Nordea gennemgår udsigterne for Tyskland efter valget i september. Det kan føre til dramatiske forandringer af politikken og økonomien på grund af De Grønnes kraftige fremgang, men da de konservative partier er begyndt at vinde frem på bekostning af De Grønne, kan det måske også føre til en politik som den sædvanlige med en stram finanspolitik. Tyskland har ekstremt lave offentlige i investeringer i forhold til andre EU-lande, fordi Tyskland traditionelt ikke vil have budgetunderskud. Nordea vurderer, at en koalitionsregering mellem unionspartierne CDU/CSU samt De Grønne er det mest sandsynlige udfald. Det er afgørende, hvem af de to grupper, der får flertallet, og hvem der bliver kansler, CDU’s Armin Laschet eller De Grønnes Annelena Baerbock.

Germany: Sea change or a return to black (zero)?

Germany will get a new Chancellor after the September elections and the course of German policies could change materially. The election result will have important consequences for financial markets as well.

- Germany has changed its stance on a number of important policy points amidst the Covid-19 crisis, and the future course will depend largely on the results of September parliamentary elections.

- After the 15-year Merkel era, Germany will get a new chancellor, while the composition of the government could change materially.

- The Greens are campaigning for an aggressive debt-financed public investment programme, relaxing Germany’s debt brake and further European integration. If materialized, such initiatives could send German bond yields and equity prices higher and support narrower intra-Euro-area spreads (see more details on likely market reactions in the table below).

- The CDU/CSU are currently leading in the polls, and while a lot could still change before September, if they retain the chancellorship, the course of German policies would likely change less.

- The debt brake is part of the German constitution, and bigger changes to German fiscal policies would require changing the constitution, a tall order.

Has the German stance on European integration and fiscal discipline changed for good? The answer to that question will to a large extent depend on the results of the parliamentary, or Bundestag, elections on 26 September.

Following years of strict budget discipline, Germany provided one of the largest fiscal stimulus boosts in Europe last year. Another major German red line was crossed when the EU recovery fund was established; it not only finances the initiative with common EU bonds but also distributes the bulk of the aid in the form of grants to members states, that is, fiscal transfers.

Chancellor Merkel, who has led Germany for more than 15 years, will step down later this year, so it is already certain that Germany will get a new leader. Further, current polling strongly suggests that the current coalition government between the conservative Christian Democratic Union, the Christian Social Union (CDU/CSU) and the Social Democrats (SPD) will not continue, so the composition of the government is set to change as well.

The CDU/CSU reportedly continue to favour lower taxes, but only if public finances allow, a return to a balanced budget as soon as possible and a firm rejection of common Euro-area bonds. The Greens, on the other hand, are campaigning for large-scale public spending programmes, modifications to the so-called debt brake (see more below), higher taxes, further European integration and of course aggressive climate targets. The two current front-runners, according to the latest polls, thus have very different policy goals, and the outcome of the election will have consequences for financial markets as well.

