Resume af teksten:

Med 10-årige britiske statsobligationer (“gilts”), der er faldet med over 30 basispunkter i oktober, får finansminister Rachel Reeves øget finanspolitisk råderum inden den kommende britiske efterårsbudget den 26. november. Dette fald skyldes primært reducerede forventninger til rentenedsættelser fra Bank of England, hvilket også har stabiliseret pundets værdi. Til trods for at markedet nu er mere optimistisk, står Reeves over for et årligt underskud på ca. 25 mia. pund, som forventes at blive dækket gennem forskellige skatteforhøjelser. Der er scenarier, hvor yderligere stramninger kan styrke obligationer, mens blødere budgetter kan medføre højere inflation og dermed mindre rentenedskæringer, hvilket kan påvirke pundet negativt. Skulle budgettet fejle i finanspolitisk bæredygtighed, kan det føre til stigende obligationsrenter og betydelig pundsvækkelse.

Fra ING:

We think the fall in gilt yields is reaching its limits, and sterling may struggle to weaken much further around the budget. But what happens if the Treasury over- or under-delivers on fiscal tightening? These are our four scenarios

The UK Chancellor, Rachel Reeves, delivers her budget on 26 November

Four scenarios for markets around the UK Autumn Budget

2026 deficit is relative to FY2025. 2026 inflation is the impact the budget will have relative to existing forecasts. Market arrows are relative to current pricing.

Source: ING

Bank of England rate cut expectations driving gilt yields lower

Finally, some good news for UK Chancellor Rachel Reeves. With a month still to go until the Autumn Budget on 26 November, 10-year gilt yields have tumbled by more than 30 basis points. Debt interest projections are likely to be pared back; the latest market moves should gift the Treasury with almost £5bn extra fiscal headroom, relative to just a few weeks ago.

That sharp decline in 10-year gilt yields since the beginning of October has been driven predominantly by renewed easing expectations at the Bank of England. Markets are pricing the Bank’s terminal rate at 3.30%, down from 3.60% a few weeks ago. Better wage and inflation news explains some of that. But investors are also more confident that the budget will deliver a more market-friendly outcome.

The 10-year gilt yield fell by some 30bp in October

Source: Macrobond, ING

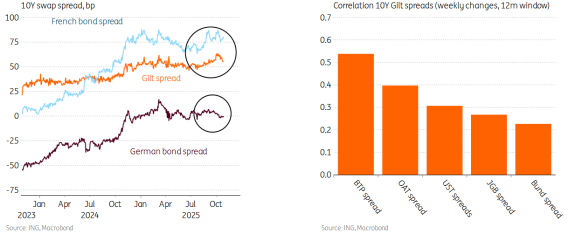

One gauge of that – the spread between the 10-year gilt yield and swap rate – has narrowed from 55bp to 50bp. Similarly, our models indicate that the risk premium in 10-year gilt yields has compressed significantly.

In the absence of (sovereign) risk and on an FX-hedged basis, government bonds from different countries should have similar yields. In our model, we compare the FX-hedged yields on 10Y Gilts to US Treasuries, German Bunds and Japanese bonds (JGBs). On this measure, we see that Gilt yields are 7bp higher than predicted, but this is already a big improvement from the 25bp premium earlier this month.

On an FX-hedged basis, 10Y Gilt yields still look some 7bp too high

Source: Macrobond, ING

If gilt yields are lower, how do you square that with a weaker pound? Typically, a UK budget crisis would see Gilt yields rise (Gilt prices fall) alongside a weaker pound – but that’s not the story today.

EUR/GBP has broken above 0.880, and GBP/USD has dropped 0.8%. We see the move, however, as one driven by the adjustment in the BoE view rather than some increased risk premium being priced into UK assets. In effect, Rachel Reeves being forced into tighter fiscal policy – and holding the line on the fiscal rules – is prompting a reassessment of the BoE easing cycle and the pound.

Our base case: The gilt rally is running out of fuel

So what next? At this point, it feels like the broad outline of the budget is now both well-recognised and well-priced.

Reeves faces a fiscal shortfall of roughly £25bn/year. That’s likely to be made up through a combination of extending the freeze on tax thresholds, extending national insurance (payroll taxes) to landlords and partnerships, raising bank taxes, as well as tax on dividends/certain types of capital gains. The Treasury is loath to do anything that might add to inflation, even if its scope to lower it is limited. All of that should mean gilt issuance falls next year in line with the Debt Management Office’s projections.

Delivery of all of that could still help remove some or all of the remaining risk premium in gilts, though that’s only probably worth an extra 5 basis points off 10-year yields. That suggests the recent gilt rally could be reaching its limits for the time being.

Indeed, market pricing is now fairly close to our own view for Bank of England easing. We expect three further cuts, with a growing chance that the first of those could be delivered in December.

