I en analyse af den seneste udmelding fra den amerikanske centralbank, stiller Nordea spørgsmålet, om det er meningsfyldt at tale om noget “gennemsnit” i Feds nye målsætning om et “gennemsnitligt inflationsmål.”

Fed Preview: How to make Average Inflation Targeting more credible

Focus at this week’s FOMC meeting will be at the operational consequences of Average Inflation Targeting (AIT). As the Fed needs to show full AIT commitment, we see a clear risk of a hike in the current QE pace as well as an “Operation Twist”.

We have got to admit it. Much of the excitement about next week’s FOMC meeting has been “ruined” after Powell’s Jackson Hole announcement of Average Inflation Targeting (AIT). Still, we do think that the meeting could turn out to be more interesting than what many market participants might believe.

The main reason is that the new strategy regime is so vaguely formulated that the pile of unanswered questions has not at all become smaller. Frankly speaking, in the regime’s current form with no time period references, we could basically just scratch “Average” from the name and call it “Flexible Inflation Targeting” instead.

Thus, it is pretty hard to calculate an average when you receive no guidance on what the time period/sample looks like. AIT is therefore in its current form also a much softer regime compared to its sister regime of price level targeting or nominal GDP targeting.

Of all of the unanswered questions, we especially think the following three will be in focus at the FOMC meeting:

- How much inflation overshooting is the Fed willing to tolerate?

- What will the Fed do to accelerate inflation?

- Will forward guidance be formally changed?

1) How much inflation overshooting is the Fed willing to tolerate?

