Finans- og pengepolitisk stimulans bliver kernen for en vedvarende genopblomstring af aktiemarkederne. Kinesiske aktier har klaret sig bedre end alle andre efter det kinesiske nytår, og det skyldes en stribe økonomiske indgreb for at styrke væksten.

Uddrag fra Merrill:

Fiscal and monetary policy will be key for a sustainable recovery in global equities. Chinese stocks have outperformed other regions since coming back from the Lunar holiday partly due to government commitments to backstop growth.

Since this outbreak, Beijing has implemented 34 easing moves that include rate/fee/tariff cuts, easing credit, and increasing government spending to support housing and autos, according to Cornerstone Macro (as of 3/1/20). Similarly, Hong Kong is implementing a $15.4 stimulus package, including cash payouts of $1,284 per adult to kick-start consumer spending.

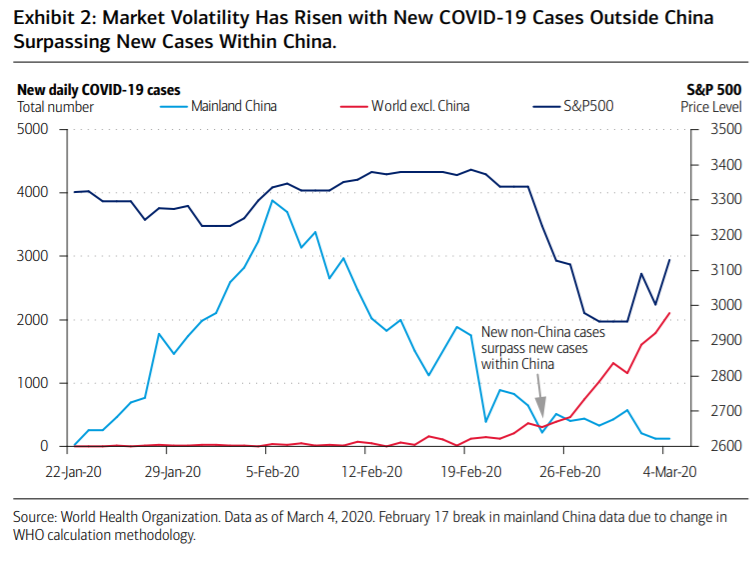

Corona-udviklingen i og uden for Kina og aktieudviklingen (S&P500):

The International Monetary Fund (IMF) announced a $50B aid package for

developing countries, while Korea has injected more than $13B in emergency funds to support growth, and Indonesia is working on a second stimulus package to add to easing measures by its central bank. These measures should help economic growth in developing economies begin to stabilize and bolster investor sentiment.

The outlook for Europe is slightly less encouraging. Europe was in the midst of a fragile recovery before this virus: While German PMIs were turning around, its industrial production continued to drop, and its fourth-quarter GDP was about flat, to go along with contractions in France and Italy. In time, as we look for the virus to be contained, manufacturing should bounce back, but growth may remain challenged in 2020.

The labor market had pockets of weakness in countries like Italy, consumer expectations were already deteriorating for most countries, while trade was sluggish, to go along with a sputtering auto market. And even after Brexit, geopolitical risk remains front-andcenter, with deliberations in Italy and the UK over a potential digital tax being a source of tension with the U.S.

A fiscal policy framework that allows more pro-growth public spending and tax policies could help backstop growth in Europe. Leadership at the European Central Bank (ECB) and European Commission is encouraging governments to take a more aggressive fiscal stance, and there are some signs that the message is being heard. European Union (EU) budgets imply 40 bps of fiscal impulse, led by the Netherlands and Germany, while Italy plans to spend $8.4B to counter the impact of the virus on its economy.

Reports also indicate German Finance Minister Olaf Scholz wants to suspend restrictions on the country’s debt levels, and has stated Germany can react with “full force” if this virus evolves into a global crisis. While these measures could face political hurdles, we believe a fiscal response from Europe becomes increasingly likely if the impact to its economy from this virus continues to worsen.