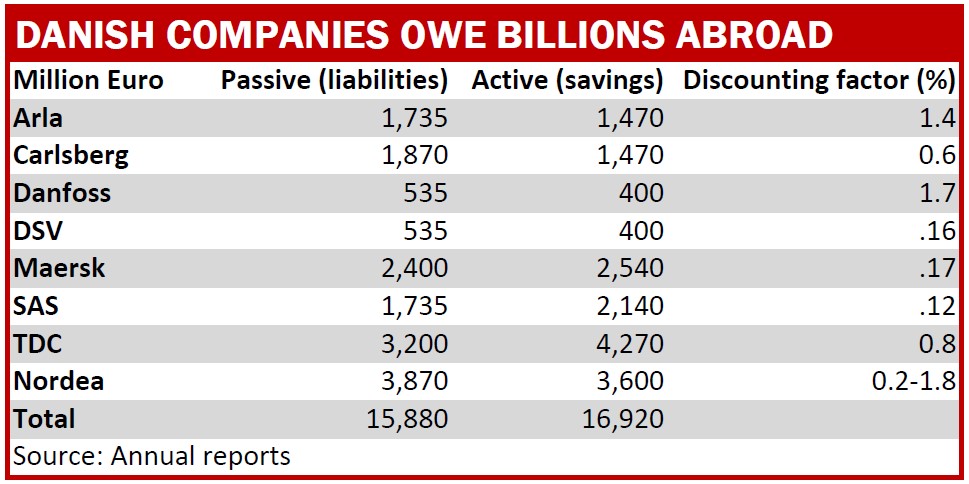

Large companies owe around €13 billion in pensions to foreign employees, and the burden is growing drastically these years. Unlike the pensions industry, companies are significantly underestimating the impact of the fall in interest rates. For example, Carlsberg has a “gap” of 385 million Euro.

It is not only the Danish pension funds that are struggling these years with a sharp fall in interest rates, which is increasing the demand on pension funds to meet future obligations. A large number of Denmark’s largest companies are struggling as well. In most cases, companies have not provisioned for the future pension liabilities of foreign employees.

At SAS, for example, foreign pension liabilities have increased by just over €265 million over the past few years, and at Maersk the liability increased by almost the same amount last year. But there are strong indications that companies have not set aside enough to cover the negative effects of falling interest rates on pensions.

GROWS WITH THE FALL IN INTEREST RATES

“As in the pension industry, we have seen this type of pension grow rapidly in size as interest rates fall. It’s just not always reflected in the accounts themselves, as in many other countries companies are allowed to use an artificially high interest rate to work out how much they owe employees in pensions. I find it hard to explain why companies are allowed to use the interest rate on a corporate bond to make up pensions. It should be the risk-free interest rate on a government bond, and there is quite a difference between using one or the other,” says actuary and pension expert Søren Andersen from FPension.

Companies fully recognise that the fall in interest rates is having a major impact on the size of pensions they owe their employees abroad. But they are simply complying with local rules in each country.

“It is true that the discount factor has fallen from 2.4 per cent in 2019 to 1.6 per cent in 2020. This is mainly due to the fall in interest rates on high-quality government bonds in the individual countries where we have liabilities. This is particularly the case in some of the European countries. A lower discount rate immediately results in a higher pension liability, but the trend is offset by lower expected inflation.” Michael Ebbe, Deputy Group CFO of DSV Panalpina explains.

You have to look far and wide in companies’ annual reports to find information on foreign pensions. But DSV’s annual report, for example, states that when interest rates change by half a percentage point, liabilities abroad increase by tens of millions of Euro.

“These are more dangerous pension schemes than the ones we know in Denmark, where we put money aside for retirement on an ongoing basis. Foreign pensions fluctuate a lot in value. In some cases, they can add up to too much, and we have seen that this can affect the company’s profits considerably in some years,” says Søren Andersen.

He believes that companies should currently use a zero interest rate, while companies typically use between 1 and 2 percent. The Danish pension industry also currently uses 0 percent when calculating pension liabilities.

“The discount factor is determined according to IFRS rules on the basis of interest rates on the corporate bond market. The discount factor has decreased in 2020, which all else equal led to higher pension liabilities. We have no specific expectations of how this will look at the end of 2021. At Arla, we consider pension liabilities as loans and we have no current plans to close the ‘gap’. However, the schemes are closed to intake for new employees. This means that the debt will be reduced over time,” says Carsten Just Andersen, group accounting manager at Arla Foods.

Carlsberg has a 385 million euro hole in its foreign pensions, but there are no plans to fill it again, says VP Tina Aggerholm.

Carsten Vitoft