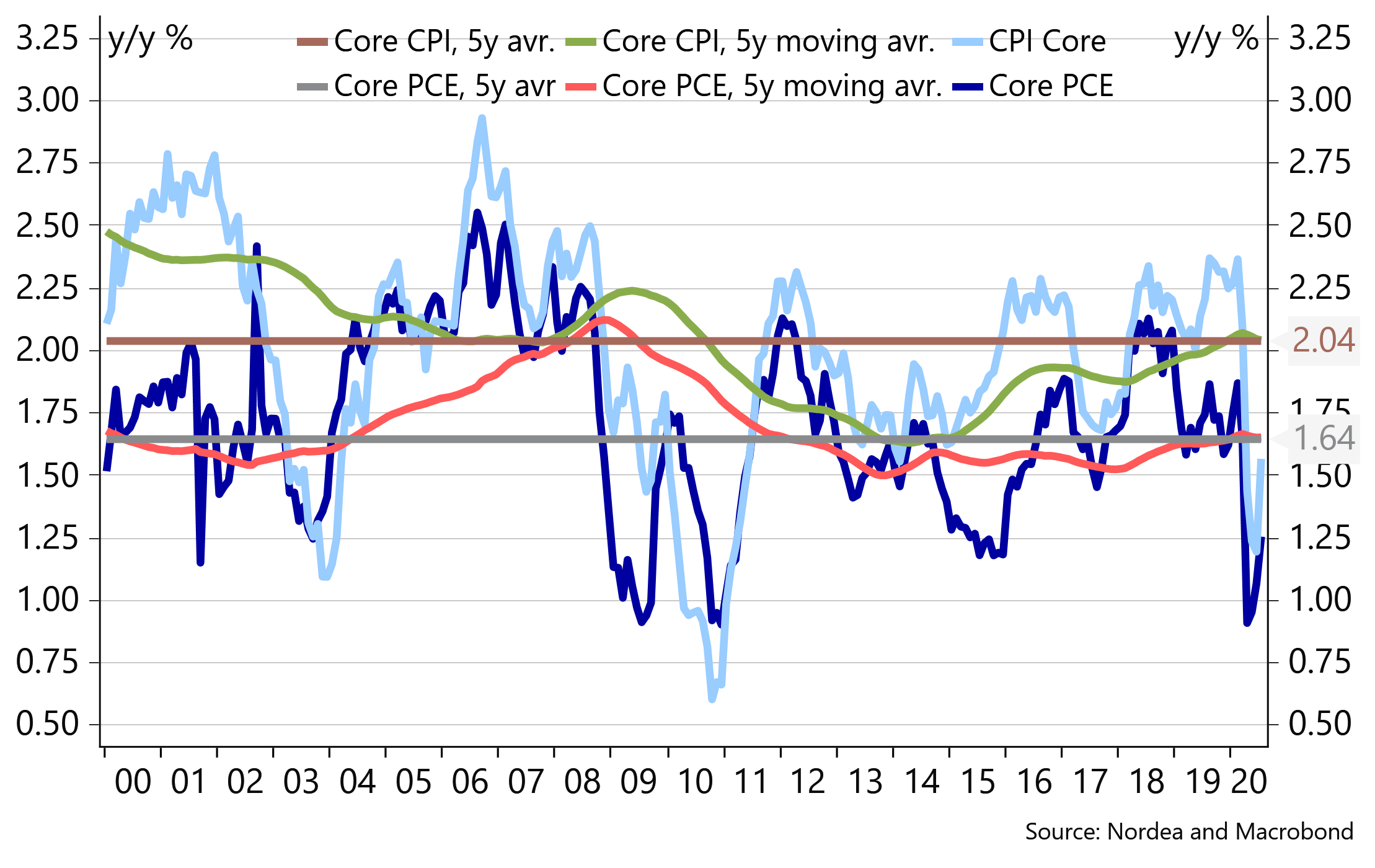

This question is the biggest unknown at the moment. Some Fed watchers have been arguing that since PCE Core inflation has averaged 1.6% (y/y) in the past five years, the Fed now has a de facto inflation target of 2.4% (see chart 1).

Well, that could be true. But it could also be 2.3% if we look only at the past two years like a recent San Francisco Fed paper suggested. Or it could be 2.25-2.375% like Kaplan wants. Or perhaps there really is no new de facto target – perhaps we should just focus on how fast inflation accelerates above 2% and the “nature” of the acceleration.

Basically we don’t know yet. All we know is that the Fed does not want to commit to any “mathematical formulas” at this point, as that would imply implementing a rule. But the Fed does not want more rules, they want flexibility. Hence, old rules like the Taylor rule and the Philips Curve have practically been killed by the Fed, while the “-2% real rate floor” has also been swept away.

Overall, the uncertainty about operational consequences of AIT is still quite high, so expect Powell to be bombarded with questions on the subject. In return, don’t expect Powell to give any precise answers (for now).

Chart 1: Core PCE has averaged 1.6% over the past five years. Is 2.4% then the new de facto target for the coming five years?

2) What will the Fed do to accelerate inflation?

The hope with AIT is that it can – if considered credible – help solidify inflation expectations at 2%. This should provide an inflation anchor which in turn can lessen the constraint from the effective lower bound (read: 0% rates) during recessions. Therefore, the Fed’s top priority when trying to make AIT a success is to credibly lift inflation expectations ASAP.

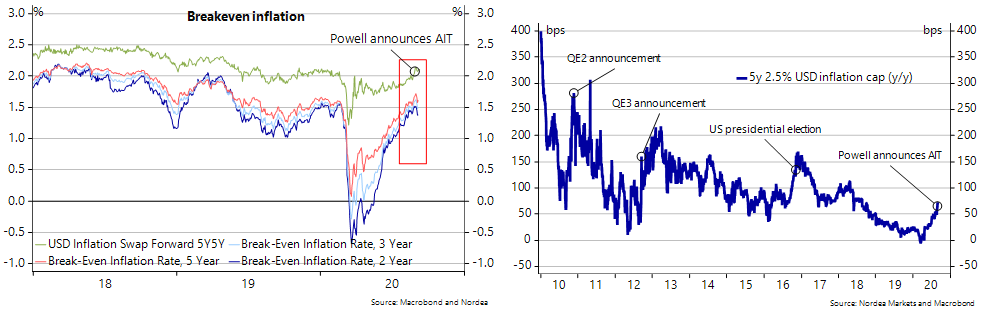

Chart 2 & 3: Inflation markets have rebounded, but they do not yet fully imply a belief in AIT becoming a success

