Nordea forudser, at markederne i det nye år bliver stærkt præget af Kina og Emerging Markets på grund af den stærke vækst i Kina.

Uddrag fra Nordea:

FX weekly: The year of the Ox (bull)

We look forward to a positive 2021 as most of our indicators keep pointing in a (very) bullish direction. This will truly be the year of the Ox (or bull)!

We are about to enter the Year of the Ox, at least according to the Chinese Zodiac calendar. That is probably as Oxish (or Bullish) as it gets, and Chinese stimulus patterns still hint of an extraordinarily strong H1-2021, while we are a bit more in doubt about H2.

We accordingly remain upbeat on EUR/USD, EM FX and risk assets in general into the start of this year and we don’t really want to question this narrative until the recovery is strong enough for both fiscal and monetary administrations to consider removing the foot from the QE/stimulus-pedal.

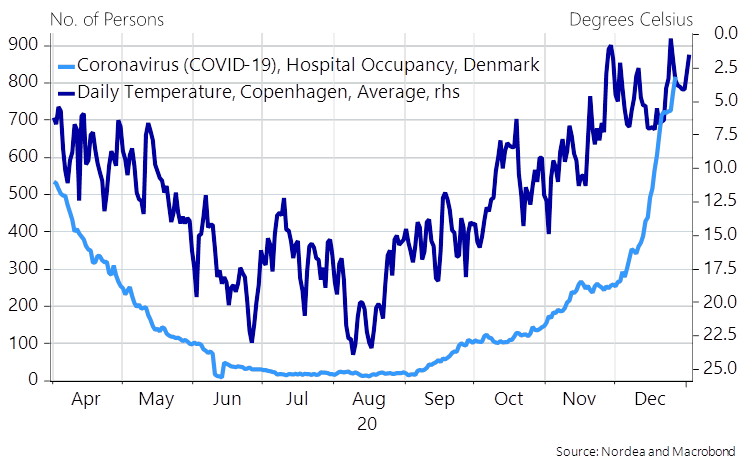

The next few months will likely still prove to be tricky, but the temperature delta could start to turn already around week 5 to 7 on average, which should lead to a more benign seasonality in the virus spread alongside the vaccine roll-out.

This still leaves a very decent possibility of the pendulum swinging towards fewer restrictions already during February. This is well before administrations across the West currently anticipate it, but they don’t want to risk adverse behavioral side effects of hinting of such a time-plan already now.

Chart 1. The virus is highly seasonal, why temperature delta matters – the Danish example

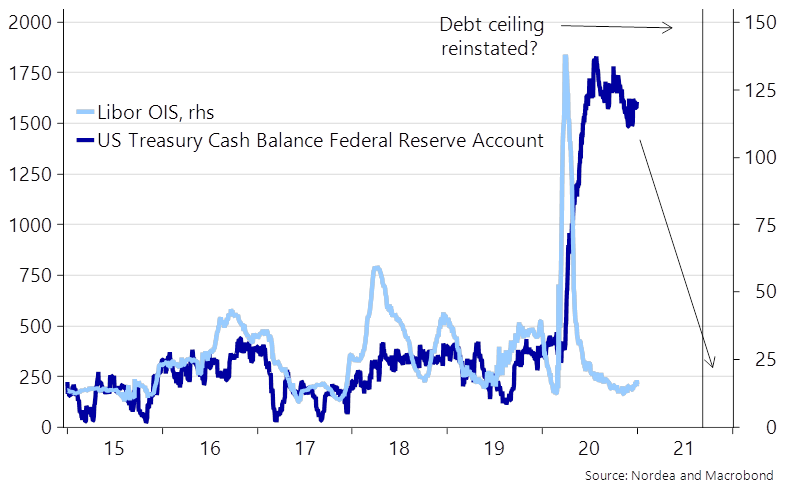

Both in parts of Europe and in the US, direct transfers will play an important part of underpinning the consumption over the next 6-8 weeks. The plan to provide almost all Americans with at least a 600$ cheque will i) work to underpin consumption (probably mostly online), ii) lead the US Treasury general account (much) lower and iii) accordingly, flush the commercial banking system with fresh USD liquidity.

Remember, that the debt ceiling could (likely) be re-instated in September 2021, should the Republicans keep the majority in the Senate intact after the Georgia re-runs (our base case). In such case, the US Treasury general account could be taken remarkably close to zero over summer, which could lead to no (or even negative) liquidity premias in the USD money market. This is one to watch for H1-2021.

The combo of strict lockdowns and a vast number of direct transfers is of course optimal for tech/online stocks, but we still believe in a decent rotation story for 2021 outside of the very near-term.

Chart 2. Could liquidity premias go very close to zero if the TGA is emptied?

The year of the Ox or rather the bull

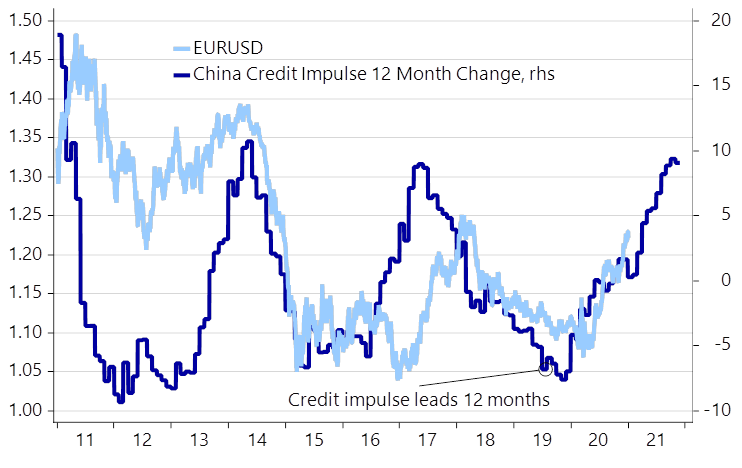

We are no going to sound awfully consensus’y when we take you through our main views for the first quarter of 2021. The Chinese credit impulse is maybe our favorite leading indicator. China is maybe THE country to watch when judging the global cycle since the Chinese credit impulse is so interlinked with the commodity cycle, the manufacturing cycle and accordingly the reflationary cycle.

