Nordea venter flere interventioner fra Nationalbanken for at hindre en styrkelse af kronen. I de første tre måneder har Nationalbanken interveneret for i alt 19,6 milliarder kr., og Nordea venter, at Nationalbanken vil intervenere for mindst 50 milliarder kr. i år, før der skrides til en rentesænkning.

More intervention from the Danish central bank – but at a much slower pace

For 3 consecutive months the central bank has been intervening in the FX market. More intervention is expected, but an independent interest rate cut is not imminent. On the contrary, the intervention is a welcome opportunity to provide more liquidity

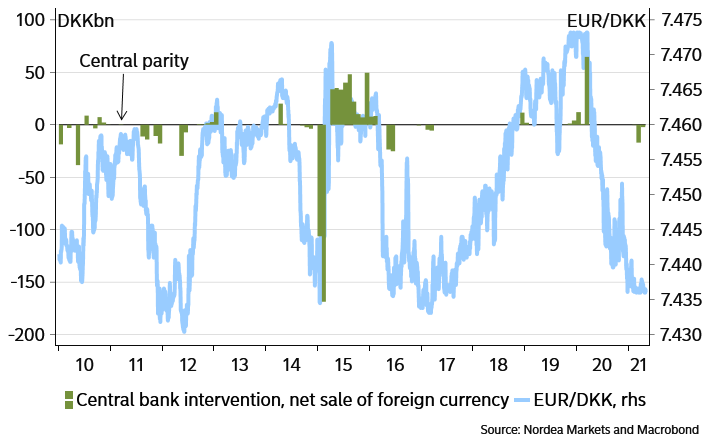

In April the Danish central bank sold DKK 2.2bn in the currency market to counter strengthening of the krone against the euro. This was the third consecutive month that the central bank had to intervene to keep the EUR/DKK cross within the desired range. Accumulated the intervention has now reach a total of DKK 19.6bn in the past three months. In March the intervention reached a total of DKK 17.0bn

Chart 1: Intervention and EUR/DKK

As usual the central bank has not revealed the exact EUR/DKK level where it intervened in April. However, judging from the development in EUR/DKK, it seems like a level slightly above 7.435 marks the lower tolerance level for the central bank at the current juncture.

Intervention is a welcome opportunity to provide more liquidity

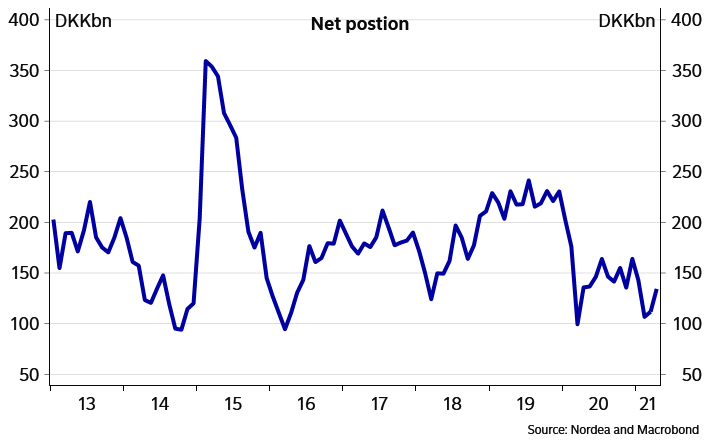

The key reason for the current downward pressure on EUR/DKK is the very low excess liquidity that spills over to a very large spread between money market rates in Denmark and the Euro area. The foundation for this low liquidity was laid back in March 2020 when the central bank bought more than DKK 60bn to counter a strong pressure for a weaker DKK. In that perspective the current sale of DKK can be seen as a reversal of the event that took place during the intense market volatility last year.

Chart 2: Excess liquidity

Therefore, in our view, the Danish central bank most likely sees the current downward pressure on EUR/DKK as a welcome opportunity to provide more excess liquidity to the Danish money market.

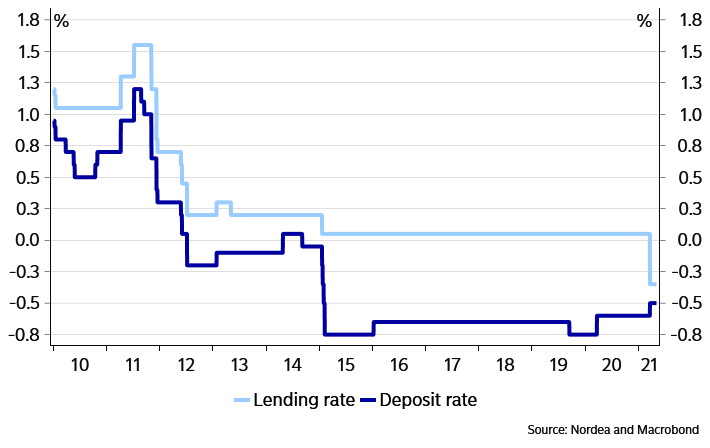

This implies that the central bank is expected to intervene for at least DKK 50bn before an independent interest rate cut comes into play. Therefore, in our main scenario we expect the Danish central bank to withstand the pressure and thereby keep the deposit rate unchanged at -0.50%.

Based on this, we see a good risk/reward in betting against an independent Danish interest rate cut.