The Fed has already taken a big step in that regard, as inflation swaps have rallied since end-July, in line with our expectations. However, inflation breakevens and inflation swaps are not yet in sync with inflation averaging 2% “in the medium-long run”.

Taking into account that inflation swaps are quoted in CPI, not PCE, and that CPI historically has had a 0.3-0.4%-point premium relative to PCE, we should see eg. USD 5y5y swaps trading at a minimum of 2.3-2.4%.

The reason for our inclusion of the word “minimum” is that we are in a “below-2%-inflation-environment” for a long time still – even if leading indicators lately have shown some stabilisation (capacity utilisation, wage indicators, money velocity, etc.).

Therefore, if we are to fully trust AIT, we should see inflation above 2% in a couple of years from now and correspondingly inflation swap forwards above 2.4%.

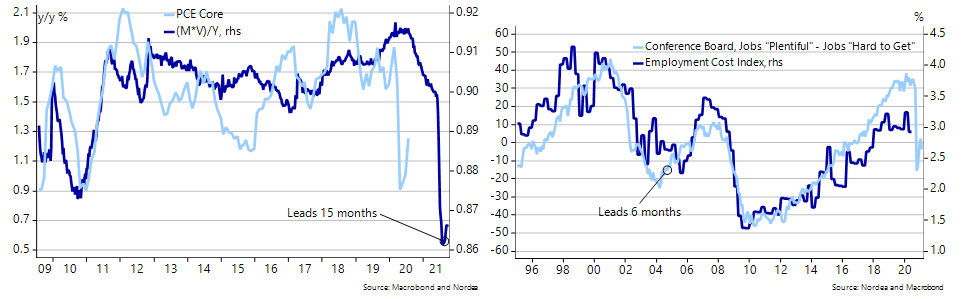

Chart 4 & 5: It will be a long time before PCE core inflation moves above 2%

So, what can the Fed do to lift inflation expectations? The first natural weapon of choice would be to re-increase the minimum pace of QE announced in June.

This also fits nicely with the July minutes in which “many participants commented that it might become appropriate to frame communications regarding the Committee’s ongoing asset purchases more in terms of their role in fostering accommodative financial conditions and supporting economic recovery”.

By re-increasing the QE purchases already in September, the Fed would ease financial conditions even more and let us now that they mean serious AIT business (Fed Watch: From stabilization to accommodation)

