Uddrag fra en stribe finanshuse:

The Fed’s interest rate decision and updated Summary of Economic Projections (SEPs), the first since April’s Liberation Day, will be released at 2:00pm EDT, followed by Powell’s Press Conference at 2:30pm EDT.

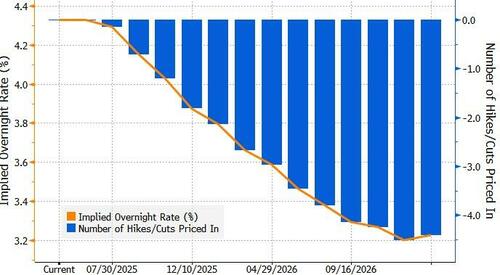

The FOMC will keep rates unchanged at 4.25-4.5%, as highlighted by the latest Reuters poll showing 103 out of 105 economists surveyed expecting this outcome, with the other 2 seeing a 25bps cut. Within the same poll, 59 of 105 economists forecast the Fed would resume rate cuts next quarter, likely in September, while 60% anticipate two cuts this year, consistent with the March median dot plot, and relatively in line with money market pricing, which discounts 46bps of easing by year-end.

In its preview, Newsquawk writes that the Fed is likely to keep its wait-and-see approach amid continued uncertainty over the economic impact of Trumpʼs tariff policies, with close attention on the updated SEPs which will be released alongside the rate decision; attention will focus be on the 2025 dot plot, which currently signals 50bps of cuts this year.

As has been reiterated by the vast majority of committee members this year, the clear message has been there is no obvious need for immediate changes in policy, and a patient approach is best. Incoming data will eventually bring together the diverging views on inflation and growth/employment. Therefore, as Jefferies notes, it is best to wait and see rather than act pre-emptively and risk making a mistake. Recent data has shown strong job growth and easing inflation, although risks from tariffs remain a concern, with attention also additionally now on any potential inflationary impacts amid the Israel/Iran conflict. Upcoming data will be key to shaping policy. Following the May jobs report, JPMʼs Feroli remarked it was almost designed to support the Fedʼs inclination to remain on hold and let future labor and inflation data guide policy decisions.

Economy: Rabo Bank notes that the stagflationary impact of the tariffs is likely to pull the Fed in two opposite directions. The upward impact of the tariffs on unemployment would ask for rate cuts to support economic activity. In contrast, the projected rebound in inflation could require rate hikes to slow down aggregate demand and get inflation under control. However, on balance, Rabo thinks that the Fed will therefore be slow and modest in its reactions. For now, the bank expects only one rate cut in H2, most likely in September. Rabo adds the Israel-Iran war could amplify these stagflationary forces, but on balance, it does not alter their forecasts for the Fed.

Recent Fed Commentary: Many on the Fed are singing from the same hymn sheet in stating that a patient, wait-and-see approach is the best course of action for policy due to ongoing uncertainties, namely around the impact of Trump’s trade policies on the economy. Kashkari stated there is a healthy debate at the FOMC on whether to look through the price-related increases from tariffs, but he finds the arguments against looking through tariff-driven inflation more persuasive. Several others, including Kugler, appear to share this view, with Kugler noting that the impact of tariffs on prices may be more permanent. Goolsbee, meanwhile, also noted that he is a little “gun-shy” about arguing that tariffs will have a transitory effect on inflation. The other side of the argument is the influential Governor Waller, who believes that it is standard central bank practice to look through one-off price increases. There are also fears about a slowdown in the labor market, and several have suggested that rising inflation and a rising unemployment rate is a possible scenario, one which would put the Fed in a difficult position. Inflation expectations have also been a key topic of discussion, stressing the need to keep them anchored, and if there was any de-anchoring, Musalem has said that price stability must become a priority. However, the Fed does have both sides of its mandate in mind when discussing policy. Fed Chair Powell noted that if dual mandate goals are in tension, they will consider how far the economy is from each goal, and the potentially different time horizons over which those respective gaps would be anticipated to close, but for the time being, policy is well positioned to wait for greater clarity. In terms of the level of restrictiveness, many suggest that policy is moderately or modestly restrictive, but Williams had described it as slightly restrictive.

