Nordea går ofte imod trenden på markedet. Nordea mener i sin udsigt for denne uge, at væksten og inflationen vil falde i det kommende år. Det vil ske under en højere rente samt et stærkt arbejdsmarked. Obligationsmarkedet fungerer ikke normalt i denne tid, skriver Nordea, der tror på en stærk jobvækst, når corona-støtten til arbejdsmarkedet slutter.

Week Ahead: Peak growth and inflation, so what?

Growth and inflation are set to decelerate over the coming 9-12 months. The deceleration will, however, come from oddly high rates and be combined with strong labour markets. The market conclusions are not as straightforward as usual in decelerations

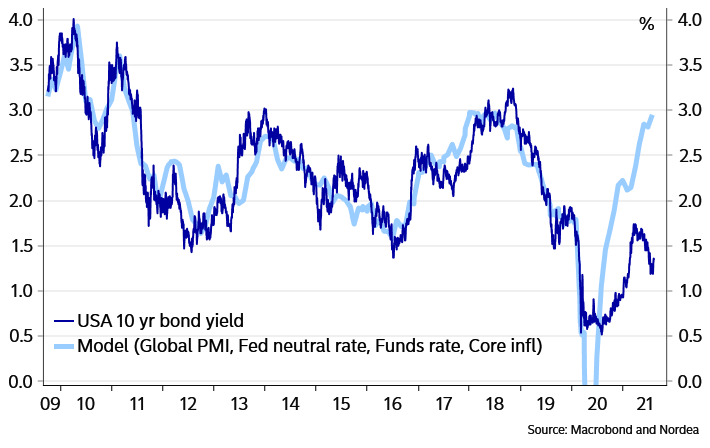

Bond markets are struggling with a macro outlook that likely spells a deceleration in inflation and GDP growth over the coming 9-12 months at the same time as bond yields are fundamentally very low and yield curves much flatter than normal at this stage of the cycle. We are struggling with that too.

Chart 1. A major central bank driven government bond bubble

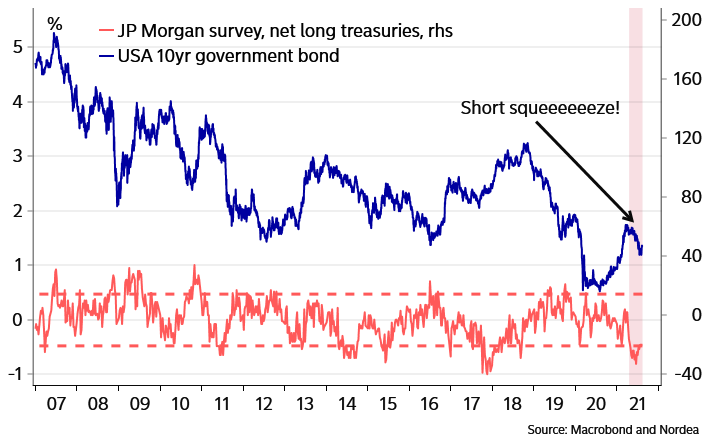

The situation hasn’t been made any easier by positioning in the US bond market being very short. Since early June we have noted that the shortness comes from three different sources: i) in broader asset allocation terms investors are long equities and thus automatically short bonds, ii) bond investors have since long been positioned for steeper yield curves and iii) bond portfolios have since late May also gone outright short in duration.

Chart 2. Outright bond positions are probably still short

With the Fed clinging on to “it’s not the type of inflation we would like to see” over the summer, marginally negative economic data surprises, a net bond supply near zero, an uptick in delta cases and a dovish ECB review – a quite notable short squeeze has happened in longer bonds. Mostly we would deem that it’s steepening positions that have been reduced. Investors are still overweight in equities, and bond surveys still show investors positioned for higher yields, even though slightly less so than before.

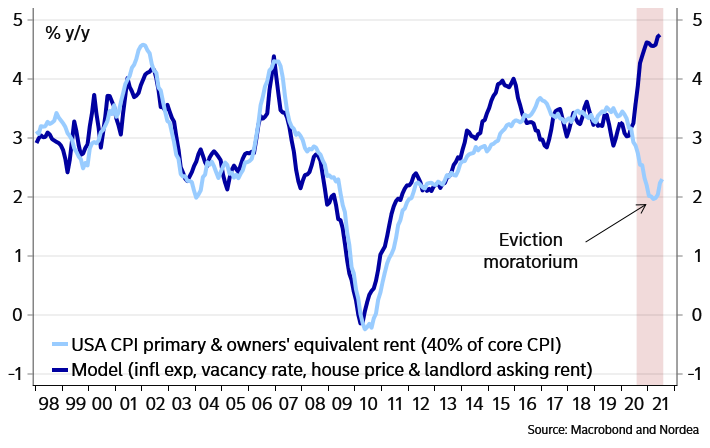

As we pointed to in the previous Week Ahead, more positive US bond news emerged in early August. The debt ceiling problem will lead to an extension of the period with zero net debt supply, which possibly could be one reason behind super strong demand in the 10-year auction on Wednesday. Also, the prolonged eviction moratorium is likely pushing the more violent rent increases into late Q4 and onwards for CPI.