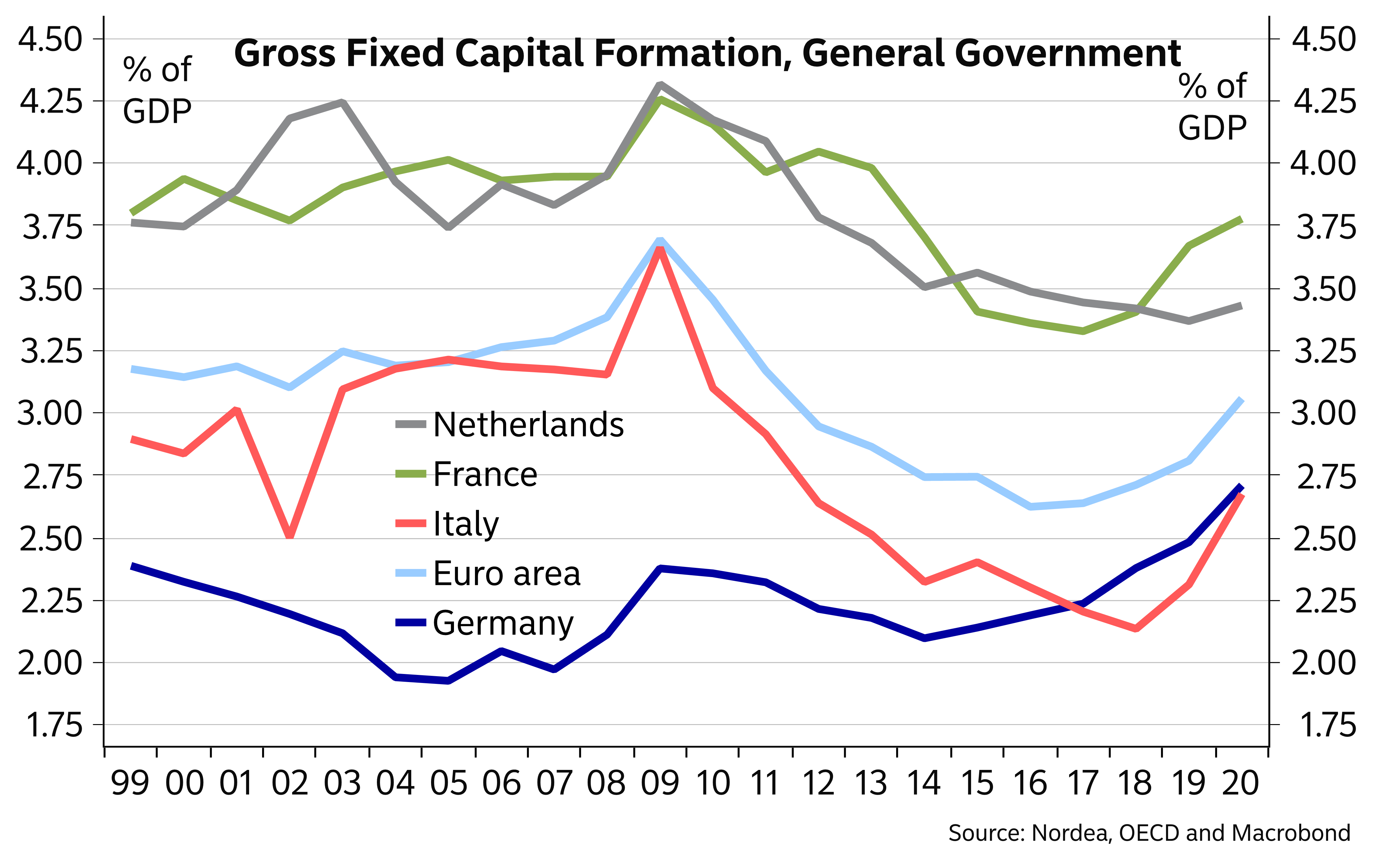

Germany has been lagging in public investment spending for a long time

Who will lead the next government?

