Are Danish banks greedy, as the Minister of Economic Affairs calls them? The answer is blowing in the wind. Financial Weekly now digs deeper. An analysis of data for banks in Denmark and other EU countries reveals several startling facts: Negative interest rates on deposits are higher here than elsewhere, lending rates are higher and return on equity is also higher. And the sector as a whole is extremely inefficient: With the same efficiency as in an average of nine EU countries, there should be 12,628 fewer employees in the Danish banking sector.

There are many indications that the banks’ strong reactions to the Danish Minister of Economic Affairs Simon Kollerup’s criticism of the banks’ negative interest rates on deposits are now hitting them like a boomerang. The banks, and even the National Bank of Denmark, have protested against the Minister’s interference in the pricing of the banking sector, even though the Minister of Economic Affairs is actually responsible for the well-being of the financial sector. But he is also responsible for ensuring a reasonably effective competition. Financial Weekly’s survey of the Danish situation compared to other EU countries shows that the Danish banking sector is in many respects “different”. Roughly speaking, the figures from the National Bank of Denmark, the EU, the European Central Bank ECB, and the European Banking Associations, EBA and EBF, show that the Danish banks have charged very high prices, that they have higher costs and that they have a return at the higher end of the scale. But also that there are extremely many employees per million inhabitants compared to other EU countries.

Incomprehensibly many employees

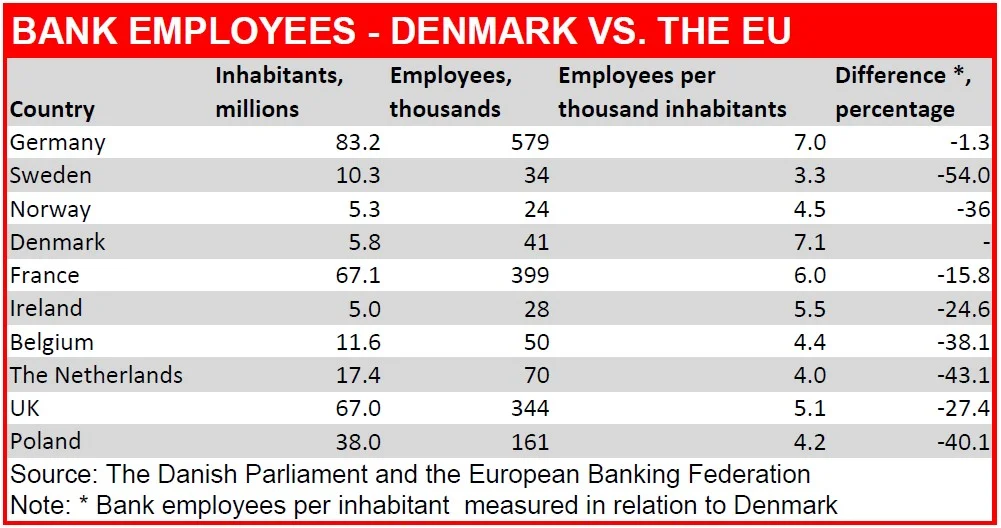

In fact, the sector would have to cut a total of 12,628 full-time employees, or 31% of the total of 44,000, to be at the same level as the other EU countries. Based on data from the Danish Parliament and the European Banking Federation (EBF), Financial Weekly calculated that Sweden has 54% fewer bank employees per million inhabitants than Denmark, and Norway 36%. Among the nine EU countries with which we typically compare ourselves, only Germany comes close to matching Denmark, as the table shows. “In a previous article in the Finance/Investment section of Financial Weekly, I demonstrated that personnel costs in the Danish banking sector are between 25 and 35 percent too high. Basically, it is incomprehensible with so many employees in the banks, when we all handle most transactions via online banking,” says Associate Professor Emeritus Johannes Raaballe from Aarhus University, who is one of the most insightful banking experts in the country. He points out that the high costs are not only due to many employees: “Most of the banking sector’s costs are wages, and the fact that wages are relatively high also increases costs in the sector a lot. The average full-time employee in the banking sector earns roughly as much as a university professor.” In a European comparison, Danish banks, despite their high costs, are nevertheless more profitable than most other EU countries’ banks, according to data from the European Central Bank (ECB), which publishes quarterly key figures on banks’ equity capital, seen as a key measure of banks’ profitability.