For sterling to fall much further from here, we’re going to need to see either: even more dovish pricing of the Bank Rate – e.g. to 3.00% – or some doubts emerging on fiscal credibility. Neither of those is a given.

Admittedly, sterling is not particularly cheap, despite edging towards the lower end of its five-year ranges. Higher inflation in the UK relative to its key trading partners in Europe and the US means that the real exchange rate this summer has traded back to levels seen pre the 2016 Brexit vote.

But our message today is that this is not a UK sovereign crisis, and we doubt EUR/GBP needs to fast-track its way back to the 0.90 area. We currently have a 0.88 forecast for year-end 2025 and 0.90 for year-end 2026 and haven’t seen enough yet to prompt a major revision to these targets.

Alternative scenario: Reeves doubles down on fiscal tightening

The idea that the Treasury will leave itself a greater fiscal buffer has been gaining traction over the past couple of weeks. And a scenario where the Treasury delivers more significant tax hikes, coupled with credible cuts to public spending, could fuel a further rally in gilts.

On tax hikes, this would likely involve raising the basic rate of income tax (a 1pp increase would yield £8bn/year). Comments made by Prime Minister Starmer in Parliament this week have opened the door to more substantial tax hikes. That could also be coupled with significant changes to pension taxation (delivering up to £10bn/year depending on the details).

On spending, the government has hinted it would like to revisit the welfare cuts it attempted – and ultimately abandoned – earlier this year. We suspect most investors are naturally sceptical, given the mounting political pressure on the prime minister. But a successful delivery of cuts, especially if front-loaded, would be well received by markets.

A scenario that alleviates stress in bond markets is likely to be GBP-negative, assuming it would also likely bake in even more BoE easing. That said, the impact may not be huge; we view the latest move in EUR/GBP to 0.88 as a BoE-easing hedge. As shown below, that already implies approximately a 1.5% risk premium, which would be largely erased in a major dovish repricing event as EUR/GBP fair value would rise.

Bottom line: More fiscal tightening means another leg lower in short and long-dated yields, plus some modest, further weakness in sterling

EUR/GBP risk premium has risen to 1.5%

Source: Macrobond, ING

Alternative scenario: A prudent – but inflationary – budget

Given the Bank of England’s increasing focus on current rates of inflation, there’s a growing recognition – both in markets and at the Treasury itself – that tax hikes which add to headline CPI through 2026 would limit scope for further rate cuts.

The most obvious example would be a hike in VAT, but also through levies on alcohol/tobacco. These are all things the Treasury is likely to steer clear of. But its decision on next year’s National Living Wage hike will be key too. This year, it rose by 6.7%, undoubtedly adding to inflation through the summer – most visibly in food prices. A rise of 4% currently looks likely; anything above that might be enough to temper Bank of England easing bets.

A scenario that boosts inflation forecasts for 2026 would be positive for sterling, assuming the budget still delivers a credible fiscal tightening. This would prompt the pound to shed any remaining risk premium, be it related to BoE-easing bets or fiscal concerns.

The worst-case scenario for EUR/GBP (assuming no negative contribution from the euro itself) would be a 0.850-0.8550. It would also require a hawkish November meeting from the BoE.

Bottom line: A budget which delivers tax hikes but pushes up 2026 inflation would lift short-dated yields & boost sterling

Alternative scenario: A lack of action

We recently outlined six areas that could cause gilt yields to spike. Those include tax hikes that don’t kick in until much later this decade, with uncertain revenue-generating capabilities. Spending increases. A lack of fiscal headroom. Inflationary tax hikes. More gilt issuance. And the big one: a change in fiscal rules, opening the door to more borrowing next year.

If that happens, then the upside to gilt yields is significant. The past few months showed that investors treated Gilts more in line with riskier French (OAT) and Italian (BTP) government bonds than with the German Bunds. This shows that Gilts remain sensitive to changes in risk sentiment.

Gilts are more sensitive to French than German government bond spreads

Source: Macrobond, ING

A loss of confidence in the UK’s fiscal discipline could therefore easily see the 10Y Gilt yield rise by some 20bp. We deem this a minor tail risk at this stage.

This scenario would also be very negative for the pound. An uncontrolled gilt sell-off would likely mean an uncontrolled GBP sell-off. That’s a 0.90+ scenario for EUR/GBP. The intraday EUR/GBP peak on 26 September 2022 (Liz Truss’ Mini Budget) was 4.8% above its short-term fair value. A similar move would translate to 0.91 this time based on our latest fair value estimates.

Bottom line: A budget that under-delivers on fiscal sustainability would undo much of the recent fall in longer-dated gilt yields, prompting a severe sell-off in the pound

Hurtige nyheder er stadig i beta-fasen, og fejl kan derfor forekomme.