Nye data fra ECB’s opkøbsprogram viser, at ECB ikke har foretaget så store opkøb af italienske statsoblgationer, som mange økonomer havde ventet. Opkøbsprogrammet PEPP er ikke så fleksibelt som bebudet fra ECBs side, skriver Nordea i en analyse og spørger tilmed, om ECB ligefrem har bluffet. ECB har foretaget forholdsvis flere opkøb af tyske statsobligationer i forhold til sin capital key-politik.

ECB Watch: Was the ECB bluffing?

The ECB has been emphasizing the flexibility of its new bond purchases, but data on its purchases imply that the central bank still feels quite bound by the capital key. The ECB’s capacity is not unlimited.

- Even though the ECB has targeted its support towards Italy, the central bank appears to feel bound by the capital key.

- PEPP is not as flexible as advertised.

- The ECB has been buying a lot of German and Dutch t-bills, implying the issue of PEPP redemptions needs to be decided soon.

- The data offer the ECB some cover amidst the criticism due to the German Constitutional Court Ruling.

- There are limits to the ECB’s support, even if the central bank has not communicated those aloud.

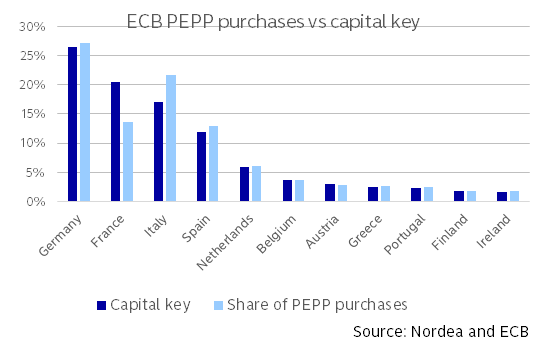

The ECB published detailed data on its pandemic emergency purchase programme (PEPP) purchases for the first time. The biggest surprise was perhaps that there were no major changes compared to how the ECB has been buying bonds before. The ECB itself has been emphasizing the flexibility of the PEPP, including deviations from the limits set for the public-sector purchase programme (PSPP), e.g. regarding the capital key.

In reality, deviations from the capital key have been modest, with two exceptions. The ECB has bought more Italian bonds than its share of the capital key would imply. This was expected, but the purchase share was “only” 21.6% vs. the capital key share of 17%, which implies that the ECB continues to feel bound by the capital key.

Second, French bond purchases were clearly smaller than its capital key share, a deviation that could have been expected for Germany. German purchases actually exceeded its capital key share slightly. One explanation could be that French issuers were bought more on the corporate side, and also the French share has been increasing in the PSPP.

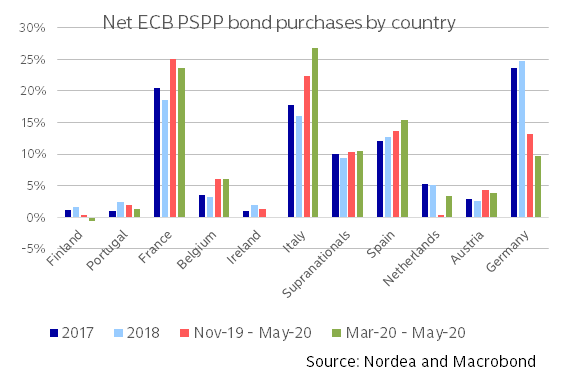

There is also a political dimension, when one examines the PEPP and PSPP data together. The Italian share has been increasing in the PSPP as well during the corona crisis. The first implication is that the ECB has targeted its support towards Italy. The German share of the PSPP, in turn, has been rather low lately. While one should always be somewhat careful when examining the PSPP data over shorter horizons due to the lags involved in reinvestments, the data implies the ECB may have wanted to show a rather high share of German purchases in the PEPP at the expense of the PSPP. In other words, the PEPP data look much more acceptable for the Germans compared to one showing huge deviations from the capital key.

On the maturity of the public-sector PEPP purchases, German and Dutch purchases stand out with average maturities of 3.15 and 3.89 years, respectively (vs. the around 7-year average maturity of the eligible universe). The data imply that the ECB has been buying a lot of t-bills in these countries, which makes sense given the large increases in especially Dutch and German t-bill supply. Large purchases of t-bills also imply the question of PEPP redemptions will become acute rather sooner than later, and needs to be decided soon.

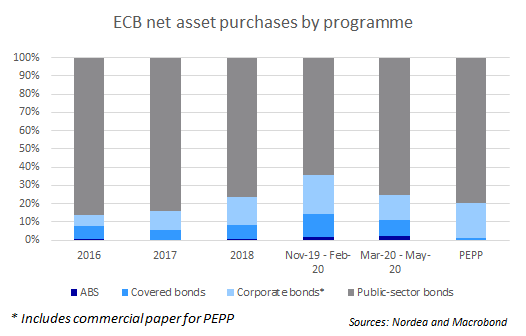

Overall, close to 80% of the PEPP purchases were in public-sector bonds, 15% in commercial paper and 4.5% in corporate bonds. The share of covered bonds stood at a modest 1%, while they have accounted for around 10% of the asset purchase programme. Naturally, the covered bond market is not feeling the issuance pressure of the government bonds markets, and thus also need less exceptional support.

We see significant ECB support continuing, and expect the central bank to increase the size of the PEPP going forward. However, the flexibility of the PEPP does not appear to be as high as the ECB has advertised in all respects and not much larger than that of the PSPP, which limits the amount of support the ECB can offer individual countries like Italy.

The same likely applies to the issuer limits. Even if the 33% issuer limit of the PSPP does not directly apply to the PEPP, also the PEPP purchases face limits, and it is hard to see the ECB owning more than 50% of individual government bonds. There are limits, even if the ECB has not communicated those aloud. The ECB needs help in addressing the corona crisis.

The data also offer the ECB some cover against the ruling by the German Constitutional Court, but the debate continues. It is naturally also possible that the ECB has changed its buying patterns after the ruling to show a more conservative picture.