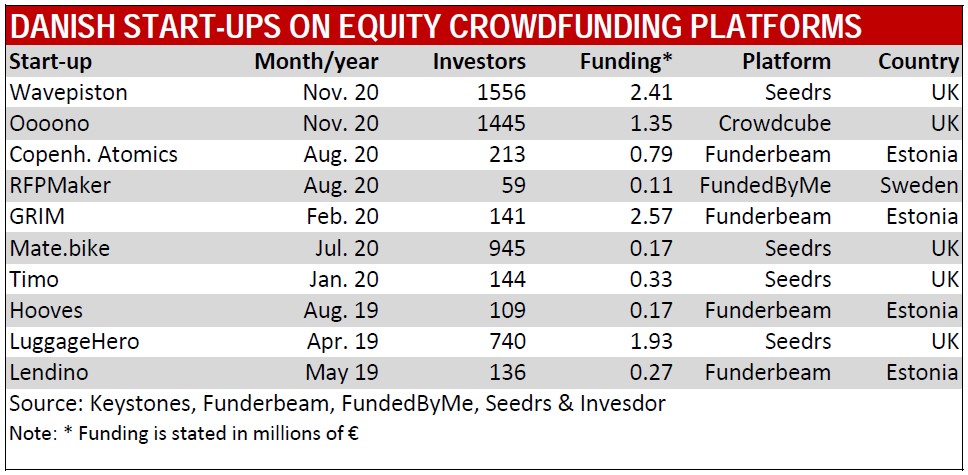

Danish start-ups such as LuggageHero have to go abroad to raise new capital with crowdfunding. In April, the company enters a new round on the English platform Seedrs. The Danish Chamber of Commerce’s new entrepreneurship initiative proposes that the government loosen the restrictive rules that risk sending Danish entrepreneurs abroad. Editor Peder Bjerge gives his monthly status on crowdfunding.

By April, Jannik Lawaetz expects to once again raise millions for his company. It’s going to happen at Seedrs, the English equity crowdfunding platform.

Because it works. Earlier, in June 2019, his company LuggageHero received 11.5 million. DKK to expand to more than 40 large cities around the world. And in the midst of the pandemic, the company has raised additional money from Seedrs, so the company now has well over 1,000 investors from both the UK and other countries.

However, Jannik Lawaetz prefers that it would be possible for Danish companies to raise capital through a Danish crowdfunding platform. “If we had been able to do it on a Danish platform, where investors could get a deduction for investing in growth companies, just like in the UK, it would bring much more capital into start-ups,” he says.

RISKS OF LOSING GROWTH AND JOBS

But that’s not possible today. After a few futile initiatives, everything went quiet. Simply because today there are a large number of rules that make it impossible to get a Danish equity crowdfunding market up and running. And that needs to change if it is up to the Danish Chamber of Commerce, which is now coming up with a proposal for a new entrepreneurship policy.

“Without new initiatives, we risk that the growth of Danish companies and the creation of new jobs will disappear out of Denmark,” Jasmina Pless, chief consultant at The Danish Chamber of Commerce, warns. “With a predominance of foreign investors from the foreign sources of financing, there is a risk that the companies will move their activities to for instance London.”

“In Denmark, rigid legislation stands in the way of creating Danish equity crowdfunding platforms. Private limited companies, for example, do not have the opportunity to use crowdfunding on a Danish platform, and rules stand in the way of more than 7 investors being able to join forces,” says Jasmina Pless.

In the new proposal from the Danish Chamber of Commerce for an entrepreneurship policy, two of the 28 proposals are directly aimed at loosening the restrictive rules: Among other things, the requirement that companies must be a joint stock company in order to raise money on a Danish equity crowdfunding platform.

In other words, today private limited companies are not allowed to use the opportunity, despite the fact that most small companies today are in fact founded as private limited companies. It requires DKK 400,000 to set up a joint stock company and it is often far more than companies in this phase have access to.

The proposal from the Danish Chamber of Commerce emphasizes that the new EU rules make it easier for foreign platforms to market themselves on the Danish market, which in the long run will give Danish companies easier opportunities to raise money that way. But it also increases the risk of companies leaving the country.

“Equity crowdfunding works well in many other countries. In Sweden, Finland and the UK, this type of crowdfunding is a very common way of financing the growth of your company in the early stages,” says Jasmina Pless.

According to the Danish Chamber of Commerce, the Danish tax rules are a barrier as well. They point out that a decision from the Tax Council, for example, means that if there are more than seven investors involved, which is typically the case with crowdfunding, the investment is subject to stock taxation.

This means, The Danish Chamber of Commerce writes, that “you pay tax on your value increases, ie both dividends and realized and unrealized gains. This is the opposite of capital gains taxation, where the investor must pay tax on the day the gain is realized. For private investors, stock taxation is thus less favourable than ordinary capital gains taxation.” They simply risk having to pay tax on a return that they may never ever see, is the point of the proposal.

For more articles in English: Our articles in English