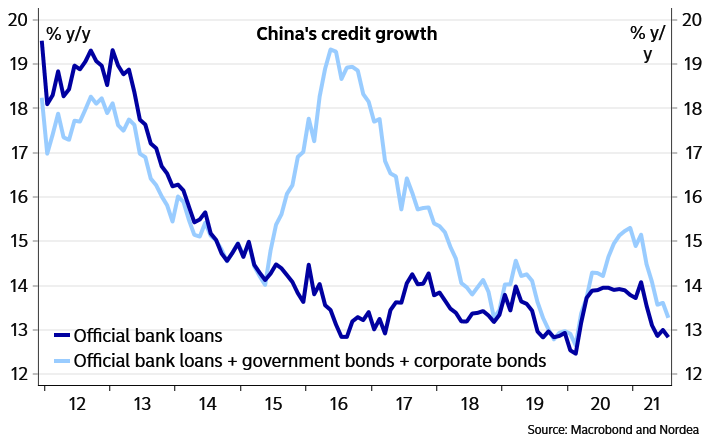

However, we still believe that China does not want to significantly accelerate credit growth from the current levels and policy actions at macro level are likely to be contained. Rather, the policy actions are likely to be targeted to certain sectors, as China wants to modify its growth model and push investments in eg high-tech manufacturing. At the same time, sectors not key for long-term growth perspectives may face much harder business conditions in many ways.

Spill-over from producer prices to consumer prices has been limited

Not another credit boom is expected

How worried we should be about Xi’s policies?

News from China has drawn many headlines in the past weeks and months. The regulatory environment has tightened and Beijing has introduced more new laws than in many years. Some observers have already started to speculate whether China is changing its economic policy course towards a really Communist society and many are worried about the prospects for private and foreign entrepreneurship in China.

Of course, centralising the power in Beijing and increasing party’s control on the economy obviously fuels worries and increases political risk in many sectors. However, we would also like to point out that Xi has set a high ambition level when it comes to long-term economic growth. A major setback in the business environment would jeopardise these goals. We thus think that the recent tone is partly due to the important Party meeting in 2022 being only a year away – and Xi is now preparing the ground for a nearly permanent term in power.

It is of course extremely important to try to understand what is changing in China’s big picture and at least try to guess which sectors are the next targets for actions. In this work, we continue to think that China’s 5-year plan, which is now implemented as concrete actions, is a good guide. The key trends and topics driving the daily policy actions and also visible in the 5-year plan are:

- Strong domestic market: Dual circulation, common prosperity

- Environmental issues

- Important role of high-tech manufacturing

- Quality of growth more important than quantity

- Worries about very low birth rates

These are very much the same trends that we pointed out in our note on the 5-year plan in March (https://corporate.nordea.com/article/64061/china-back-to-basics) but at least the challenges related to slow population growth became more urgent in May when the results of the population census revealed even lower-than-expected birth rates and very slow population growth. Since then, new regulation on eGames and tutorial companies clearly emphasise the role of kids in the society and encourage couples to have more kids.

One group of companies that have suffered a lot from new regulation this year is of course the internet giants. Data protection, and especially in Ant Group’s case financial stability, have of course been part of the regulatory motivation, but one way to look at the new regulation is also via the efficiency of the domestic market. One idea of “dual circulation” and ”common prosperity” is to ensure that the domestic market is efficient and monopolies are not allowed. This has always been important when reforming the Chinese economy.

It is also possible to interpret Xi’s recent speeches about “common prosperity” and recent tighter regulation on rents and on healthcare costs from the growth angle. Households’ high saving rate has been one of the brakes on economic growth in China and now that dual circulation, i.e. the domestic economy, is expected to play a larger role, leaders want households to consume more. That could be done by improving household’s safety nets which could of course be financed via some new taxes on the wealthier population.

One of the motivations for new regulation and policy measures will certainly be the environmental challenges. We have already seen cuts in the production of steel in order to limit CO2 emissions in the summer. These limits have had an enormous impact on prices of iron ore and steel, for example, but we believe that this is just the beginning of the actions on this front. However, at this point it is not at all clear how China will start to direct its economy towards the ambitious CO2 targets which increases uncertainty about the regulatory environment in many sectors.

Summing up, Beijing is certainly not afraid of introducing new regulation at a fast pace even if the consequences on some companies or sectors would be drastic. Thus, political risk has clearly increased and it is hard to guess which sectors will be targeted next. Communication from Beijing has to followed very closely. However, we do not think that the actions so far have done a permanent harm on China’s most important growth engine, people’s hunger to increase their well-being, and we thus remain relatively optimistic about the long-term outlook.