Nordea sætter fingeren på et ømt punkt i en analyse: Alle forventer, at inflationen falder i 2022, men der er tendenser, der går i den modsatte retning. Lønningerne stiger kraftigt, og desuden kan den voldsomme stigning i corona-smitten måske ende med tvungen vaccinationer. Hvilken effekt får det? Vil det presse inflationen opad og dermed også renterne? Dertil kommer usikre faktorer som strid mellem UK og EU om Nordirland og udviklingen i Kina. Vi står over for en meget usikker periode, som ifølge Nordea ikke svarer til de beroligende toner fra ECB: At der ikke er nogen tvivl om en faldende inflation.

Nordea weekly: An inflationary vaccine mandate is coming to a town near you

There is NO DOUBT that inflation will slow in 2022 according to the ECB, which is quite a cocky stance given the uncertainty. Vaccine mandates could lead to even further distortions in the labour supply, which will show up as inflation.

Highlights from the analysis:

– Inflation has not peaked yet(!) and vaccine mandates and restrictions are making matters worse

– The ECB is touring with a message that there is NO DOUBT that inflation will drop in 2022

– Vaccine mandates are about to arrive across Europe, and they may prove inflationary

– The UK is about to re-enter the Brexit mess, while Bank of England act as amateurs

– No one is talking about China despite a continued meltdown among property developers

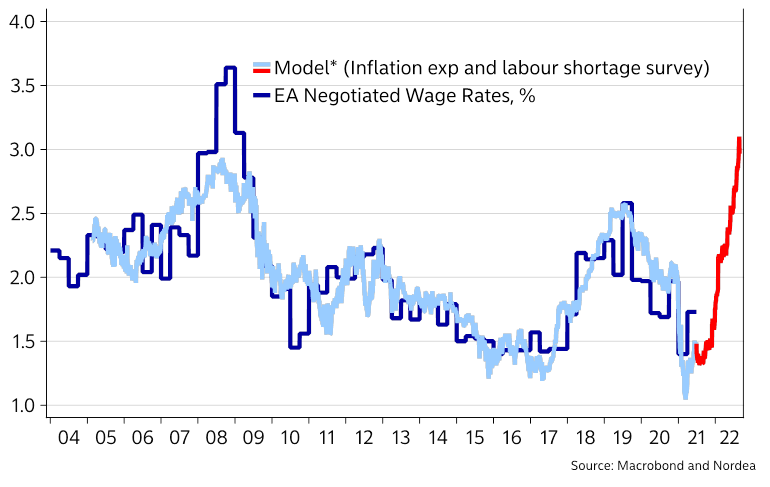

How the table has turned since 2019. Today, the ECB is touring with a message that there is NO DOUBT that inflation will drop back in 2022, and while that is arguable the most likely scenario (at least in the Euro area), we just want to highlight that wage growth pressures pull in the other direction. So, there is doubt, and actually quite a bit of it around the current inflation outlook. No one, not even ourselves (the inflation bank No1 as a Twitter-user put it), thought that inflation would be running as hot as we see currently.

This is a complete upside-down world of the 2014-2019 situation, when the ECB was constantly accused of being overly optimistic on its ability to meet the inflation target. Markets refused to believe the ECB and inflation never came up. Now markets tend to see a greater risk that inflation will run hot versus the ECBs mandate, and then suddenly the ECB starts arrogantly pushing back with remarks that there is “NO DOUBT” that inflation will drop back. We will let you guys decide for yourselves, but this chart may provide food for thought in this debate.

Chart 1. Wage growth about to enter a new regime in the Euro area?

European macro strategy is anything but boring currently, and the French election in 2022 may add a little extra spice to the already fully seasoned macro-dish. Maybe you already feel like everyone is talking about Éric Zemmour, but we don’t find that anyone in the world of finance has even started thinking about the market repercussions should Zemmour gain further tailwind ahead of the election. We find several similarities to the 2016 election in the US, when Donald Trump suddenly started gaining tailwinds in the run-up to the election.

Energy prices remain a hot topic in France (remember the yellow vests?), and even if France has been decently shielded against the energy crisis due to a large electricity production from nuclear plants, Macron is still under pressure to mitigate the energy price increase.

