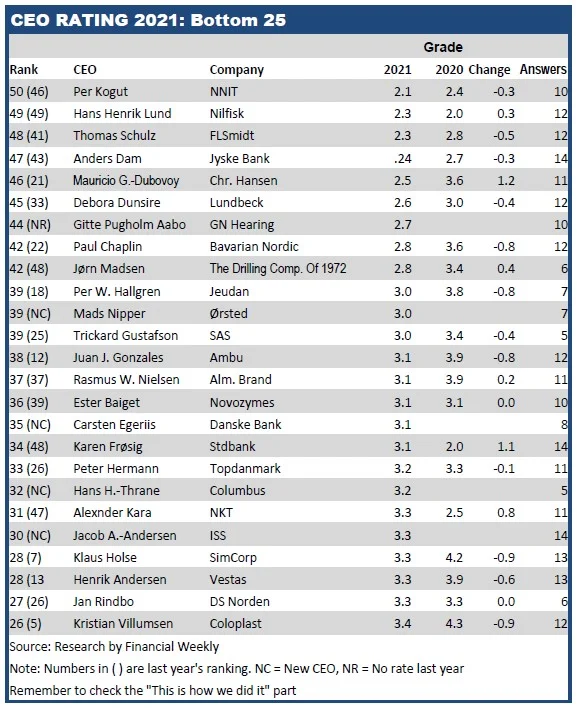

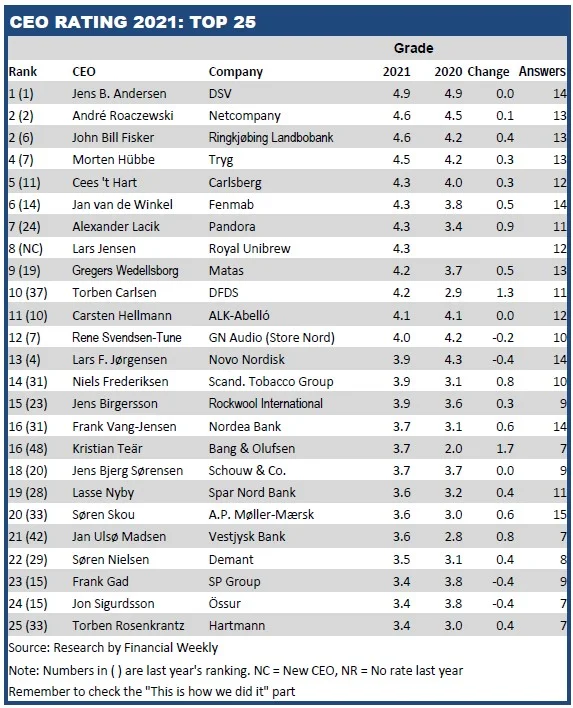

Financial Weekly presents the annual ranking of the top executives of the 50 largest listed companies in Denmark. For the sixth year in a row, DSV’s Jens Bjørn Andersen wins. The rating is based on responses from 35 stock analysts and portfolio managers. Netcompany’s André Rogaczewski repeats last year’s ranking as runner-up. But otherwise there have been big shifts at the top of the rankings, where there are several high-flyers. Here we review this year’s winners and losers, and seek to present explanations for what has moved the positions.

The super-team of Danish top executives, which is highlighted positively by analysts and portfolio managers, is unchanged from last year in the top two positions. But otherwise there have been big changes.

CEO Jens Bjørn Andersen of DSV is very hard to topple from the throne, which he now occupies for the sixth consecutive year. Investors still see him as their superhero, and this is reflected in the share price, which has tripled since March last year alone.

Jens Bjørn Andersen has not only proved once again that DSV’s business model is incredibly solid. The management has also proven that it is capable of successfully making large acquisitions. With the latest major acquisitions, paid for with DSV shares, Jens Bjørn Andersen has almost created a money machine: the Swiss foundation, Ernst Göhner Stiftung, has probably not regretted its sale of the logistics company Panalpina to DSV in 2019. In that deal, DSV for the first time paid for a major takeover by issuing its own shares to the seller. And the value of the shares the foundation received as payment has more than doubled since then.

