Nordea analyser EU-aftalen om en genopbygningsfond samt det nye EU-budget. Den omfatter den største grønne satsning i EU’s historie. Samlet set reducerer aftalen risikoen for euro-området, og det vil styrke euroen og reducere det eksisterende rente-spread.

Euro area: EUforia

EU leaders agreed on a EUR 750bn recovery fund, which contains EUR 390bn in grants and EUR 360bn in loans. The deal supports the euro and should narrow euro area bonds spreads further.

- EU leaders agreed on a EUR 750bn recovery fund today to support the recovery from the corona crisis. The program will be financed by issuing debt at the EU level. For the first time, the EU will issue joint EU debt to provide a coordinated fiscal response to an economic crisis.

- While the overall size of the fund remained unchanged (EUR 750bn), the amount of grants was somewhat watered down from the original German-Franco proposal in May. This was hardly surprising given the so-called Frugal Four (Denmark, Sweden, Austria & Netherlands) strongly objecting the share of grants.

- The recovery fund thus now contains EUR 390bn in grants, while the original proposal was EUR 500bn. The loans allocation was instead increased by EUR 110 billion to EUR 360bn. Of the overall spending, 30% is earmarked to green investments – the largest green stimulus package in the EU’s history.

- The capital raised on the financial markets will be repaid by 2058 through the EU budget, with new taxes providing additional revenue streams for the EU. A new plastic levy will thus be introduced in 2021, while the EU will continue to work on a carbon border adjustment mechanism and on a digital levy.

- The majority of the recovery fund (EUR 672.5bn) will be used under the Recovery and Resilience Facility (RRF) and of these funds 70% will be committed in 2021 and 2022 and the remaining 30% will be fully committed in 2023.

- Moreover, EU leaders agreed on the EU budget (Multiannual Financial Framework, MFF) for the years 2021-2017. The size of the budget will be EUR 1074.3bn which is lesser than the original expectation of 1100 bn. The budget will – after some hefty opposition from Hungary – be linked to the Rule of Law where a qualified majority can decide whether a breach of the Rule of Law has been made.