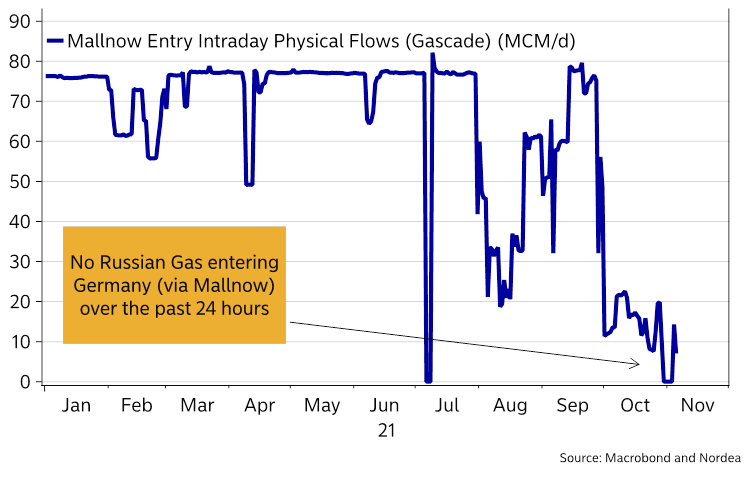

The energy crisis is far from being over as Russia is still not delivering any gas via the Mallnow station at the Polish/German border (or else Poland keeps it in Poland). This is the exact week Putin promised to start filling the German underground storages from. Can we take the Tsar at face value? We doubt it. It may be time to re-consider adding to EUR/RUB and EUR/USD shorts should the flow not begin this week.

And if it wasn’t enough, the EU may have to refocus on the Brexit-deal as rumors suggest that the UK may decide to trigger the article 16 in the Northern Ireland protocol latter this week, which will lead to a renegotiation of the whole Brexit-deal. We decide to enter GBP/USD shorts as 1) The Bank of England are flip-flopping without credibility and 2) the Brexit-risks may resurface soon.

We target 1.2750 (and have a S/L at 1.3850).

Chart 3. Still no Russian gas flow to Germany via Poland

We also stick to our view that Europe will suffer into the Covid-19 peak season compared to peers on the Southern Hemisphere. The case count and accordingly the levels of restrictions are increasing again despite firm political promises that the crisis was over just 1-2 months ago. A political scapegoat is needed to re-implement draconian restrictions, and the only politically palatable solution is hence to take aim at those who remain unvaccinated. Expect vaccine mandates to show up all over Europe very soon, also in the private sector.

The interesting thing is that renewed Covid-19 restrictions and subsequent vaccine mandates allow for: 1) The ECB to continue crisis purchases, if they want to, 2) Continued elevated goods consumption versus trends (instead of services), which is highly inflationary and 3) continued wage growth as the supply labor is lowered.

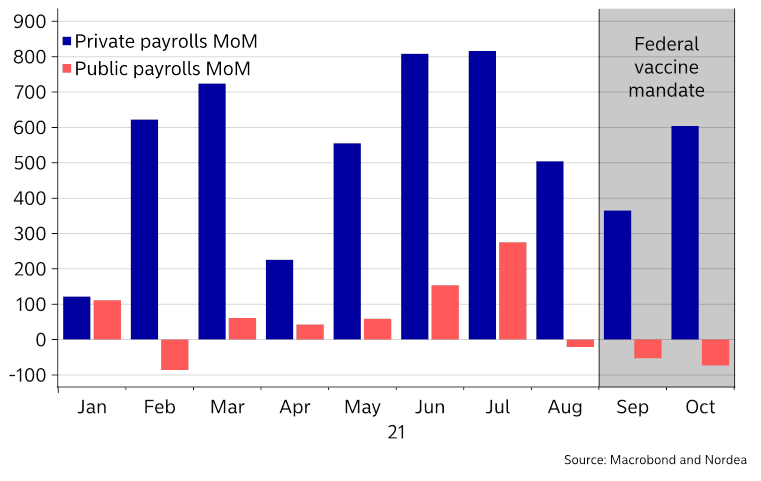

Vaccine mandates likely continue to distort the non-farm reports in the US as well. We have seen negative job growth in the public sector ever since the Federal vaccine mandate was implemented in early September, likely driven by homeschooling and a lack of labour supply due to vaccine mandates among other things.