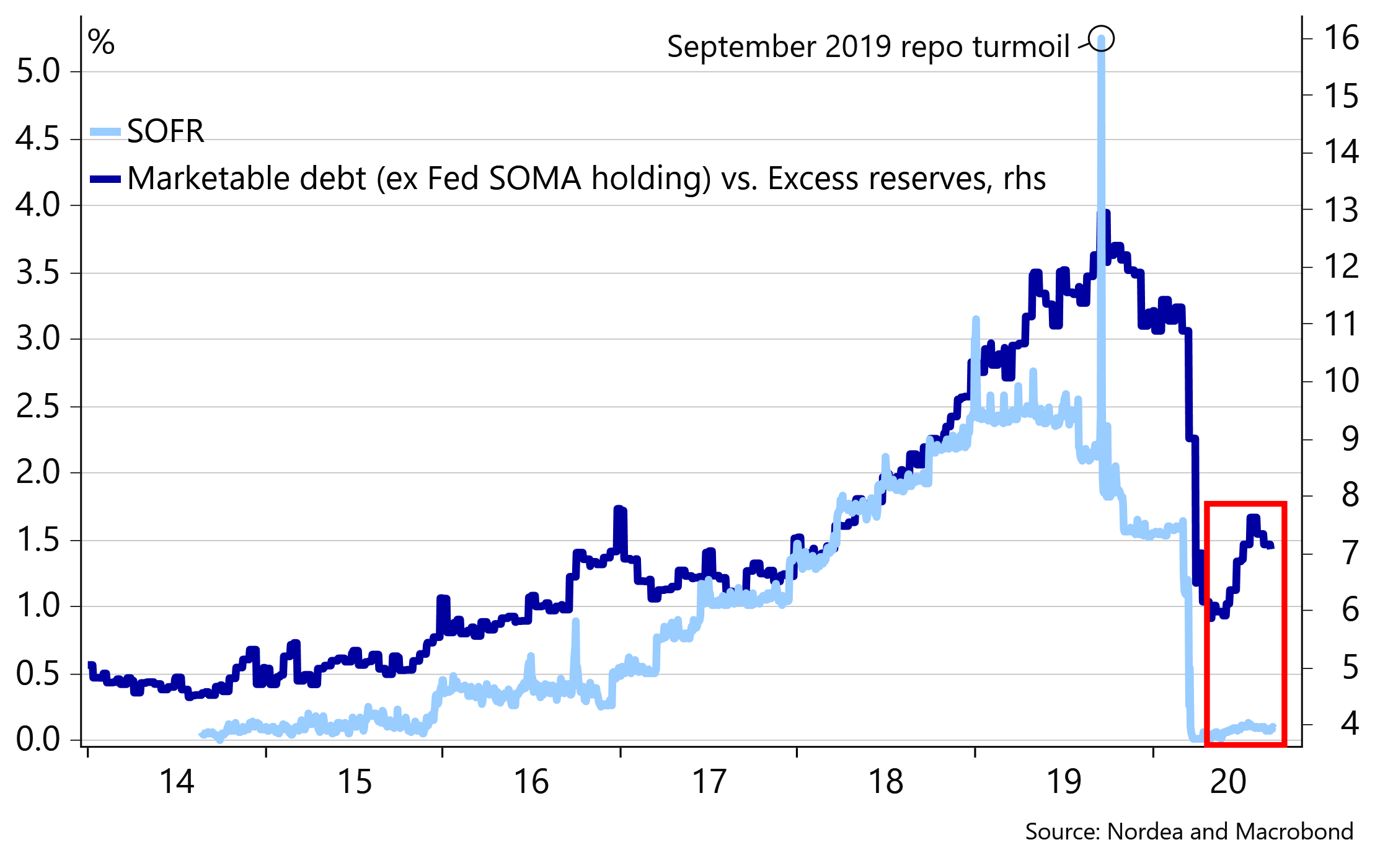

Besides improving inflation expectations, hiking the QE purchase tempo would also have the positive side effect of easing recent upwards pressure on secured overnight funding rates (see chart 5).

Hence, funding rates have – although not alarming – been raised, as excess reserves have dwindled almost $500 bn since its peak in June (primarily due to the spike in the Treasury’s cash account).

Given the focus of lifting inflation, it could also make sense to change the mix of the purchases by buying larger amounts of inflation-linked bonds (TIPS).