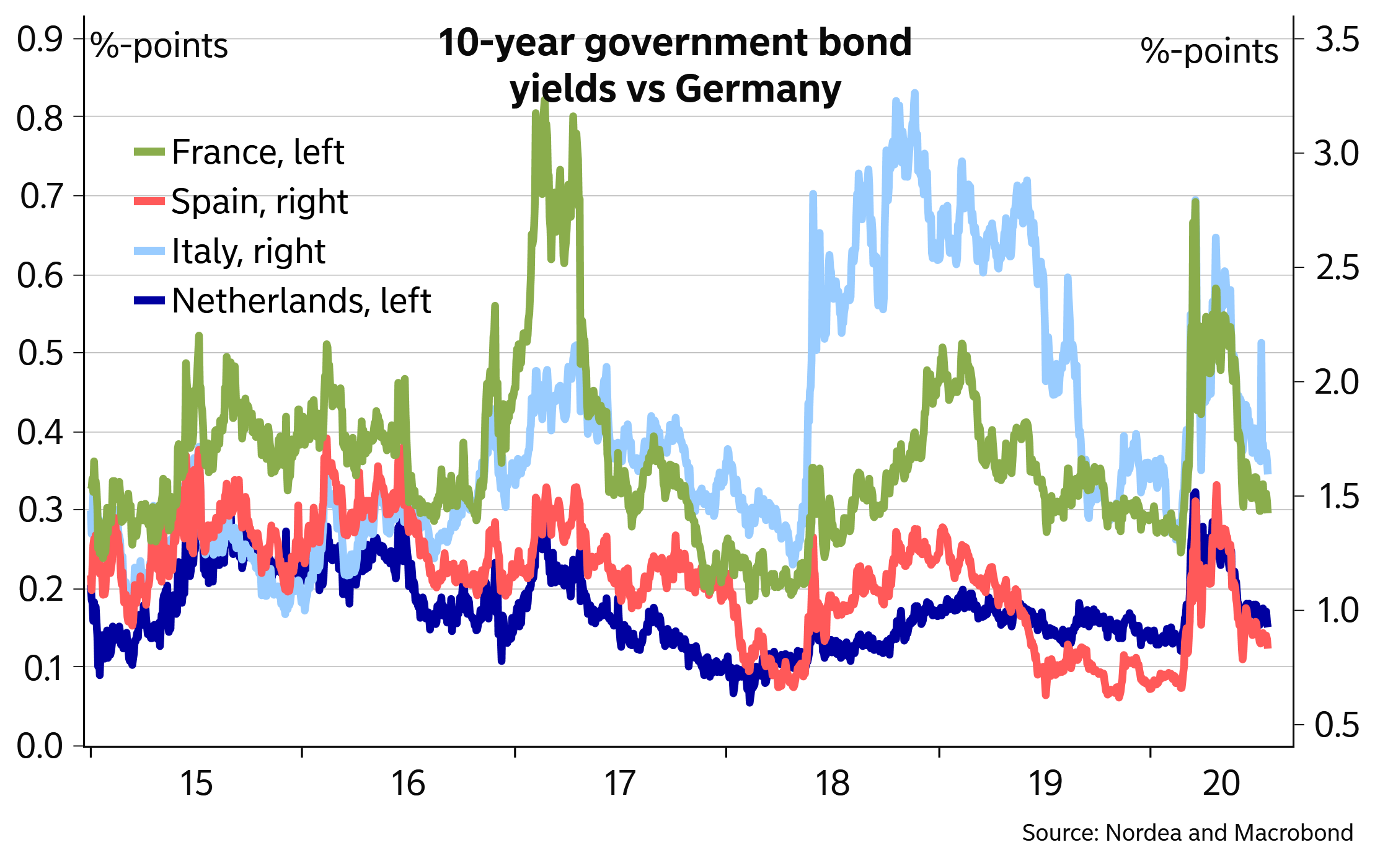

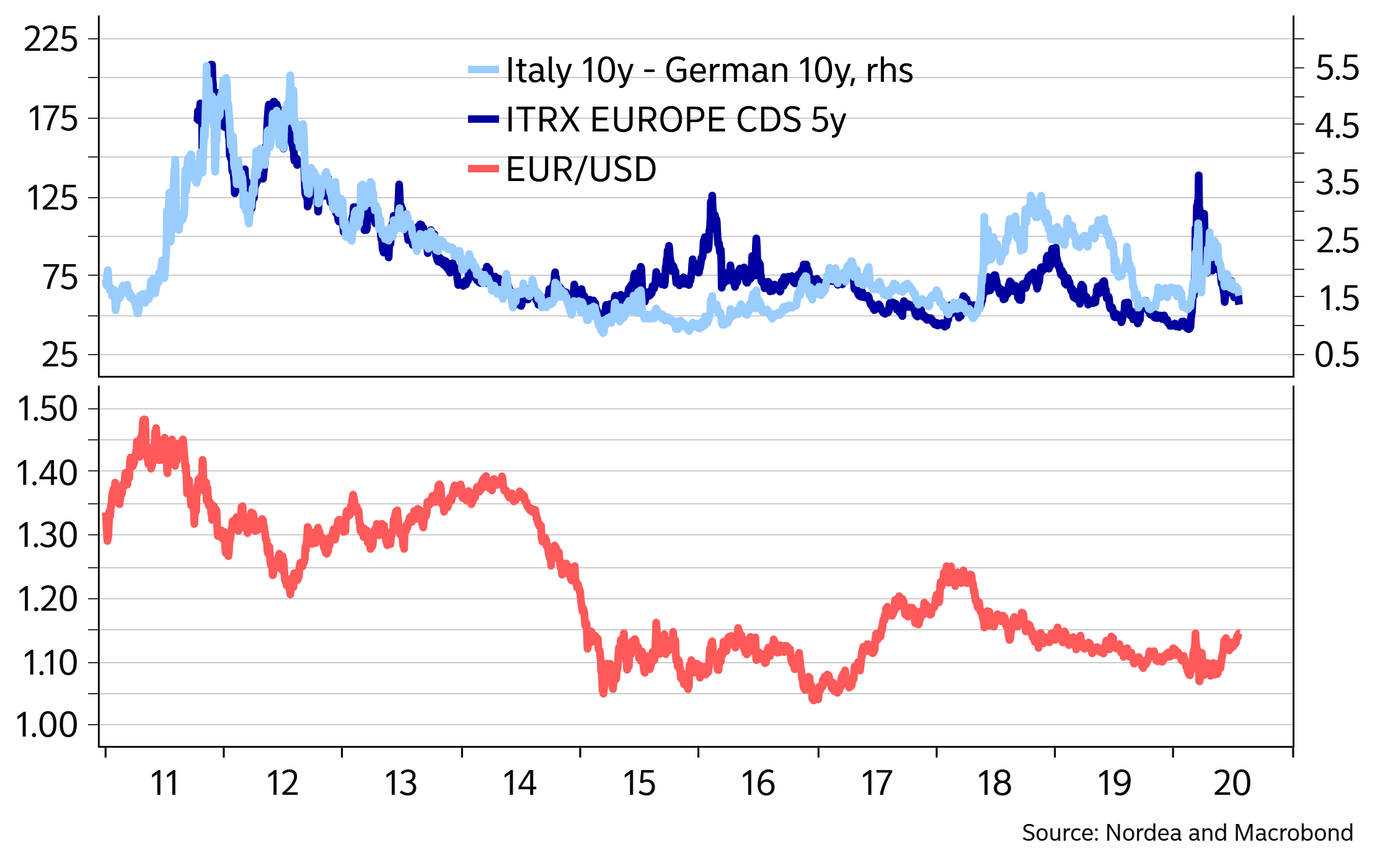

- The deal decreases the risks regarding the future of the euro area. The euro has therefore recently strengthened (although the pricing today was somewhat of a “buy the rumour sell the fact”) and bond spreads have narrowed. In particular, Italian bonds have benefited from the prospects of a deal, and it also seems like Italy will be the biggest beneficiary.

- The deal allows bond spreads to remain at low levels and we may see even some narrowing pressure in the short term. However, for German bonds the deal is somewhat negative both via a higher credit risk component, as the EU’s credit status relies heavily on the German credit rating, and via an improved economic outlook.

- In terms of the ECB, the recovery fund will likely be welcomed. However, the implications for monetary policy will probably be fairly small, as it will regardless of today’s decision be extremely accommodative, with PEPP set to be expanded later this year.

Details can be found from here: Special European Council, 17-21 July 2020: Main results

The deal is positive for Italian bonds, negative for German bonds

The debt deal offers some support for the euro and credit spreads