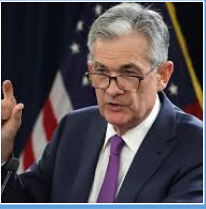

De økonomiske data viser fremgang i forbindelse med genåbningen, men den bekymring, som centralbankchefen Jerome Powell gav udtryk for i går, lægger en dæmper på markederne, mener ING. Der er også bekymring over nye tilfælde af coronavirus i Kina og USA.

ASEAN Morning Bytes

EM Space: Concerns about virus resurgence likely to weigh on sentiment

- General Asia: Economic data out from the US surprised on the upside but Jerome Powell indicated that economic activity will likely fall well short of pre-pandemic levels even after a bounce from the lows in April.

- Meanwhile, investors continue to worry about the rising number of new daily cases in China and in the US with Beijing shutting down schools. In the US, states that moved quickly to reopen their economies have noted a recent spike in cases but governors have pointed to expanded testing to explain the increase in new daily infections.

- Caution should be the theme for Wednesday’s trading as investors monitor Covid-19 developments and the prospects for a drawn-out economic recovery.

- Singapore: Non-oil domestic exports have started to give in to weak global demand, finally. Just released, data for May showed a 4.5% YoY NODX fall, worse than the consensus of 1% growth. This followed a strong surge in the preceding two months (17.6% and 9.7% in March and April, respectively).

- Two consecutive months of month-on-month NODX falls confirms that the strength seen earlier in the year is wearing off. Indeed, it was lop-sided vigour, unsurprisingly led by a surge in pharmaceutical exports, while key exports electronics were missing in action. This state of affairs reversed in May with pharma posting a 7% fall and electronics surging by 12.5%.

- By destination, shipments to China remained a weak link (-7% YoY) but those to the US and Japan continued to be strong with over 50% growth. Weak NODX supports our view of a sharp GDP fall in the current quarter (INGf -9.2%), although most of this weakness stems the service sector, disproportionately affected by the Covid-19 circuit-breaker.