This is probably a major reason why DSV Panalpina has now been able to pay for a takeover with its own shares for the second time: the Kuwaiti company Agility has just sold its Global Integrated Logistics business to DSV.

Agility no doubt looked at the Panalpina deal before accepting DSV shares as payment. Indeed, on the very first day, the sale turned into a particularly good deal for Agility. The shares that constituted the payment immediately rose 88 price points, becoming worth 225 million Euro more.

DSV has thus once again consolidated its position as a major Danish company in a league of its own. Despite the fact that truck transport is not rocket science.

Another large Danish company that continues to surprise positively is IT consultancy Netcompany. CEO André Rogaczewski continues to deliver growth and strong profitability. The stock has tripled since the IPO three years ago, and there is more to come if you look at the performance of the latest Q1 results: sales growth was stronger than analysts had expected, and if the company keeps up the momentum in the coming quarters, an upward revision is in the pipeline. Growth is coming from all four countries, with a shift towards more private sector activity at the expense of the public sector.

Next in this year’s CEO Rating are Ringkjøbing Landbobank’s John Fisker and Tryg’s Morten Hübbe. Over the years, guests from the financial sector at the top of the rating have been sparse. Both CEOs have shown aggressive strategic action in recent years, with Ringkjøbing Landbobank’s acquisition of Nordjyske Bank and Tryg’s acquisition of UK-based RSA Insurance Group together with Canadian Intact.

How RSA-owned Codan has become part of this context remains to be seen, and despite competition authority approval of the transaction, it remains uncertain what influence Tryg has on future ownership. It seems obvious that analysts think Tryg is significantly sexier than Topdanmark, whose CEO Peter Hermann gets a rating only slightly above average. The difference in ratings is hardly due to ownership, as both companies have large shareholders: Topdanmark with Finnish Sampo, and Tryg with Tryghedsgruppen.

The next places in this year’s CEO Rating are occupied by brand new names, which in previous years have been significantly lower down the ranking. In particular, Alexander Lacik from Pandora moves up from 24th place last year to 7th place this year. In several analyses, Financial Weekly has described the impressive journey the jewellery group has been on in recent years after a multi-year downturn in which there was no doubt that the company’s brand value was deteriorating completely. There is every indication that Pandora is heading for a new heyday, in which the recovery of the Chinese market in particular will be crucial.

Pandora’s management seems to have found the recipe in several of the major markets, so the way forward seems clear. Underpinning the whole story is the fact that Pandora’s CEO has some 13 million private Euro invested in Pandora shares, so there is a real case to be made that management has a significant financial interest in common with investors.

Other strong CEO positions include Lars Jensen of Royal Unibrew. He replaced the previous CEO last year and is the best placed of the new CEOs from last year. Lars Jensen is ranked eighth, while the outgoing CEO of the country’s second largest brewery was ranked 15th last year. Carlsberg’s Cees ‘t Hart also moves up the rankings nicely to fifth place from eleventh last year, and he is followed by Genmab’s Jan van de Winkel, who moves up from 14th last year to sixth this year.

At the bottom of the rankings are several companies facing major challenges, including NNIT’s Per Kogut, who continues to struggle to break free from Novo Nordisk, and Hans Henrik Lund of Nilfisk, who has just been sacked.

Biggest surprises at the bottom of the rankings are Anders Dam of Jyske Bank, who drops to 48th place this year from 43rd last year. Sydbank’s Karen Frøsig has now put significant positive distance between herself and Jyske Bank’s top boss.

Morten W. Langer

Here’s how we did it

Financial Weekly’s annual CEO Rating is based on input from 35 equity analysts and portfolio managers. 154 were surveyed by email, giving a response rate of 23.

Each respondent was asked to rate the CEOs of large-cap companies on the stock exchange, as well as selected mid-cap companies, on a scale of 1 to 5.

It was made clear that the assessment is made from an equity point of view and that a mark should only be given in cases where the respondent feels that he/she has sufficient knowledge of the director and the company.

The CEO Rating in Financial Weekly has been conducted every year for the past 20 years.

For more articles in English: Our articles in English