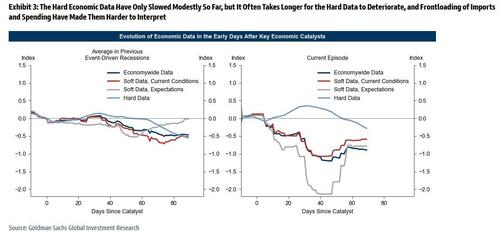

Recent Data: Recent data has been solid with inflation remaining stable, with both CPI and PPI cooler than anticipated, albeit still above target, while the labor market remains robust. The latest payrolls report was solid, as the headline topped expectations, although the prior was downwardly revised, while the unemployment rate was unchanged at 4.2%, albeit the labor force participation did ease, but unemployment remains beneath the Fed’s year-end projection (from March) of 4.4%, indicating there is still room to move higher without cause for concern. Some have suggested that the upcoming inflation reports will start to encapsulate more of the price effects from tariffs, but it may take longer for the impact to show up in the labor market figures while growth numbers have been distorted due to front-loading.

Tariffs: Since the last FOMC meeting in early May, trade tensions have diminished dramatically with the US-China tariff reductions, inflation has come in low as tariff effects have so far appeared modest, and the hard data have shown only limited signs of softening. While the uncertainty about trade, fiscal, and immigration policy that clouds the economic outlook has diminished a bit, it remains high. On Wednesday, the FOMC will likely reiterate that it sees risks to both sides of its mandate and plans to remain on hold until it has further clarity about the outlook. In his press conference, Chair Powell will likely downplay the message from the Committee’s interest rate projections as still highly contingent on a very uncertain outlook for both policy and the economy. According to Goldman economists, it is still quite early to judge the impact of tariffs and other policy changes on the economy. The chart below shows that the soft or survey data remain noticeably weaker than before tariffs were announced, despite rebounding a bit. But many investors and policymakers are reluctant to trust them in light of their poor track record in recent years. The hard data have only softened a bit, but historical experience suggests that it is probably too early to expect them to have weakened significantly, and frontloading of imports and spending have made them harder to interpret and might further delay any softening.

Policy Statement: Morgan Stanley expects the following changes to the May FOMC statement that will appear in June. Strikethrough text is language that we expect will be removed from the May statement, and boldface text represents new additions that may appear in the June statement. For the June FOMC statement, the bank thinks minimal changes are the most likely outcome given the high level of uncertainty and risks to both sides of the Fed’s mandate. Chair Powell is likely to keep the message simple: the Fed will maintain its focus on keeping inflation low and stable, but will be prepared to respond to any signs of labor market weakening.

The statement can still reference the swings in net exports as clouding the signal from the headline GDP data. April trade data showed a large reversal in imports as some of the front-running behavior reversed. The Fed will continue to take signals from final sales to domestic purchasers (GDP less trade and inventories) and final sales to domestic private purchasers (final sales to domestic purchasers less government spending). There is some risk that recent inflation data, which have generally surprised to the downside, could lead the committee to alter the language that “inflation remains elevated.” The year-on-year rates of change in headline and core inflation have nudged lower in recent months, consistent with further disinflation ahead of tariffs, but Morgan Stanley thinks the combination of expected tariff effects and the spike in oil following the re-emergence of geopolitical risk in the Middle East are likely to keep the Fed’s assessments about inflation unchanged. After all, any nod to increased disinflationary signals could be taken as a sign the committee will look through tariff-induced inflation and ease preemptively. That said, Morgan Stanley does not think the Fed has consensus to signal this; if so, the main message from the statement will be that uncertainty remains high. The risk of maximal tariffs following “Liberation Day” has likely been reduced, but the effective tariff rate remains high at 14% and the economy has yet to see the effects of this on inflation and activity.

