Kerneinflationen i USA faldt yderligere i maj med minus 0,45 pct. i forhold til april. Det er tredje måned i træk, at inflationen falder. Risikoen for deflation er øget. Der er også en tendens til, at lønningerne presses.

US Macro Flash: Core CPI sets negative record

US core set yet another negative record in May, as the index declined for a third consecutive month. Deflation risks are heating uprising.

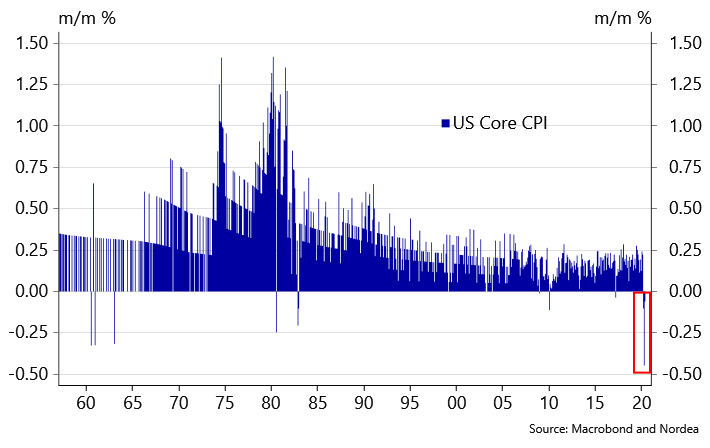

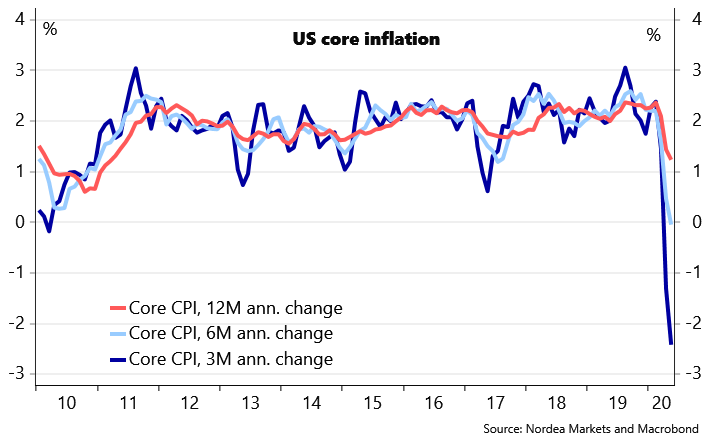

In April, a record was set as US core CPI suffered its biggest decline ever of -0.45% (with data back to 1957). That print was followed up today by a new record, as the May number showed core CPI declining for the third consecutive month. That has never happened before.

Chart 1. For the first time in history US Core CPI m/m declined three consecutive times

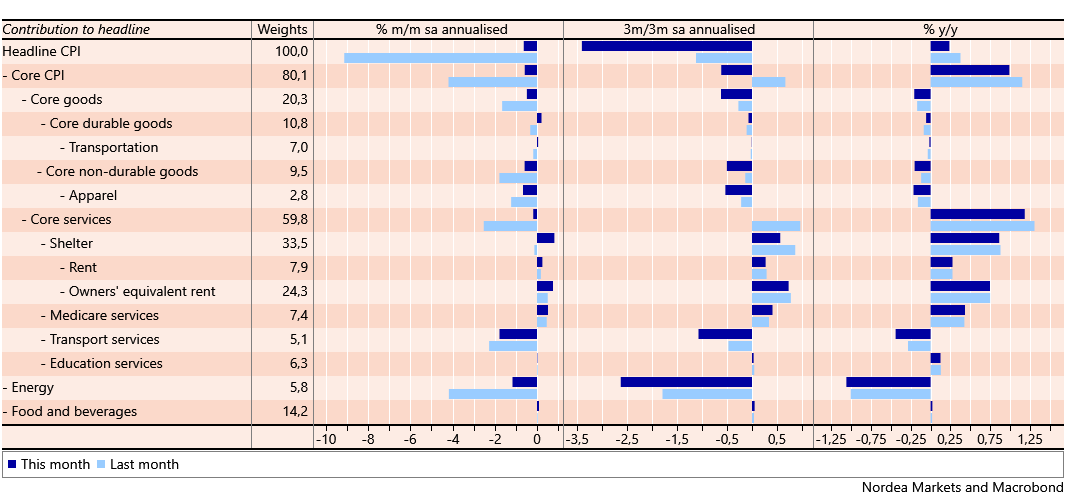

Looking at the details, core goods prices contributed more to the negative reading compared to services – the opposite pattern of the April numbers. Especially apparel and transport services continue to be a negative drivers, whereas medical services and various part of housing prices (which has been quite resilient during the corona crisis) are positive drivers.