Chart 6: Less excess reserves have contributed to SOFR moving slightly higher

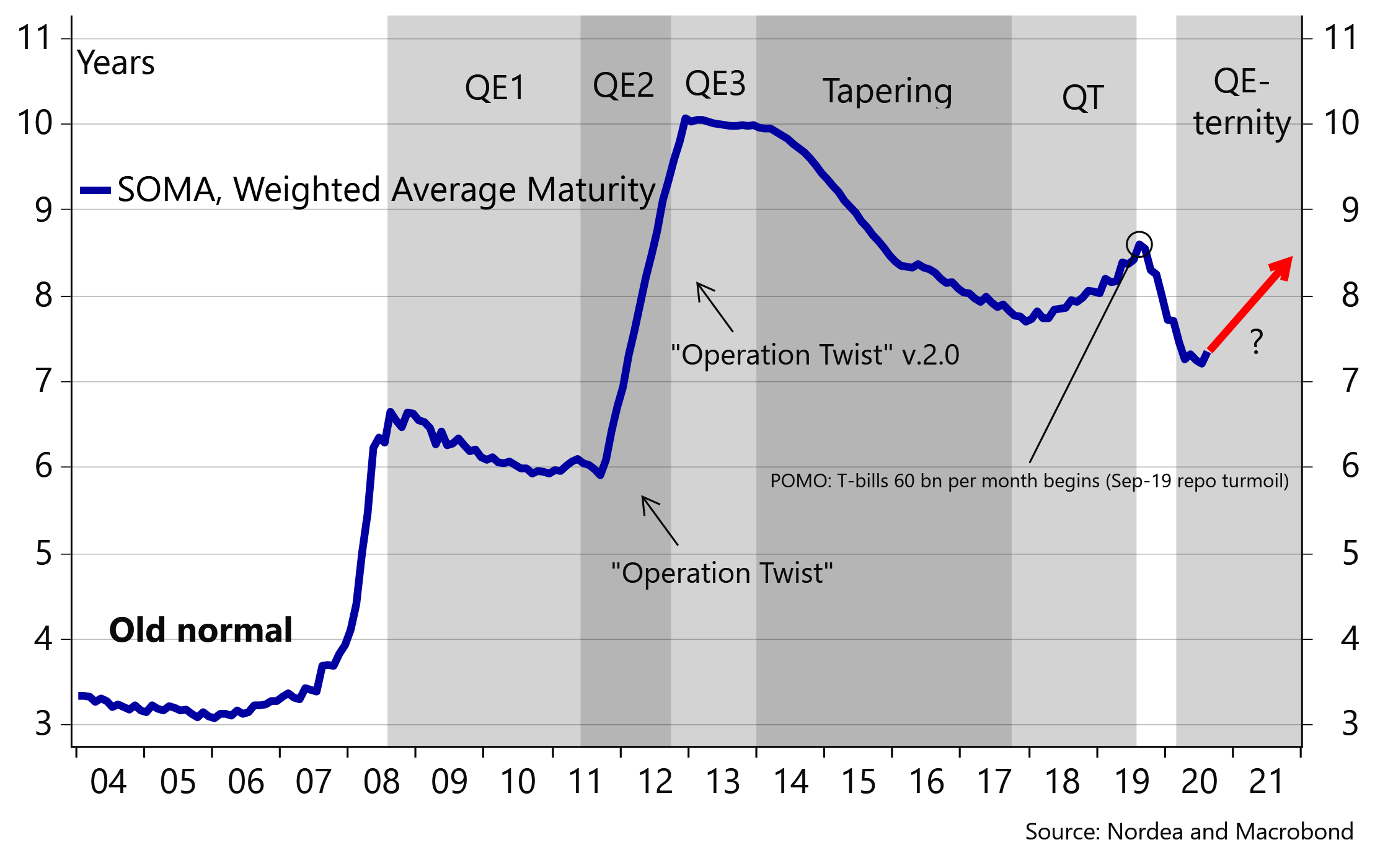

Another viable option is a classic “operation twist” (see chart 7). Thus, the Fed currently buys Treasury securities across the curve roughly in with the composition of total marketable debt, but a shift towards buying more long-tenored securities (i.e. old school QE) would indicate that the Fed has now truly moved from the phase of stabilisation to the phase of accommodation.

The market implication of this would in turn be that curve flatteners are still the name of the game in Q4 (while steepeners, on the other hand, could be a solid bet for 2021).