The non-farm report was hence once again a supply guessing game, which makes it extremely difficult to grasp how the Fed will assess the current job market. We basically find that the Fed has no clue on what to think of labor markets into 2022, why we find tree hikes warranted still as the labor supply has likely waned permanently through Covid-19.

Unless the Fed accepts that the true supply of labor has weakened, then we simply need to see signs of improvement in employment to population ratios before the Fed is willing to consider hiking interest rates. The problem is just that the Fed will likely have to wait forever to get back to February-2020 participation as a nationwide Jan 4 vaccine mandate for big employers is on the cards (84 million workers will be effected). This will likely to worsen the supply situation on the labor market even more, and we may get (very) weak non-farm payroll reports early next year as a consequence.

Chart 5. Vaccine mandates are leading to lower public employment. What will happen in the private sector when the mandated deadline arrives in January?

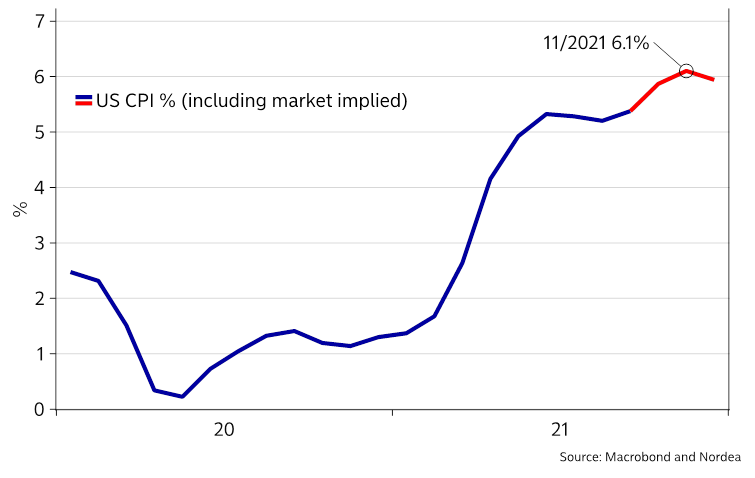

Inflation has accordingly not peaked yet in the US as the rent of shelter component may surge to 6% YoY levels as soon as in late Q1-2022, while the price of used cars has re-accelerated. >5 readings in core inflation are on the cards, while >6% readings in headline are already consensus ahead of New Years. It will be in increasingly difficult cocktail to balance for central banks as basically all leading indicators on growth point down!

Chart 6. Inflation has not peaked yet in the US

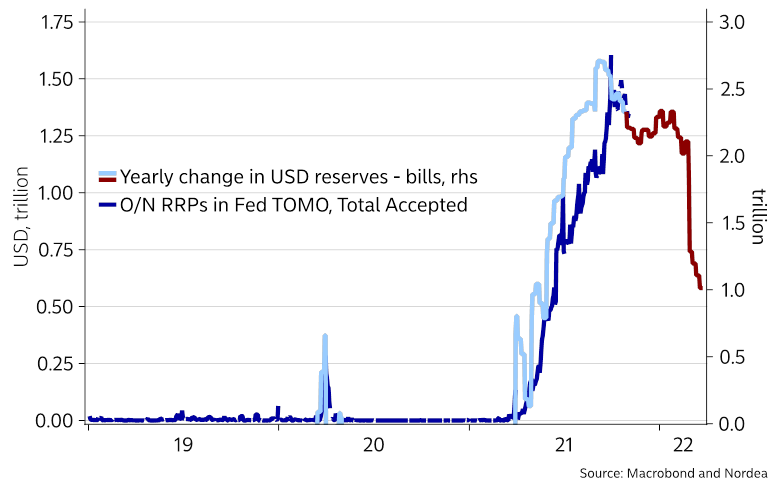

Biden won a legislative battle during the weekend as the infrastructure bill passed the house despite “the Squad” refraining from backing it. This will further emphasize the need for funding in 2022 when the debt ceiling is effectively suspended. Markets will have to swallow almost 10x the nominal of T-securities over the next 3 quarters compared to the most recent three, but arguably most of the spike in funding will be seen in T-bills.

A truckload of USDs is standing idle at the reverse repo at the Fed ready to buy these bills, why the funding surge will most likely only lead to a flattening of the USD curve, while the usage of the reverse repo facility will fall off a cliff into Q1.