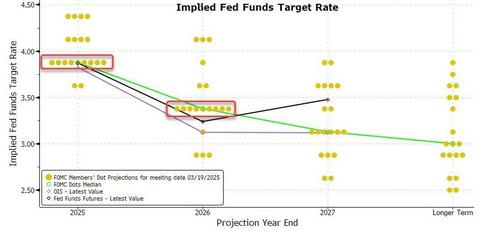

SEPs: While the statement and Powellʼs post-meeting presser are likely to reiterate familiar themes as they await further clarity, the new dot plot will already reveal how many rate cuts the FOMC still expects to make this year and beyond. UBS expects Powell to highlight the uncertainty in his press conference, which may even undermine the staying power of the SEPs. However, UBS expects a relatively hawkish tone to the meeting, and as such the May gain in Nonfarm payroll employment was good enough to signal staying on hold, and on hold for longer than was signaled in March. Thus, UBS expects the median dot to be revised up in 2025 and 2026. The June SEP should incorporate tariffs more than the March projection, likely pushing inflation and unemployment projections higher. Meanwhile, Citi expects the median “dot” to continue to indicate two 25bps rate cuts this year.

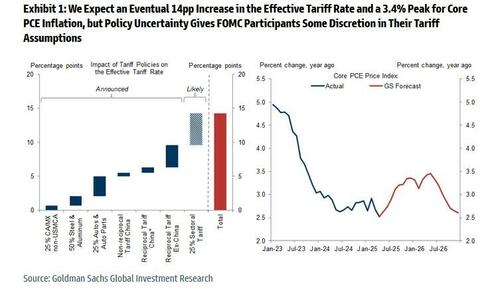

Goldman’s economic forecasts build in an eventual 14% increase in the effective tariff rate of which over 9% comes from tariffs already in effect and the remainder comes from the sectoral or critical imports tariff that we expect to be implemented later. Based on this assumption and the limited amount learned so far about the likely impact of tariffs on consumer prices, Goldman expects core PCE inflation to rebound to a peak of 3.4%.

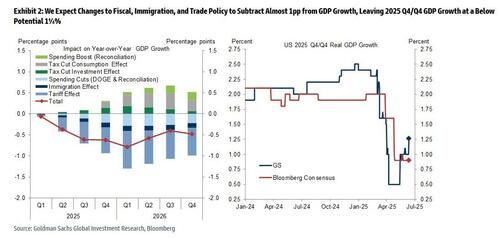

Goldman also expects tariffs to reduce GDP growth this year by almost 1% through a tax-like hit to consumer spending and the impact of policy uncertainty on business investment. Coupled with the effects of other changes to fiscal and immigration policy, the bank expects this to leave 2025 Q4/Q4 GDP growth at a below potential 1¼% resulting in a 0.2% increase in the unemployment rate to 4.4%.

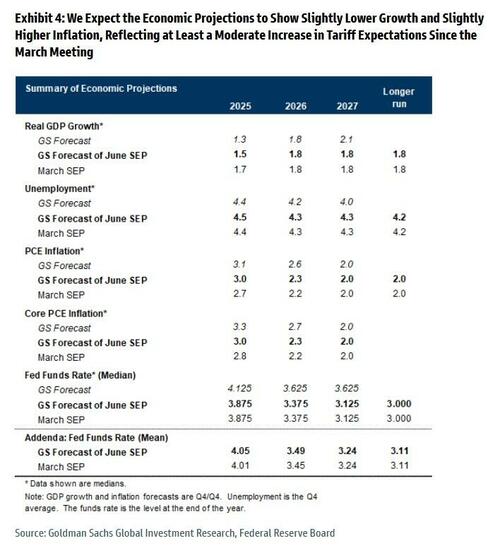

As a result, Goldman expects the median projection to show slightly lower 2025 GDP growth of 1.5%, a slightly higher 2025 unemployment rate of 4.5%, and slightly higher headline and core PCE inflation of 3.0% in 2025 and 2.3% in 202 . These changes would reflect a moderately larger assumed increase in tariff rates than at the March meeting tempered by otherwise decent news from incoming growth, labor market, and inflation data.

