Uddrag fra John Authers morgenkommentar:

Jerome Powell seemed to get the message across this time. After the most recent Federal Open Market Committee meeting (last Wednesday, but it already feels much longer ago), bond yields fell as he laid out an extremely hawkish agenda in his press conference. The conventional wisdom is that traders took Powell’s repeated insistence that the economy was strong enough to withstand repeated hikes as reason to be optimistic about the economy, rather than as a statement that he had no need to keep rates easy.

If there was any misunderstanding on that point, it’s been cleared up. Once Powell’s Monday lunchtime speech to the National Association for Business Economics went live on the Federal Reserve’s website, bond yields surged upward into new territory. You can find the text of his prepared remarks here. It’s fair to say that the whole thing is hawkish. The most important market-moving passage is this one:

In particular, if we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings, we will do so. And if we determine that we need to tighten beyond common measures of neutral and into a more restrictive stance, we will do that as well.

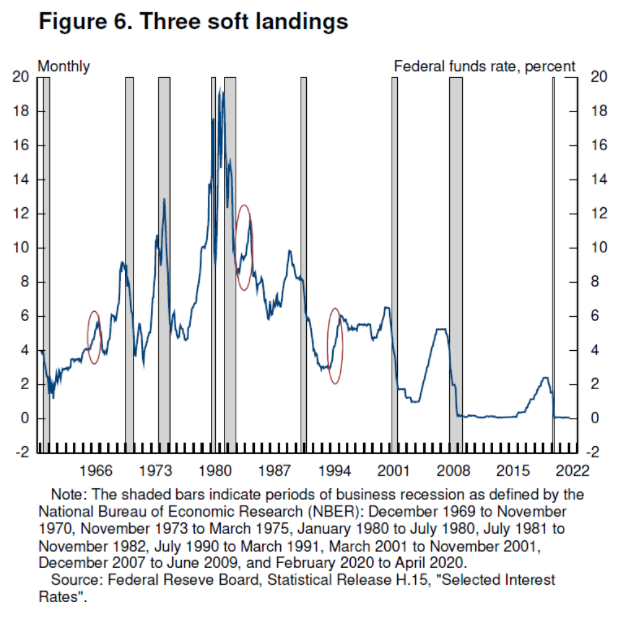

One of the most intriguing points, I thought, was that the Fed chair went to some lengths to counter the strong narrative that the central bank cannot hike rates enough to thwart inflation without also engineering a recession. This chart shows three “soft landings” when hiking cycles did not result in recessions. The last was as long ago as 1994, a hiking cycle that caused a mess in Mexico and the rest of Latin America, and a lot has changed since then. But the point is well taken that the Fed can, on occasion, execute a significant tightening without prompting a recession:

Whether or not Powell showed any greater hawkish intent this week than last, he got his message across this time. This shows up most dramatically in the two-year Treasury yield, which in the course of this year has risen by 125 basis points. As marked on the chart, yields jolted upward with the publication of the December FOMC minutes, the January meeting, the strong January payrolls data, and then the awful consumer price index data for that month before Russia’s invasion of Ukraine knocked yields sharply down. Last week’s FOMC meeting, and now the Powell speech, have brought two-year yields right back on to a rising trend. A day that started amid speculation over whether the two-year yield could top 2% instead saw it exceed 2.1%:

This in turn prompted one of the developments the Fed most dreaded. For two decades, inflation expectations have been “well-anchored,” in the central banking argot. Bond market forecasts for the next five years stayed below 3%, and for the next 10 years below 2.75%. Those thresholds, marked below, have now been decisively breached.

The importance of expectations in creating inflation is the subject of controversy, but this certainly gives the Fed a strong incentive not to desist. It looks as though inflationary psychology is getting out of hand, so it behooves the central bank to counter that.

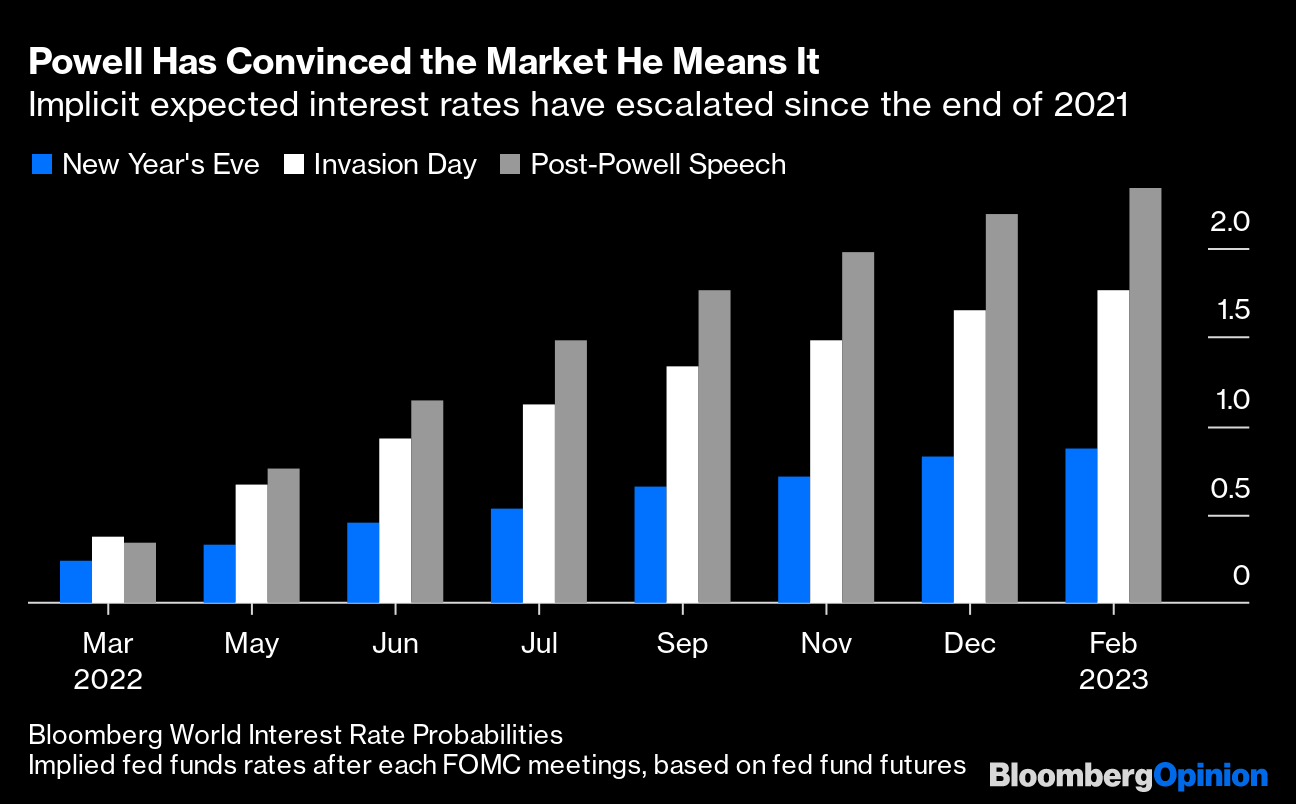

Market-based expectations for how the Fed moves its target fed funds rate have also broken out. The shift in expectations has come with breathtaking swiftness. The following chart shows implicit expectations for rates after each of the next seven meetings as they stood on Dec. 31, where they had moved by the day the tanks entered Ukraine, and where they are now:

Bear in mind that as the year began, CPI had already topped 7% for the first time in four decades. It’s remarkable both how long it took for investors to come around to expecting a sharp monetary tightening, and how swiftly that realization has now taken root.