Judging from most recent historical patterns, it could be that EUR/USD will not peak until the Chinese momentum starts to wane, which is not a story for the first part of this year. >1.25 levels could be on the cards, but it may be worthwhile considering option strategies that take profit above such levels.

Chart 3. EURUSD vs. the Chinese credit cycle

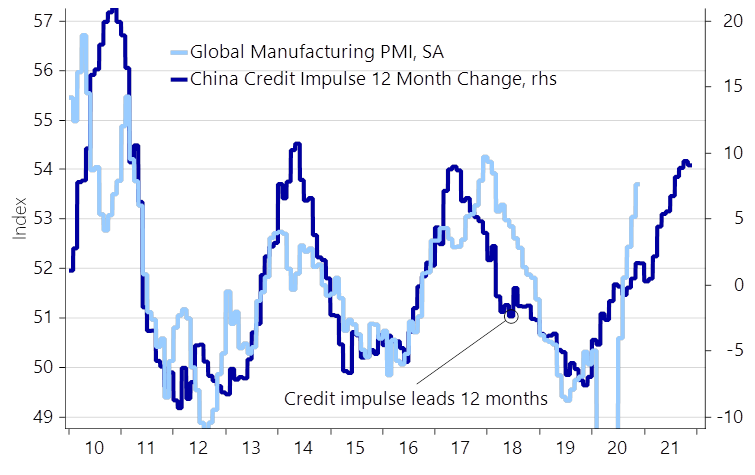

The global manufacturing cycle will likely also continue to improve at least during Q1 and Q2 due to lagged effects of stimulus. No matter whether we use the Chinese credit cycle or the combined year on year effect of the drop in 2 and 10yr bond yields as the gauge, we find that the cycle will not peak until sometime during the early summer of 2021. This is bullish for global trade and accordingly also for trade sensitive regions.

Chart 5. The global manufacturing cycle will probably not peak until late Q2-2021

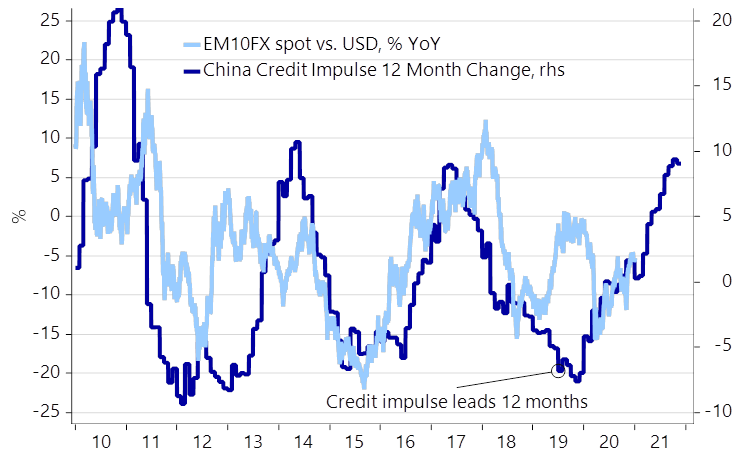

This also leaves a benign environment ahead for EM even if it has slowly but surely formed as a consensus view since Joe Biden won the election.

Intra-EM we would argue that one needs to watch i) the country-specific access to the Oxford-Astra vaccine and ii) temperature delta for countries on the southern hemisphere, which e.g. leaves India as a decent low-volatility pick, while a country like Brazil will likely be challenged by the negative temperature delta during the spring unless a vaccine roll-out is decently in place ahead of it, which is still doubtful.

Chart 6. EM FX vs. Chinese credit cycle – more EM bullishness coming?

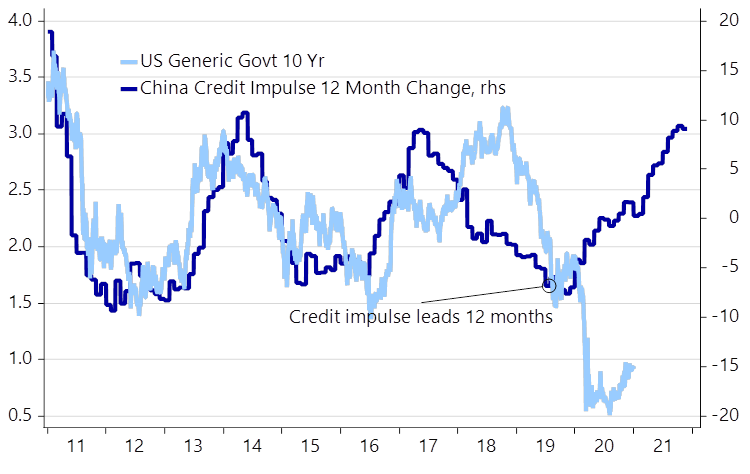

The dark horse is the USD yield curve, while we are more certain that the EUR curve will face another low-volatility year, with the most likely steepening pressure seen in EUR 10s30s, if anything. The USD curve could still steepen up markedly if the Fed at some point during H1 just barely allows it to. Most historical correlations between long USD bond yields and the credit/business cycle have broken down during 2021, but they may be re-instated at lower levels during the late part of H1.