Despite oil prices having squared some of its losses recently, the headline CPI number also declined 0.1% m/m, corresponding to a y/y reading of 0.1%.

Table 1. Dissecting the inflation numbers

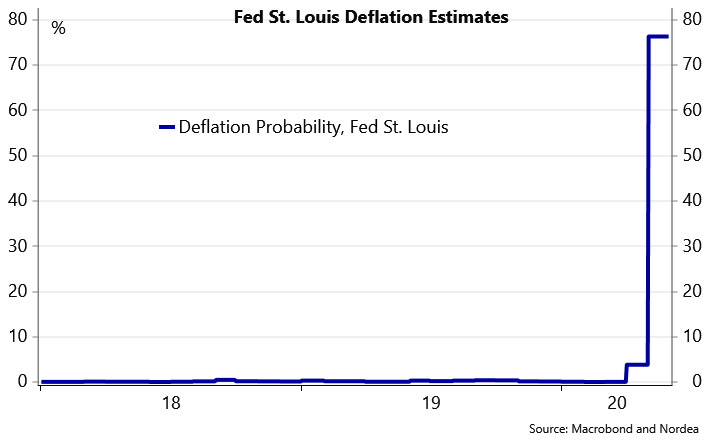

The negative readings should, in our view, be of big concern to the Fed. We will therefore also keep a close eye on how Chair Powell chooses to address the deflation risk at tonight’s FOMC meeting (Fed Preview: Finding the best forward guidance tool).

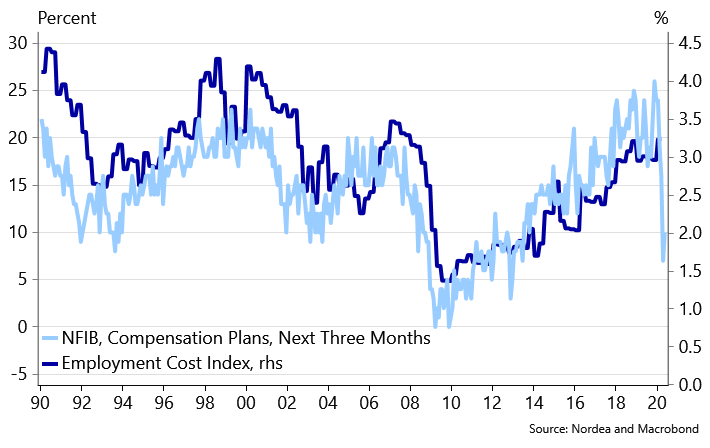

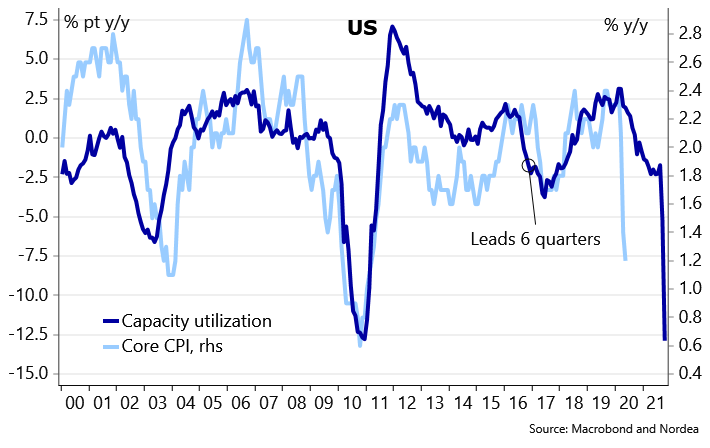

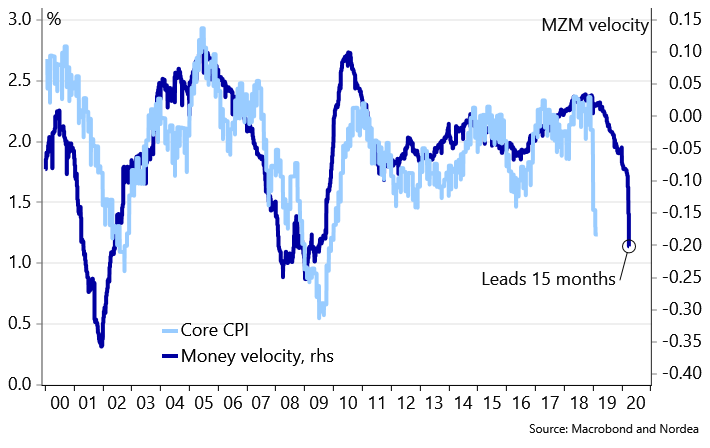

We have been flagging the risk of deflation for a while and we still see the risk as high (US: Deflation vs. hyperinflation risks). This also seems to be the conclusion from Federal Reserve St. Louis’ own deflation probability indicator which recently skyrocketed as well as other leading indicators (see charts below).