Finally, what could really increase inflation expectations is an introduction of true “Friedman Helicopter Money” (aka. People’s QE). We have seen some Fed members lately – in particular Brainard – showing interest in this topic, however, the consideration of People’s QE as an actual policy option is, in our view, still probably at least a few years away.

This will though likely be a hot topic in the foreseeable future (read more in our inflation and money creation primer: US: Deflation vs. hyperinflation risks)

Chart 7: The WAM of the SOMA portfolio declined after last year’s POMO operations. If “Operation Twist” come into play, we should see a reversal of that trend.

3) Will forward guidance be formally changed?

Introducing a stronger forward guidance could also help anchor inflation expectations. And with the AIT regime in place, it would seem like a no-brainer to link forward guidance to inflation.

For instance, the Fed could say that “the federal funds rate will be kept at 0-0.25% and asset purchases will continue at least at the current pace, until inflation shows progress consistent with the symmetric 2% objective and inflation expectations have been well-anchored”.

However, while we think that forward guidance will be linked to inflation at some point, then just before the blackout period several Fed members (Kaplan, Kashkari, Bostic, Mester and Rosengren) downplayed the chances of updated explicit forward guidance (i.e. policy actions linked to time- or objective-based metrics).

Again, it seems like the Fed members really do not want to tie its hand and introduce any rules at this point.

Still, at least some forward guidance will be offered as the Summary of Economic Projections (SEP) will be published. These forecasts now run until 2023.

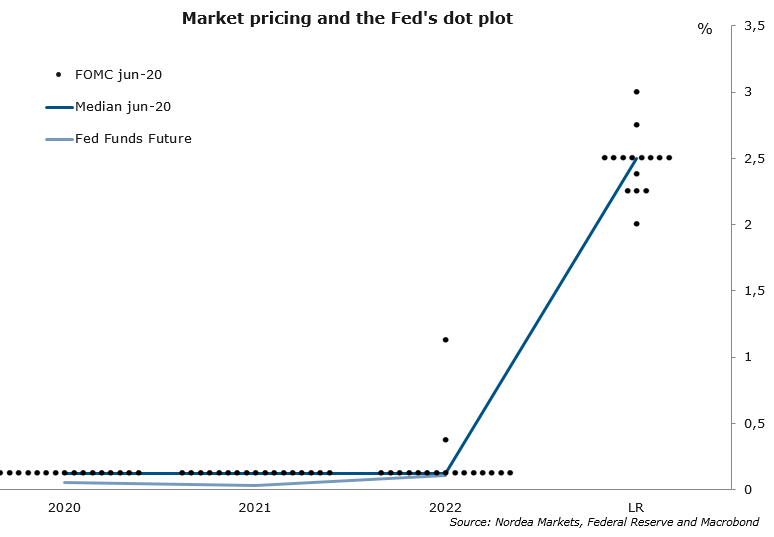

We expect the Dot Plot to show no rate hikes throughout the forecast horizon, with the two “rate hike dots in 2022” from the June meeting (see chart 8) likely to have migrated to 0-0.25%. This would be in line with the new AIT “lower for longer” regime.

Chart 8: Dot plot from the June meeting

We will also pay a lot of attention to the inflation forecast and in particular those for 2022 & 2023. Thus, if those projections have PCE inflation running at, say, 2.3-2.4%, it would be a clear indication of how much overshooting the Fed is willing to tolerate (our question 1).

Finally, due note that the September meeting is the last one before the November Presidential Election. However, contrary to common belief, we do not think the Fed sees itself as constrained because of this, as history has shown that the Fed generally will do whatever it finds necessary in the run-up to an election (Electionomics: No, the Fed is not on “election pause”).

In fact, we think that Powell will not hesitate to use his airtime next week to tell the politicians of the importance of more fiscal aid, despite it being a sensitive topic ahead of the election. Powell will certainly highlight the downside risks that the economy still face, and that another fiscal package is needed to sustain the economic recovery.