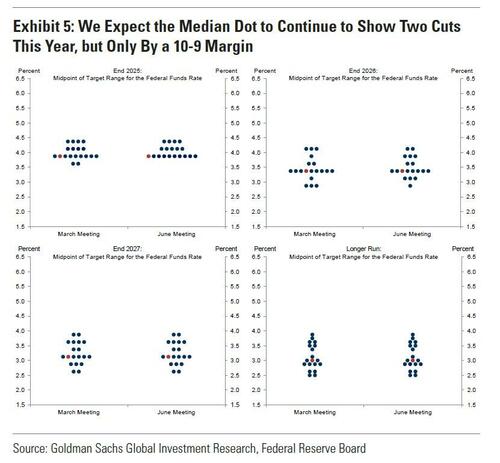

Dots: Goldman expects the Fed to apply a similar conservative approach to the dots as it will apply to its SEPs. The bank expects the median dots to remain unchanged, showing two cuts to 3.875% in 2025, two cuts to 3.375% in 2026, one cut to 3.125% in 2027, and a 3% neutral rate. But the 2025 dots are expected to show a very close split, with ten participants showing two cuts against nine showing either one cut or no cuts. The bank also expects the mean interest rate projections in 2025 and 2026 to increase modestly as some participants delay or remove cuts this year.

JPMorgan’s Michael Feroli also chimes in, noting that since the March SEP, trade policy developments have likely led to a significant change in Fed forecasts, as evinced in changes to the May FOMC statement language. JPM expects the median estimate of GDP growth this year will be marked down from 1.7% to 1.4%, while the core PCE inflation forecast will be revised up from 2.8% to 3.2%., and expect more modest changes in the out years. These stagflationary revisions don’t point to a clear direction of the revision to the dots. Even so, JPM thinks the dots will revise in a modestly hawkish direction. Most notably, the median dot for this year goes from looking for two cuts in March to one cut next week, especially since Chair Powell’s opening remarks in the May press conference moved in a hawkish direction, as he dropped the previous bidirectional optionality (hold or cut) and put primacy on price stability. JPM suspects the rest of the Committee has also shifted in a mildly hawkish direction. For the out years, the bank projects two cuts per year, which would put the ’27 year-end rate near neutral. Meanwhile, the process of revising up estimates of neutral is still under way, and we look for the median long-run dot to move up an eighth to 3-1/8%.

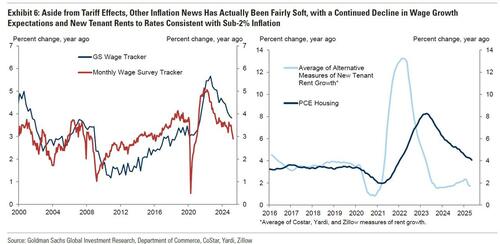

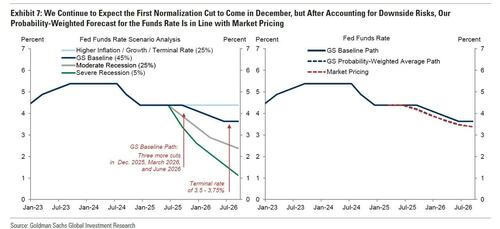

When Is The First Cut: While the market consensus is for the first cut to take place in September, Goldman’s own forecast continues to be that the FOMC will deliver the first of three normalization cuts in December, followed by two more in 2026 to a terminal rate of 3.5-3.75%. The bank is confident that we are still on track for eventual rate cuts because aside from the tariffs, the inflation news has actually been fairly soft. In particular, the tracker of survey-based wage growth expectations has fallen to around 3%, and alternative data measures of new tenant rent growth have fallen to around 2%, numbers that are likely consistent with sub-2% overall core PCE inflation. While an earlier cut is possible if the economy weakens more than we expect or if inflation remains more subdued than in our forecast, the peak summer tariff effects on the monthly inflation prints will most likely be too fresh for the FOMC to cut before December.

Goldman recently flip-flopped again, and cut its 12-month recession probability to 30%, after hiking it for about an hour above 50% in early April before trimming it; that is still about double the historical unconditional average. After accounting for downside risks, Goldman’s Fed scenario analysis indicates that our probability-weighted forecast for the funds rate is essentially in line with market pricing

Market Reaction(s)

For a detailed discussion on how various asset markets will react to the FOMC tomorrow, we go around the Goldman trading floor where various specialists all share their views

Rates:

Long Duration in Front-End & Steepeners; Mike Mitchell – Head of UST Trading:

Markets have been pretty range bound of late and investors have been lacking conviction. Consistent with that, positioning is smaller than it has been for a while. Market is still in steepeners and long the front-end, albeit in smaller size than curve. Investors are long spreads but none of these positions are outsized as people don’t have convicted views. The labor market has shown some signs of softening, but we haven’t seen the sharp drop the market was worried about. On the inflation side, it’s an uncomfortable time to be focused on the downward trend when you know there is going to be a different inflation story from tariffs in the coming months.