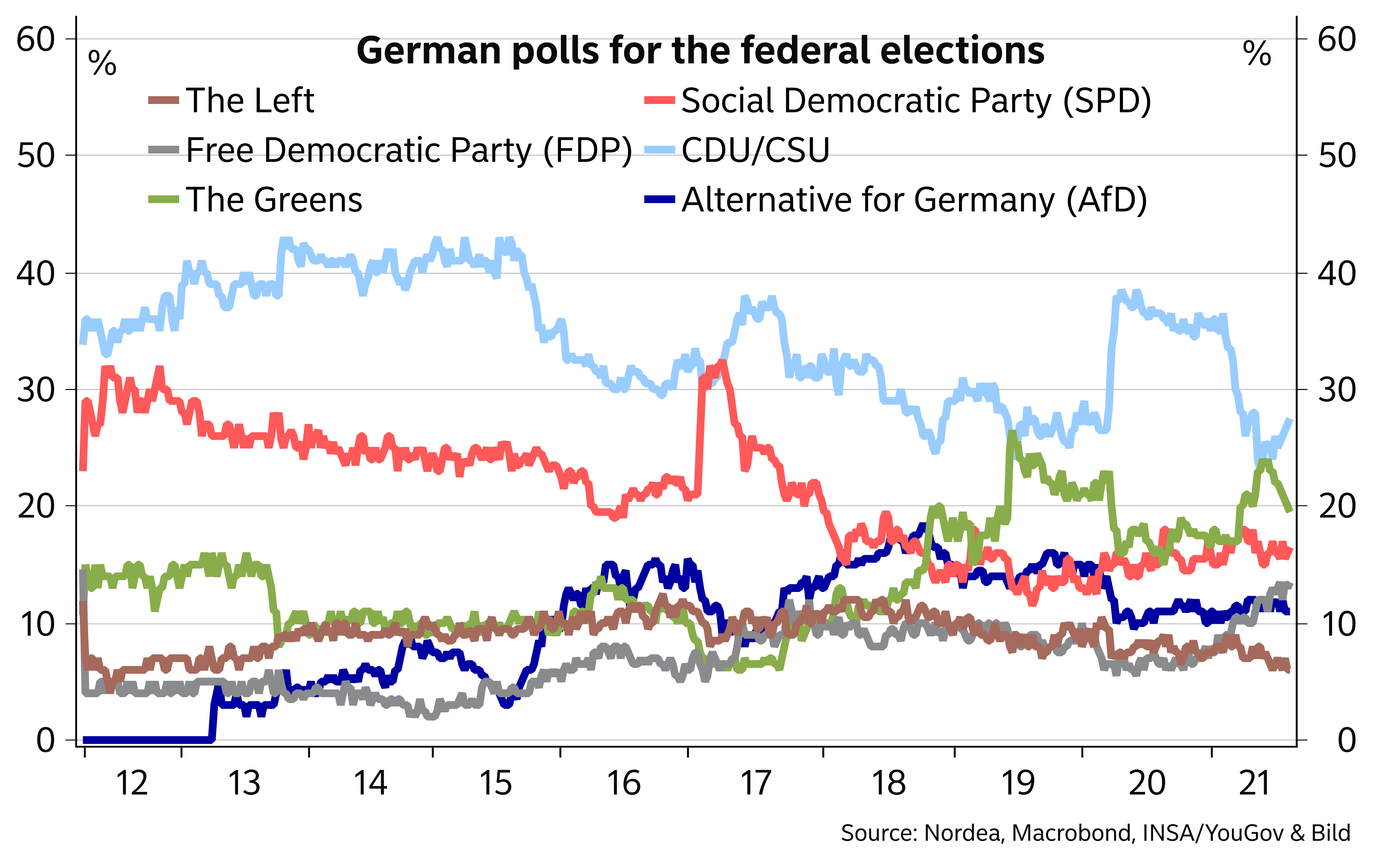

After the Greens chose Annalena Baerbock as its candidate for chancellor, while the CDU’s candidate Armin Laschet failed to inspire the Germans, the Greens briefly overtook the CDU/CSU as the largest party in the polls. Support for the Greens has since waned, in part because of some gaffes by Baerbock, and the CDU/CSU are back in the lead. Still, the CDU/CSU are currently polling clearly below 30%, far below the around 33% they scored in 2017.

The liberal Free Democratic Party (FDP) has been gaining recently in the polls, gaining on the SPD and opening more options for the post-election coalition.

The other parties have excluded co-operation with the Alternative for Germany (AfD), which is currently polling at just above 10%, while the Left party is unlikely to be high among preferred coalition partners either.

Below, we look at the most likely coalition options and try to estimate how financial markets would react if the chances of such coalitions increased. The longer-term market consequences will naturally depend a lot on what kind of policies will eventually be implemented, which is likely to fall clearly short of what the individual parties are campaigning for ahead of the vote.

CDU/CSU back in the lead in German polls

CDU/CSU + Greens (+FDP)

The most likely government after the September vote will be led by the CDU/CSU and include also the Greens and possibly the FDP as well (so-called Jamaica coalition, as the colours of the parties would match the colours in the Jamaican flag). Depending on the exact relative shares of the participating parties, we would expect such a government to commit to relatively strict climate targets and a limited public investment programme (priorities for the Greens), a return to a balanced budget without any significant tax hikes (a priority for the CDU/CSU) and a return to somewhat more flexible EU fiscal rules (compromise between the parties).

Being a baseline scenario, the formation of such a government would probably not have big short-term market consequences. If the Greens were able to persuade the CDU/CSU into supporting even some relaxation of the debt brake, though unlikely, then the result would probably be a larger public spending programme and with that higher bond yields and a stronger euro.