Fra Zerohedge/ Bloomberg:

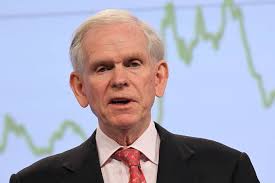

Jeremy Grantham then sees it all ending in tears, or rather a collapse rivaling the 1929 crash or the dot-com bust of 2000, when the Nasdaq cratered 80% before recovering thanks to trillions more in Fed “stimmy” checks.

And while some (increasingly fewer) investors claim that today’s valuations are justified by the growth potential of transformative technologies and new business models, Grantham, 82, dismisses that argument as fanciful, and rejects the popular theory that the Federal Reserve can cushion or even the next crash with even more QE or easing.

“At the lowest rates in history, you don’t have a lot in the bank to throw on the table, do you?” he said.

“We will have a few weeks of extra money and a few weeks of putting your last, desperate chips into the game, and then an even more spectacular bust,” the value-investing legend said in a Bloomberg “Front Row” interview.

“When you have reached this level of obvious super-enthusiasm, the bubble has always, without exception, broken in the next few months, not a few years.”

Unfortunately for Grantham, and his now cemented reputation as a perma-bear who misses out on rallies, the stock market has sneered at all warnings it will crash and just keeps on rising

To be sure, as we reported last year, GMO’s bearish stance has been costly as assets under management fell by tens of billions of dollars during the decade-long bull market, as the firm steered clear of growth stocks. Then in April, GMO doubled down, insulating its portfolios from directional bets on the market and largely missing out on the second leg of the 2020 rebound.

As Bloomberg notes, Grantham thought the economy was on shaky ground even before the pandemic and he was concerned about the steady decline in U.S. productivity, warning that the Fed had only succeeded in blowing out the inequality and income gap to record wides, amid worries that the profit-at-all-costs nature of American capitalism was destroying the environment and fraying the social fabric.

For Grantham, the combination of fiscal stimulus and emergency Fed programs led to “spectacular excesses” and pushed an already overvalued market into bubble territory.

Echoing BofA’s earlier note, Grantham believes that the Fed’s “Immoral hazard” will have other devastating consequences as well:

“If you think you live in a world where output doesn’t matter and you can just create paper, sooner or later you’re going to do the impossible, and that is bring back inflation,” Grantham said. “Interest rates are paper. Credit is paper. Real life is factories and workers and output, and we are not looking at increased output.”

As a reminder, earlier today, BofA’s CIO Michael Hartnett – who is similarly concerned about the near-future – warned that asset price (hyper)inflation will eventually drag Main Street inflation higher, risking a disorderly rise in bond yields, which results in a taper tantrum, tighter financial conditions and “volatility events”, i.e., a market crash.

Grantham agrees and warns that the threat of inflation is the biggest risk, which is why he also thinks that bonds are risky. He also has reservations about gold because it generates no income. And in his view Bitcoin is make-believe nonsense.

In short, he is an asset manager who sees no attractive assets, and who is prohibited from shorting because the Fed will just keep ramping prices ever higher.

While selling everything and holding cash is one option, Grantham said his best advice for long-term investors is to focus on low-growth stocks that are cheap relative to benchmark indexes, emerging markets and companies fighting climate change with renewable energy and electric-car technology.

“You will not make a handsome 10- or 20-year return from U.S. growth stocks,” he said. “If you could do emerging, low-growth and green, you might get the jackpot.”

All this and much more in his full 38 minute interview with Bloomberg’s Erik Schatzker below:

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her