All that together means that the Fed meeting tomorrow will likely be pretty uninteresting. The focus will be on SEP. GS Econ is calling for 2 cuts and market is split between 1 and 2 for 2025. My guess is that it’ll be 1 cut, but that it’ll be close. Don’t need to see many people to move from 2 to 1 to show a majority and the bar feels pretty low. Would guess enough people will move and market will have some reaction to where that comes and what the vote split is. We like being long duration in the front-end and structurally trading in the steepener. Anticipate the next few weeks to be a low vol window. Payrolls is the next event that could really move markets.

Steeper Yield Curve to Manifest; Josh Schiffrin – Chief Strategy Officer and Head of Financial Risk:

I think they will show 1 dot for 2025 and that it will be a pretty strong baseline. There will be some people at 0 and some at 2, but I’m expecting a strong majority to show 1 cut. I also think the 2026 dots will go up by 25bps as well. For the rest of the SEP, you’ll see a small rise in the unemployment rate up to 4.5%, the core PCE projection should go up to 3% or higher, and the GDP projection will come down a little bit. The Fed will likely indicate that given where they think inflation will run to, they will be more cautious around cuts. Ultimately, I think the unemployment rate is the crucial thing to watch for what they actually do. To the extent that we get to 4.5%, this would trigger cuts if it happens earlier. The unemployment rate is the most important variable in the economy to watch. I continue to favor steepeners. While the trade has stalled out a little bit and has been in a bit of a range, I retain high conviction that it remains the trend and that we’ll ultimately be in a much steeper curve regime over time. Whether this happens over next the next 6 months due to labor market weakness or with a new regime at the Fed, I think we will ultimately move to lower front end rates. Risk premium can continue to build with the fiscal backdrop, and I ultimately expect a steeper yield curve to manifest.

Looking For Uptick in Median Dot; Brian Bingham– STIR Macro Trading

While uncertainty is high and the market has been caught wrong-way on the front dot estimate twice in the last four SEP meetings, we disagree with GIR’s forecast for the 2025 dot and are looking for upticks in both median (from 3.875 to 4.125) and mean (from 4.01 to 4.14). While the sequencing/daycount argument alone should be enough to tip the scales, given only 2 out of 9 votes from 3.875 need to revise higher and 3mo have now passed without any meaningful deterioration in the labor market, communication across the committee has leaned so decidedly hawkish that we believe messaging a u-turn in the face of overt political pressure would be difficult, if not impossible, for Powell to navigate. The 2026 dot is a far closer call, but premised on the stagflationary impulse penciled in the 2025 forecasts (4.5% UER + 3% Core PCE) we are looking for an unchanged median. We view this as a more elegant means of validating the message Powell will subsequently deliver in the press conference: tariffs strain both legs of the mandate in the near term, meaning the Fed has time to ‘wait and see,’ but on a terminal basis rates remain restrictive and the Fed will be willing to act as needed when/if the outlook begins to deteriorate. The composition of economic forecasts will be more impactful for FOMC pricing on a forward basis, in our view, than the 2025 dot. In March, there was a clear delineation between the year-end unemployment rate and the policy rate: 10 dots w/ 2+ cuts vs. 12 participants submitting a >4.4% UER. This time around forecasts are centering on a 4.5-4.6% median expectation, but in the event that the median estimate is not revised higher and remains at 4.4% – certainly plausible, conditional on a 4.125 dot – the bar for hard data to quickly render this set of projections stale would be extraordinarily low.