Chart 4. Eviction moratorium delays the huge CPI rent increases

Against that background what did we learn from this week’s events? Let’s start with the US.

Countdown to extinction? No, but to tapering!

Yes, we and everyone else know that the US is at peak growth and inflation rates. They will decelerate. Usually that means lower bond yields and sometimes trouble for equities. But peak growth rates are very odd this time, being extremely high so a deceleration tells us basically nothing. It’s not like the US economy is falling off a cliff. If anything, we would still guess that a strong labour market catch up when the extraordinary unemployment benefits ends, will keep growth higher than potential for longer.

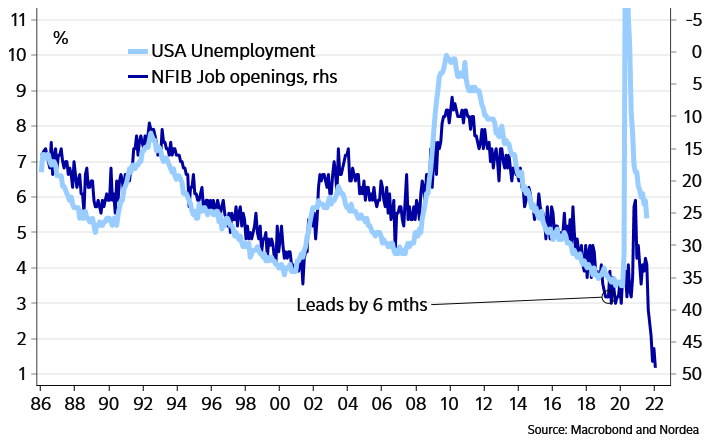

The labour market indicators published this week included all-time high job openings of more than 10 million, i.e. more openings than unemployed, and NFIB with new records in hiring plans and positions unable to be filled. Once again, labour supply disruptions through increasing Covid-19 cases and expanded unemployment benefits are holding back a more rapid return to all-time low unemployment. The underlying labour market looks much tighter to us than the Fed is claiming.

Chart 6. … but strong labour demand indicates above potential growth for longer

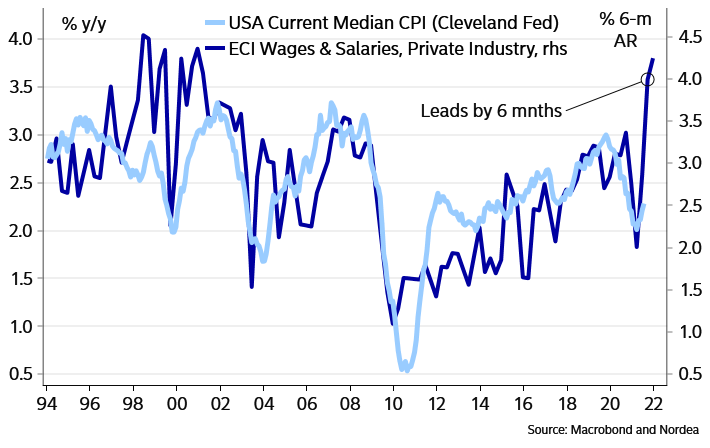

Chart 7. Wage growth points to higher median CPI

Our forecast is that core CPI will remain close to or probably over 4% y/y until Q2 2022. When it then starts to drop towards 2%, the labour market will be tight and wage increases high, meaning that the Fed’s medium-term inflation forecasts should remain above 2%. Or paraphrasing Powell – an inflation backdrop the Fed would like to see and thereby act on with rate hikes from late 2022.

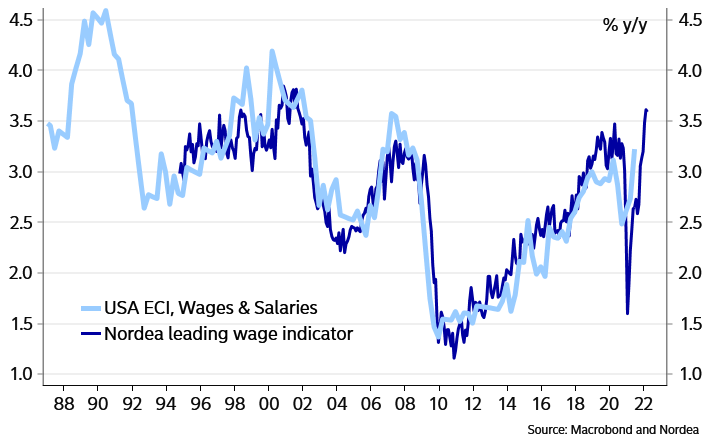

Chart 8. Wage pressures higher than in a long time

And action seems to be the current name of the game for a rapidly growing number of Fed governors saying that tapering is around the corner. Some still want to see a couple of 800’ – 1,000’ non-farm payroll prints, but our longstanding out-of-consensus call for a tapering decision in September is alive and well. The more hawkish contingent also wants a quite fast tapering with Kaplan citing eight months as a reasonable period. The “old” Fed would have hiked rates already this autumn, but now tapering instead will serve as a way to lift the markedly negative “shadow” fed funds rate towards zero.