Better return than neighbours

According to ECB data, the Danish banking sector achieved a return on equity of 8.7 percent in 2019, compared to the EU average of 5.4 percent. The German banking sector delivered only 1.7 percent return, and Finnish banks 4.9 percent. The year before, in 2018, the situation was roughly the same: The Danish banking sector delivered an equity return of 8.0 percent, compared to the EU average of 6.1 percent. Here too, German banks came out weak with a 2.0 percent return, while Finnish banks performed like the Danish banks.

In other words, the Danish banking sector overall delivers a better return on equity than banks in many other EU countries, despite high cost levels. The high costs are also confirmed by a study by the European Banking Association (EBA), which shows that Danish banks, together with German banks, have some of the highest cost ratios: Danish banks have costs equivalent to almost 80 cents for every Euro of income. The FSA’s calculation shows a lower cost ratio. But Danish cost ratios are still significantly higher than, for example, Norway, with 38 cents in costs per revenue Euro, and Sweden with 54 cents, with a European average of 67 cents. “It is surprising that the Danish banking sector has higher costs than in Sweden and Norway, which have a much larger geographical spread than Denmark. And therefore banks have to cover a significantly larger geographical area,” says retired professor Finn Østrup, who has researched and written books on the banking sector for several decades. The high cost ratio in an international comparison is surprising, as the Nordic banks are seen as some of the most digitalised in the world. Nor can the higher cost ratio be explained by significantly lower prices than in other EU countries. Data from the National Bank and the ECB show that Danish banks generally have higher lending rates and higher negative interest rates on deposits than banks in other countries. Figures from the National Bank of Denmark show that businesses (non-financial corporations) pay an average lending margin of 2.06 percent in March 2021. Similar data from the EU for the Eurozone countries show that businesses pay an average lending rate of 1.11 percent, with Finland at 1.33 percent and Germany at 1.17 percent for large businesses, for example. That is a lot lower than in Denmark.

High interest margin

For small business borrowing, which typically represents only 10-20% of total sector lending, the interest margin is 1.92% in Eurozone countries, including 1.62% in France and Spain and 1.83% in Germany. The National Bank’s figures also show that Danish banks’ new, small business loans (of less than DKK 2 million) cost a lending rate of around 2.4-2.6 %, well above the EU average. The figures are slightly clouded by the fact that the Danish data may include mortgage loans. But the bottom line is that Danish banks’ gross lending income is, all other things being equal, higher than that of European banks. In addition, Danish banks also earn more on negative interest rates on deposits than other European banks. For private households, the average deposit rate in Denmark is minus 0.03%, while in the EU as a whole it is plus 0.18% on a current account. For businesses, the EU average deposit rate is minus 0.11% on a current account, including minus 0.12% in Germany and plus 0.02% in Finland. But the EU average is plus 0.18% for a one year binding period. In Denmark, banks have an average business deposit rate of minus 0.46 % National Bank figures show. Danish companies are thus hit much harder by negative interest rates than companies in the rest of the EU. “Overall, the situation is that the high costs of Danish banks are having a direct impact on the prices that private Danes and businesses pay for bank loans. Ultimately, a pattern of lack of competition in the banking sector is emerging,” says Johanns Raaballe.

Need for rationalisation

Finn Østrup agrees: “The banks’ costs are higher than abroad, and so are their returns. In the end, this can only be due to a lack of competition. And if anything is to be done about it, banks need to become more efficient through increased competition, for example through more structural rationalisation and innovation.” In the latest statement from the industry association Finans Danmark in the debate on negative deposit rates, it is stated that private deposits of around DKK 1 trillion cost minus half a percent, equivalent to half a billion DKK annually in costs. It seems that Finans Danmark sees deposits only as a cost, without taking into account that most of the deposits provide liquidity for lending to other customers.

MWL

For more articles in English: Our articles in English