FX:

USD Price Action Has Been Macro-Agnostic; Mark Salib – G10 FX One-Delta Trading

While PPI and CPI data helped shift front-end pricing, we do not think it is enough at this juncture for a u-turn from the wait and see narrative from last meeting. While we see room for a hawkish surprise on the dots to short term wash out some recent EUR length (currently +0.9 std vs +0.6 std this time last week), especially given the DXY hovers at cycle lows, and we have seen a chase up in short USD positioning, we think the bar will be high. USD price action has been more macro-agnostic recently, particularly in EUR where the current divergence in EURUSD spot/vol correlation could continue amid the current narrative on adjusting hedge ratios and continued de-dollarization.

Global Risk Factors More Impactful for FX Than Fed; Isabella Rosenberg – FX Research

“Implications from this week’s Fed meeting look limited for the Dollar. Global risk factors have been more impactful for FX markets than domestic policy, and we expect that to continue despite a week chock full of G10 central bank meetings. The most meaningful signal from the Fed will be how they frame their tariff expectations, and what policy will look like conditional on that outlook. The Dollar has exhibited a more normal relationship with rate differentials in recent weeks, following May’s sharp, fiscal-related dislocation between the Dollar and rates. So, any clarity on the policy path going forward, though unlikely this week, will eventually be quite meaningful for the Dollar.”

Equities:

Carry Long Vol Bias; Alexis Slattery – Index Deriv Trading

“Over the past week we saw both index vol and skew bid dramatically in the wake of geopolitical tensions, only to reverse course and revert sharply as fears failed to materialize over the weekend. The speed at which they brought the SPX straddle back down to earth has been impressive – Tuesday’s SPX straddle is a measly 0.5% and Wednesday’s straddle which includes the FOMC is 0.9%. Looking ahead to Wednesday’s meeting, we think Monday’s vol destruction has brought options back to levels that look like an attractive own. The desk likes carrying a long vol bias over the FOMC, particularly in SPX topside calls.”

Makes Sense to Hedge Long Risk Positions into Events; Vickie Chang – GS Research

“The FOMC is likely to keep the policy rate unchanged at this meeting and to reiterate that it continues to wait for further clarity around the outlook on policy and the economy. Since the last meeting in early May, positive trade policy developments have meant that the worst-case growth and inflation scenarios that were on the table before are now unlikely. But the ultimate tariff destination and the impacts of tariffs on the economy remains unclear. Because of that—and the fact that the economic data so far continues to hold in meaning that the Fed can afford to wait—the Fed is likely to maintain its wait-and-see approach. In the near term, the median dot moving to show 1 cut instead of 2 this year would likely be a modest hawkish surprise. But the median remaining at 2 cuts (where it was in March) could now also represent some dovish relief, as could any sense from Powell that underlying inflation news has been better than expected. Beyond this meeting, we think the risks to front-end yields skew to the downside, helped by the fact that the underlying inflation picture has been fairly benign. Our macro tools tell us that the market has more than fully unwound the negative growth shock since early April, but not the tighter policy shock—so any sense that softer-than-expected inflation news eases the constraint on the Fed could still be a tailwind for risk assets over time, although this meeting is probably still early for that. We’ve thought that the market can likely continue to drift higher in the absence of much fresh news, but that it makes sense to hedge long risk positions into event risks—vols have risen somewhat off their recent lows, but implied vols in payer swaptions are less elevated relative to their 1y-histories than equity put implied vols.”

Credit:

Strong Technicals Driving Resiliency in Credit Markets; Usman Omer – Macro Credit Index Trading

“Since May FOMC, credit has continued to tighten as accounts eschew paying carry in sympathy with relaxation in broader risk parameters, and RM deploy length in light of continued inflows, providing further support to macro implementations. Some themes to highlight are (1) compression across the credit ecosystem as accounts look to buy wider trading names / HY asset managers remain under-risked, and (2) credit losing its beta to equities as we trade in tight ranges and drivers of equity returns (recovery in tech names) diverge significantly from Macro Credit. Second order indicators have relaxed as 1m IG Vol is in the 62nd percentile on a 1y lookback, with skew steeper across the surface, making short skew implementations incredibly attractive in our view. We think at this moment credit is taking its cue from broader macro and notwithstanding a deterioration in bonds and equities, we expect credit to remain resilient. “

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her